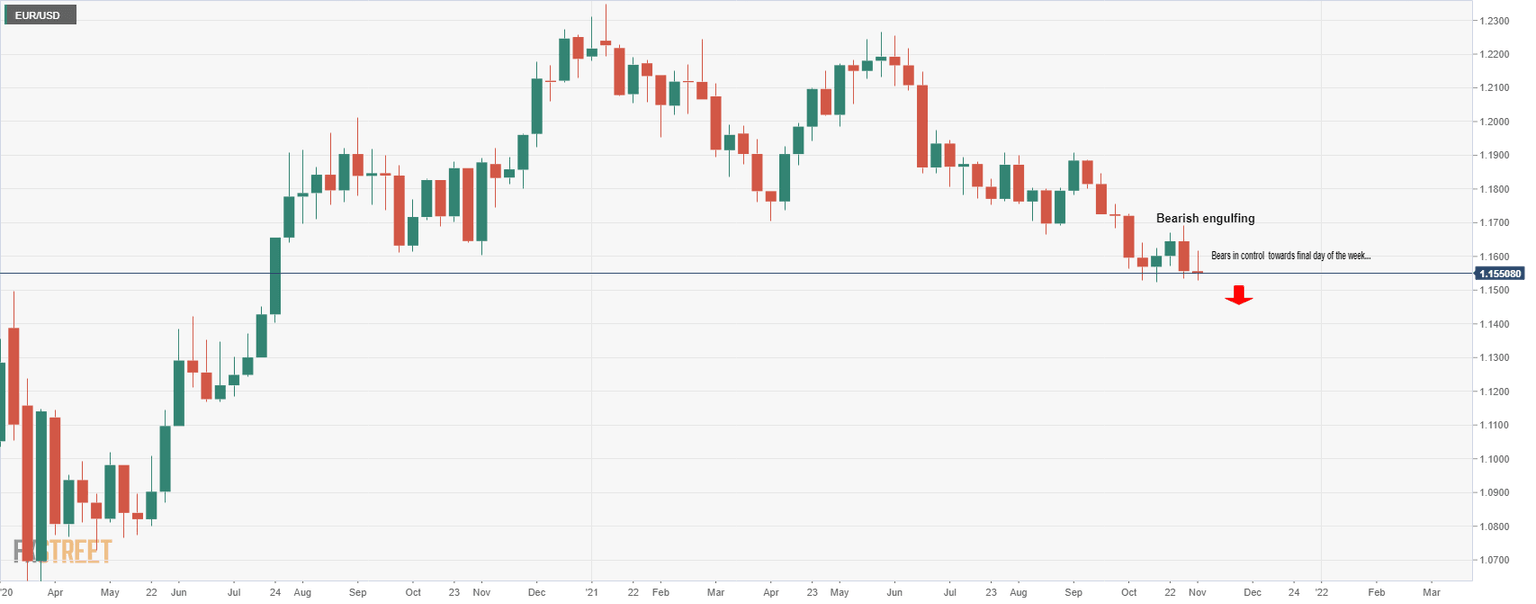

EUR/USD is vulnerable to a solid Non Farm Payrolls event

- EUR/USD sits tight ahead of the all-important NFP report schedule for the US session.

- Bears are looking for a weekly bearish close on a solid NFP report.

Risk appetite remained firm on Thursday following the Bank of England's surprise hold which led to yield curves shifting lower across geographies as traders stepped off the peddle with respect to interest rate expectations. Nevertheless, EUR/USD fell to a one-month low, falling from 1.1615 to 1.1528. The pair then steadied around 1.1555 into Asia and sits between there and 1.1545 the low so far today in Tokyo.

The US dollar was on course for a second straight week of gains against major peers on Friday as traders bought the dip in the greenback, expecting a solid outcome from today's showdown in the US Nonfarm Payrolls report that could sway the timing of Federal Reserve interest rate increases.

''Non-farm payrolls should see a strong gain in October (market median f/c +450k, Westpac +500k),'' analysts at Westpac explained. ''The unemployment rate should edge down to 4.7% despite higher participation. Average hourly earnings are meanwhile expected to rise at a robust pace as labour shortages continue to support wage growth.''

The dollar index DXY, which measures the greenback against a basket of six rivals, climbed from the post-Federal Reserve meeting lows of 93.82 to a high of 94.47 and rallied 0.51% on Thursday. That lifted it into the positive for the week, so far, adding 0.21%.

Central bank sentiment weighs on EUR/USD

Overall, investors have been forced to reset monetary policy expectations this week, after some of the biggest central banks knocked back bets for early rate hikes which have helped support the greenback. For instance, the European Central Bank President Christine Lagarde pushed back on Wednesday against market bets for a rate hike as soon as next October and said it was very unlikely such a move would occur in 2022.

Also on Wednesday, Fed Chair Jerome Powell said he was in no rush to hike borrowing costs, even as the Federal Open Market Committee announced a $15 billion monthly tapering of its $120 billion in monthly asset purchases. Nevertheless, should the data impress on Friday, amongst a sold backdrop of PMIs this week, the greenback could remain on the front foot for the foreseeable future and weigh on EUR/USD.

EUR/USD technical analysis

In line with the fundamentals, the signal currently is technical under pressure as well:

From a weekly perspective, the price is in the running for a bearish close as illustrated above.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.