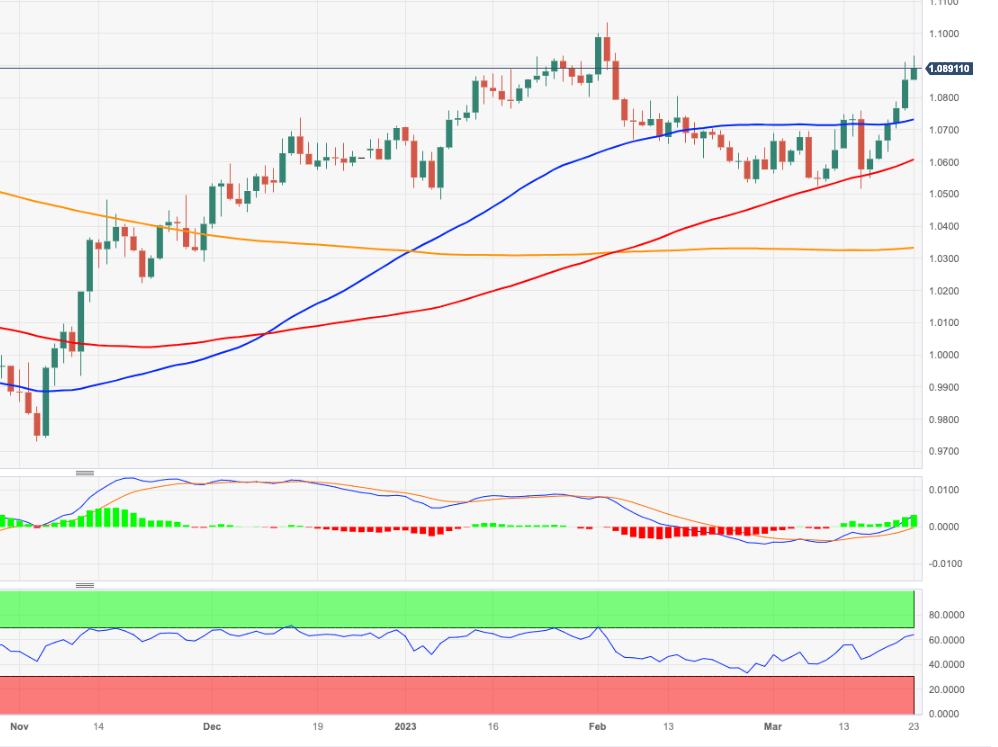

EUR/USD Price Analysis: Above 1.0930 comes the 2023 high

- EUR/USD keeps the bid bias unchanged near the 1.0900 region.

- Further upside could see the 2023 peak near 1.1030 revisited.

EUR/USD manages to clear the 1.0900 barrier and advance to fresh multi-week highs on Thursday.

The continuation of the strong uptrend appears on the table for the time being. That said, the pair now needs to clear the March high at 1.0929 (March 23) to allow for a probable challenge of the 2023 top at 1.1032 (February 2) in the short-term horizon.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0331.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.