EUR/USD nudging higher towards 1.1350, but stuck within recent ranges as NFP looms

- EUR/USD has nudged higher to the 1.1340s but remains stuck within recent intra-day ranges.

- Further strong US macro data has been ignored, with focus instead on Friday’s US jobs report.

EUR/USD continues to trade within recent intra-day ranges in the 1.1300-1.1350 region as FX markets take a breather from the heightened volatility of recent sessions. FX market conditions are likely to remain fairly subdued now ahead of Friday’s US jobs report. The pair has nudged modestly higher and is currently trading in the 1.1340s, up about 0.2% on the day. These gains come despite further strong US macro data in the form of a better-than-expected initial weekly jobless claims number and job layoffs in November dropping to near 30-year lows.

The pair has also largely ignored the latest headlines about Germany imposing restrictions on the unvaccinated and restrictions being tightened in Belgium. Ahead, four Fed speakers will be coming out of the woodworks on Thursday and if they adopt more a hawkish line in tandem with Fed Chair Jerome Powell earlier in the week.

Hawkish Fed being priced back in

On the back of strong US macro data and hawkish commentary from Powell, who sounded concerned about inflation risks and hinted at a faster QE taper, USD money markets have been unwinding last Friday’s dovish repricing. Recall, news of the Omicron variant last Friday saw markets aggressively pare back expectations for Fed policy tightening in 2022 amid fears it would derail the US economic recovery. The implied yield on the December 2022 three-month eurodollar future fell from close to 1.10% on Thursday to as low as 0.80% on Tuesday prior to Powell’s comments but has since recovered to around 1.0%.

But dollar struggling to keep up

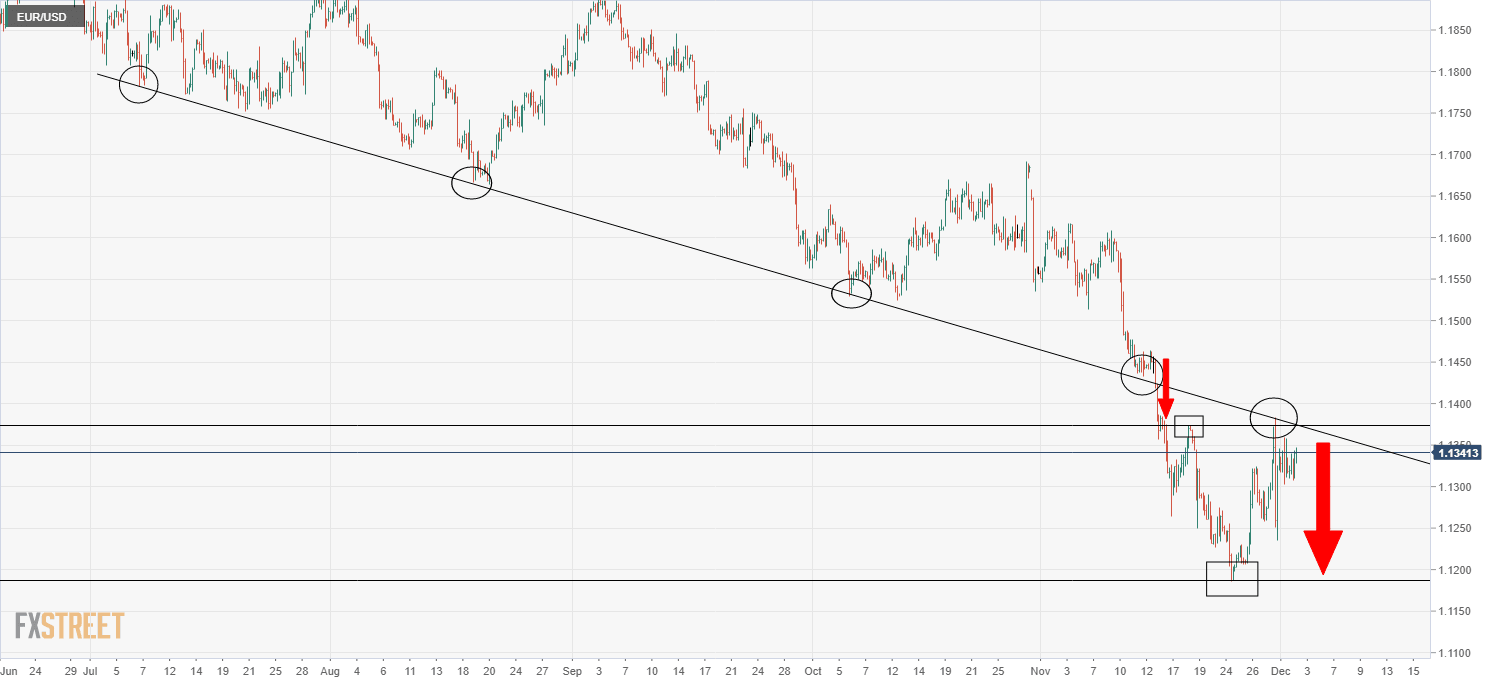

Yet the dollar recovery has been far less impressive. EUR/USD was trading close to 1.1200 prior to the omicron news and is only about 30-40 pips below Tuesday’s 1.1385 highs. Uncertainty regarding the new variant remains elevated and it seems that this, combined with profit-taking on the overbought dollar (particularly versus the euro) is keeping EUR/USD supported. In terms of the technicals; EUR/USD is currently testing a key downtrend that acted as support until mid-November but is now acting as resistance. This, coupled with the earlier weekly highs and 21-day moving average in the 1.1380s, is likely to continue capping the price action for now.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset