EUR/USD fails to sustain above 1.0600 as street sees Fed’s interest rate peak near 6%

- EUR/USD has refreshed its day low at 1.0582 as a recovery in the risk appetite theme has faded.

- Federal Reserve could push interest rates to 6%in the battle against stubborn inflation.

- European Central Bank looks set to deliver one more 50 bps interest rate hike in March.

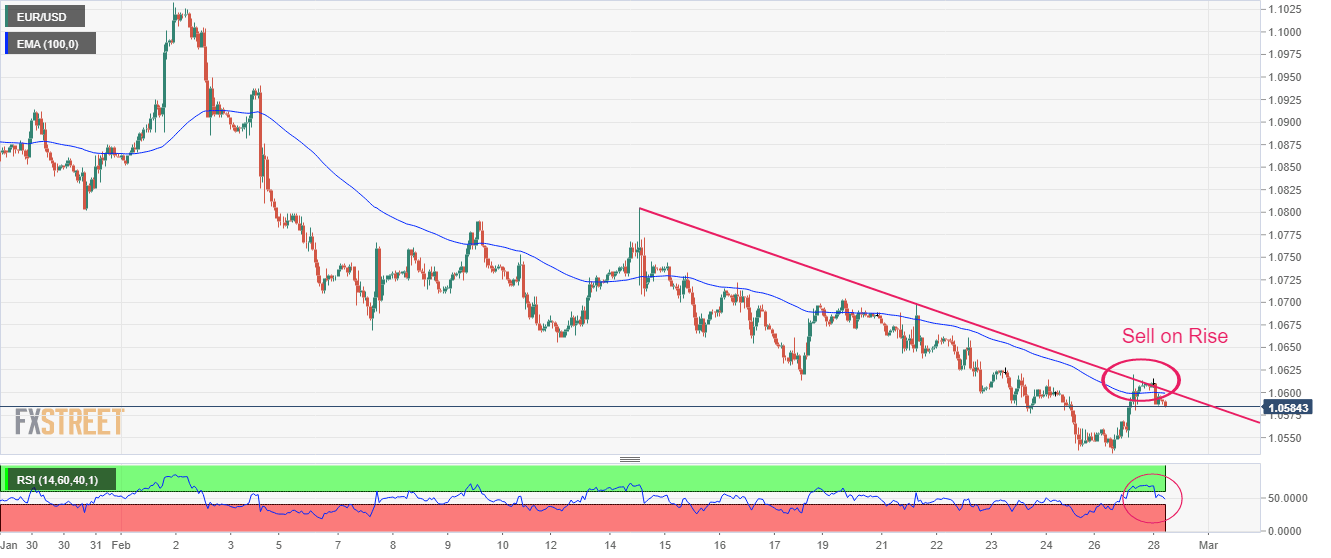

- EUR/USD has sensed selling pressure while attempting to deliver a breakout of the downward-sloping trendline from 1.0805.

EUR/USD has delivered a breakdown of the consolidation formed above the round-level resistance of 1.0600 in the early European session. The major currency pair has sensed immense pressure while reclaiming the 1.0600 resistance as the US Dollar Index (DXY) has rebounded modestly. The USD Index has sensed interest after dropping to near 104.30. A sideways auction is anticipated from the USD Index as investors are expected to remain on the sidelines after the release of the United States ISM Manufacturing PMI data, which is scheduled for Wednesday.

Gains added by the S&P500 futures in morning Asia have trimmed. It looks like the risk-appetite theme has retreated as the dismal market mood is roaring again. The return distributed on 10-year US Treasury bonds has rebounded to near 3.93%.

Resilience in US consumer spending pushes Fed’s rate projections near 6%

Right from the labor market data to households' spending, the majority of the economic indicators have confirmed resilience in the retail demand in the United States economy. To soften the red-hot inflation, Federal Reserve (Fed) chair Jerome Powell has already pushed rates to 4.50-4.75%. Considering the recent spark in the inflationary pressures, it won’t be early mentioning the current monetary policy as incompetent to decelerate the stubborn inflation.

Therefore, the street is expecting a higher terminal rate projection than the current estimates of 5.3%. Analysts at Bank of America (BofA) expect Fed chair Jerome Powell to announce three more rate hikes this year considering the resilience in the demand-driven inflation. The BofA sees the terminal rate above 6%. The investment banking firm expects a recession if a higher terminal rate projection materializes.

US Manufacturing PMI is in focus for further action

This week, the mega event will be the US ISM Manufacturing PMI data. Manufacturing activities in the US economy have been contracting for the past three months. Again, a dry spell is expected as firms have paused their expansion plans to avoid higher interest obligations.

The economic data is expected to improve to 48.0 from the former release of 47.4. A figure below 50.0 is considered as a contraction in activities. It would be appropriate considering it a decline in the contraction streak. The New Orders Index that conveys forward demand is expected to rebound to 43.7 from the prior figure of 42.5.

Economic Confidence fails to grab the 100.00 figure

It was the sixth time on Monday when Eurozone Economic Confidence failed to garb the figure of 100.00. The street expected the sentiment data at 101.00, however, it even failed to surpass the prior figure of 99.8. The rising cost of living pressures has dented the confidence of households in the economy. Individuals are struggling to address their necessities amid higher prices for goods and services due to galloping inflation.

European Central Bank (ECB) President Christine Lagarde is reiterating the need for interest rate escalation by 50 basis points (bps) in the March monetary policy meeting to strengthen its defense in the battle against persistent inflation.

EUR/USD technical outlook

EUR/USD has sensed immense selling pressure after a pullback move to near the downward-sloping trendline plotted from February 14 high at 1.0805 on an hourly scale. This indicates that the market participants are following a ‘sell on rise’ strategy while dealing with EUR/USD.

The shared currency pair has failed to sustain above the 100-period Exponential Moving Average (EMA) at 1.0660.

Also, the Relative Strength Index (RSI) (14) has slipped into the 40.00-60.00 range from the bullish range of 60.00-80.00.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.