EUR/USD recovery stalls ahead of US Claims, manufacturing data

- Euro recovery from 1.1780 stalls at 1.1750 ahead of the release of US Jobless Claims, Philly Fed Manufacturing data

- The Fed cut rates as expected and hinted at further easing on Wednesday, with policymakers split about the rate path.

- A moderate risk appetite might hold the US Dollar's recovery on Thursday.

EUR/USD pared previous losses on Thursday's early European session but failed to find acceptance above 1.1850The pair has eased to 1.1820, as investors turn their focus from the Federal Reserve's (Fed) monetary policy decision to US Jobless Claims and Manufacturing figures, due later on the US session.

Applications for unemployment benefits are expected to have dropped to 240K in the US during the week of September 12, from 263K over the previous week, while continuing claims are seen increasing to 1.95 million, from 1.93.9 million lin the previous week.

Later on, the Philadelphia Fed Manufacturing Index is expected to show a mild rebound to a 2.3 reading in September, following a 0.3% contraction in August.

On Wednesday, the US central bank met market expectations, cutting rates by 25 basis points (bps) and signaling further rate cuts ahead to support a weakening labor market. The interest rate projections pointed to two further cuts in 2025 and another one in 2026, although policymakers were divided on the rate path.

Fed Chair Jerome Powell struck a less dovish tone during the ensuing press conference. Powell considered the decision a "risk management cut" but warned that inflation would continue growing through the rest of the year and into 2026, and reiterated that he is in no rush to cut interest rates, which provided a significant impulse to the US Dollar.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.07% | 0.18% | 0.28% | 0.03% | 0.09% | 1.03% | 0.04% | |

| EUR | 0.07% | 0.13% | 0.37% | 0.13% | 0.14% | 1.19% | 0.14% | |

| GBP | -0.18% | -0.13% | 0.24% | -0.01% | -0.00% | 1.00% | 0.00% | |

| JPY | -0.28% | -0.37% | -0.24% | -0.27% | -0.27% | 0.70% | -0.23% | |

| CAD | -0.03% | -0.13% | 0.01% | 0.27% | 0.04% | 1.13% | 0.01% | |

| AUD | -0.09% | -0.14% | 0.00% | 0.27% | -0.04% | 1.08% | -0.01% | |

| NZD | -1.03% | -1.19% | -1.00% | -0.70% | -1.13% | -1.08% | -0.96% | |

| CHF | -0.04% | -0.14% | -0.01% | 0.23% | -0.01% | 0.01% | 0.96% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: US Dollar bounces up as Fed meets market expectations

- The Federal Reserve cut its benchmark interest rates by a quarter-point to the 4.0%-4.25% range, and the median of the dot plot anticipates two further cuts in the next two meetings, highlighting a dovish turn from June's projections.

- In the Fed's Summary of Economic Projections, US Gross Domestic Product (GDP) growth projections have been revised up to 1.6% this year and 1.8% next, from 1.4% and 1.6%. PCE inflation is expected to remain at 3% at the end of the year and ease to 2.6% in 2026, above the 2.4% forecasted in June, while the Unemployment Rate is seen at 4.5% at the end of the year, unchanged from previous projections and down to 4.4% in 2026. In June, the projection for next year was 4.5%.

- Regarding interest rates, policymakers showed a wider dissent. The median forecast projects 50 basis points of further cuts in the last quarter of the year, with the most hawkish option leaning for a 4.4% rate in December, while the lowest option, probably Trump's new appointment, Stephen Miran, showed a preference for a 2.9% rate. Such divergence puts the median forecasts into question.

- On the macroeconomic data front, Tuesday's figures showed that US Retail Sales grew 0.6% MoM and 5% YoY in August, beating expectations of a 0.2% and a 4.1% respectively. July's data was revised up to a 0.6% monthly increase from the previous 0.5% and a 4.1% yearly increment from the previous 3.9%.

- In the European morning, ECB Vice-President De Guiondos assessed that the present monetary policy is appropriate and that some small deviations from the inflation goal should be accepted. De Guindos forecasts economic growth to remain subdued in the second half of the year but said that risks are now more balanced. The Euro ticked up as De Guindos spoke.

- Data from Europe released on Wednesday showed that the Harmonized Index of Consumer Prices (HICP) grew at a 0.1% pace in August and 2% in the last 12 months, below expectations of steady inflationary pressures, at 0.2% and 2.1% respectively. Core inflation grew at a 0.3% monthly pace and 3.1% year-on-year, unchanged from July.

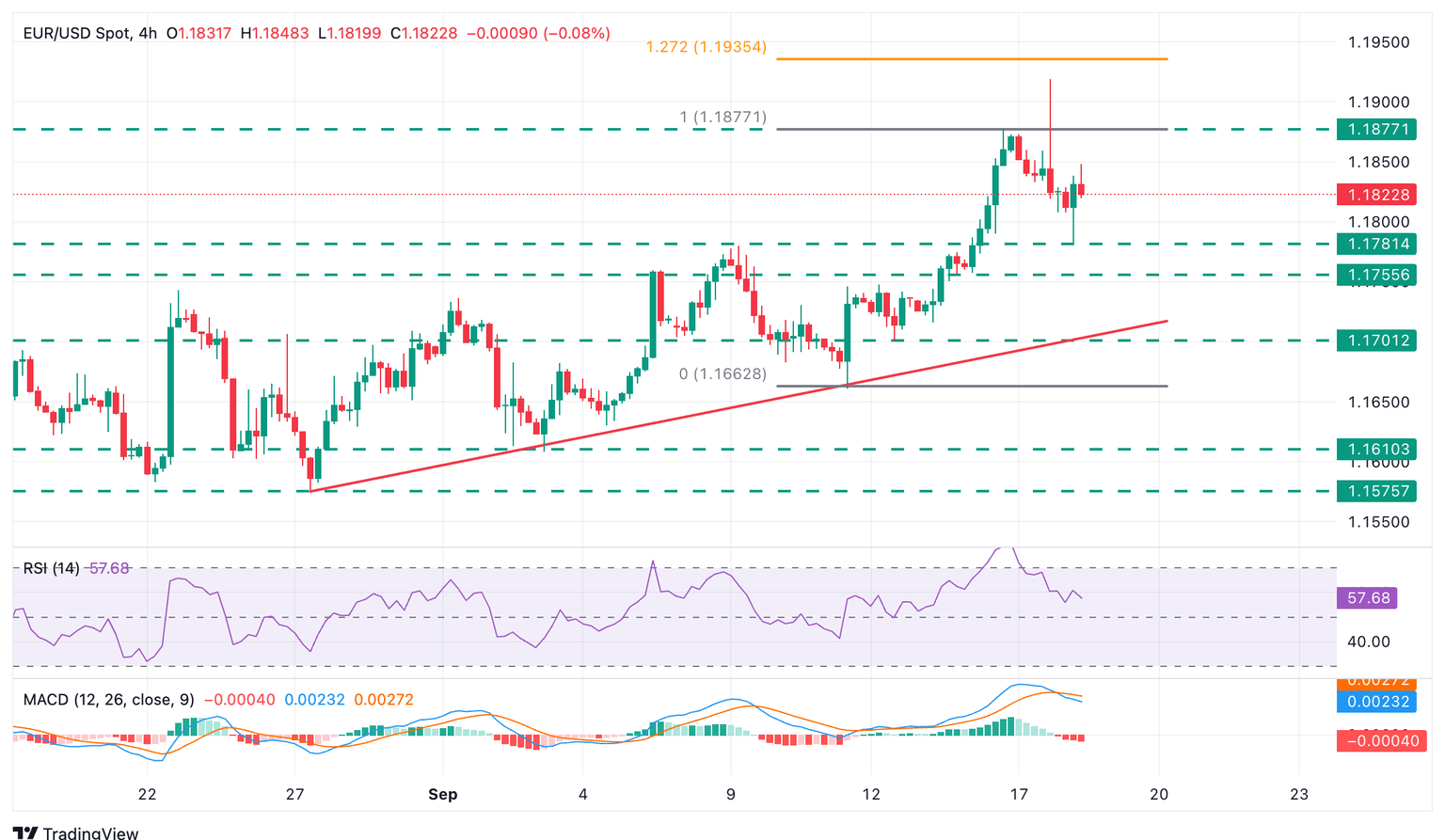

Technical Analysis: EUR/USD correcting lower within a bullish trend

EUR/USD is going through a bearish reversal, following a nearly 2% rally from last week's lows. The pair has given away some ground after the Fed's monetary policy decision, but the broader trend remains bullish. The 4-hour Relative Strength Index (RSI) has pulled back from overbought levels but remains above the key 50 level so far.

The 4-hour Moving Average Convergence Divergence (MACD) indicator shows a bearish cross, but Euro bears are likely to be challenged at a previous resistance area in the vicinity of 1.1780 ( September 9 and 15 highs) ahead of the intraday support level at 1.1755. Further down, trendline support from late August lows meets the September 12 low at the 1.1700 area.

To the upside, immediate resistance is Tuesday's high, at 1.1878. Beyond here, the 127.2% Fibonacci retracement level of the September 11-16 rally is at 1.1935 ahead of the 1.2000 psychological level.

Economic Indicator

Initial Jobless Claims

The Initial Jobless Claims released by the US Department of Labor is a measure of the number of people filing first-time claims for state unemployment insurance. A larger-than-expected number indicates weakness in the US labor market, reflects negatively on the US economy, and is negative for the US Dollar (USD). On the other hand, a decreasing number should be taken as bullish for the USD.

Read more.Next release: Thu Sep 18, 2025 12:30

Frequency: Weekly

Consensus: 240K

Previous: 263K

Source: US Department of Labor

Every Thursday, the US Department of Labor publishes the number of previous week’s initial claims for unemployment benefits in the US. Since this reading could be highly volatile, investors may pay closer attention to the four-week average. A downtrend is seen as a sign of an improving labour market and could have a positive impact on the USD’s performance against its rivals and vice versa.

Economic Indicator

Philadelphia Fed Manufacturing Survey

The Philadelphia Fed Survey is a spread index of manufacturing conditions (movements of manufacturing) within the Federal Reserve Bank of Philadelphia. This survey, served as an indicator of manufacturing sector trends, is interrelated with the ISM manufacturing Index (Institute for Supply Management) and the index of industrial production. It is also used as a forecast of The ISM Index. Generally, an above-the-expectaitons reading is seen as positive for the USD.

Read more.Next release: Thu Sep 18, 2025 12:30

Frequency: Monthly

Consensus: 2.3

Previous: -0.3

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.