EUR/USD Price Analysis: Bears attacking the bullish H4 trendline support

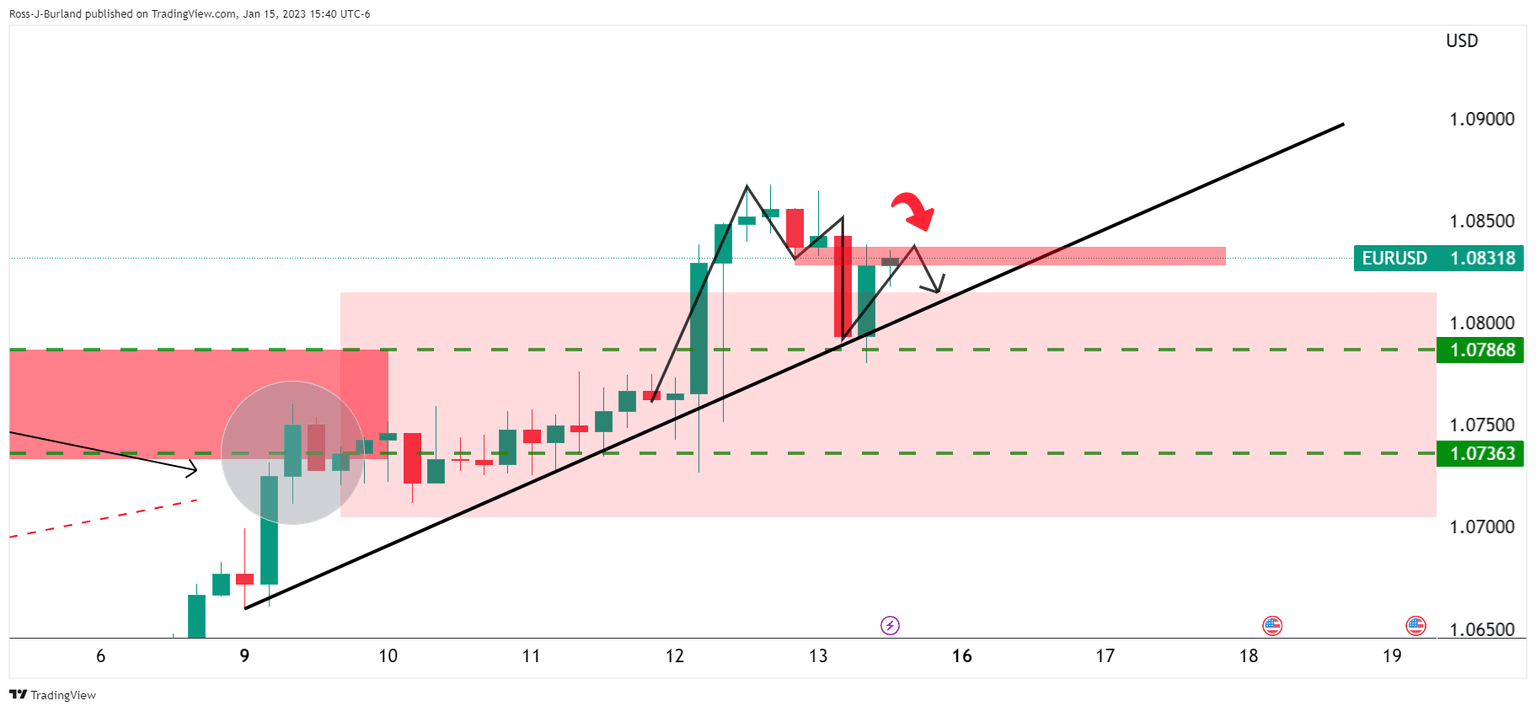

- EUR/USD H4 M-formation is compelling for the start of the week.

- Bers eye a downside move below 1.0780.

As per the prior analysis, EUR/USD Price Analysis: Bulls could be running into a trap, it was explained that the breakout traders had been triggered into the market ahead of the Consumer Price Index event. However, the data ignited a rally that took out the 1.0800 and likely hunted down stops in the 1.0850s. This leaves the scope of a reversal on the cards for the days ahead as per the poster CPI technical analysis, EUR/USD prints fresh bull cycle highs, on course for 5-day rally.

EUR/USD prior analysis

This puts the downside thesis into play as follows:

The analysis highlighted the downside risks as illustrated above.

EUR/USD update

The price has since stalled and is on track for a re-test of 1.0780s and lower towards 1.0700. However, the bears need to break trendline support on the lower time frames, such as the 4-hour chart as follows:

The M-formation is compelling in this regard. the neckline needs to hold for the open this week to reaffirm the bearish bias and prospects of a break of the trendline and downside potential for the week ahead.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.