EUR/USD bears seeking restest of 1.1780s

- EUR/USD is technically stretched on the upside, bears seek retest of support structure.

- US data will be under the spotlight in Fed blackout period.

EUR/USD is trading on the backfoot, but holding around flat on the day as the US mid-day sees less volume to support the overnight bid. At the time of writing, EUR/USD is sat near 1.1800 and has travelled between a low of 1.170 and a high of 1.1817.

The daily ATR of approximately 47 pips has been exhausted within the day's volatility and range so we can expect consolidation from here on until the US Consumer Price Index data on Tursday. While the Federal Reserve has left an emphasis on achieving their maximum employment goal, the US CPI data will still be an important event. With that being said, there are few expectations of a surprise.

Analysts at TD Securities argued that core CPI likely rose at its slowest pace since February. retail Sales on Thursday will take up some of the attention of the market, and so too will Jobless Claims which could anchor risk sentiment following a downbeat CPI reading if the other data proves to be the kind of data that will leave a taper announcement from the Fed on the table.

EUR/USD weighed by hawkish Fedspeak

It is also Federal Reserve's blackout period, so the most recent comments from speakers last week are of importance ahead of the Sep 21-22 FOMC meeting. Last week, most Fed officials sounded as if they are looking through the weak August jobs report and still want to taper this year, analysts at Brown Brothers Harriman argued.

''Mester said Friday that 'I don’t think the August employment report has changed my view that we’ve made substantial further progress. I would like us to begin tapering sometime this year.' This followed similar comments from Williams, Bowman, and Kaplan last week,'' the analysts noted.

''Our best guess is that the Fed announces a formal timeline for tapering at the November 2-3 meeting and starts tapering at the December 14-15 meeting. Sure, it’s possible the Fed waits until January but really, why wait?''

EUR/USD depends on the eurozone's recovery

As for the domestic front, the European Central bank was a bit of a nonevent in terms of subsequent market direction. ''It’s noteworthy that the dollar remains bid despite the somewhat softer U.S. data recently and a more hawkish ECB,'' the analysts at Brown Brothers Harriman said, referring to last week's ECB meeting.

The ECB delivered a hawkish hold Interest rates and the size of PEPP were all left unchanged. However, the central bank announced that the pace of PEPP buying in Q4 will run at “a moderately lower pace” than in past quarters. Some might regard this as a taper, but the size of the PEPP is left unchanged.

The ECB's governor, Christine Lagarde, said that the “recalibration” was for the next three months, which suggests that if the recovery falters, the PEPP pace can be recalibrated again for Q1. The euro now depends on whether markets start to have more confidence in the eurozone recovery that would equate to the removal of accommodation, however incrementally.

EUR/USD technical analysis

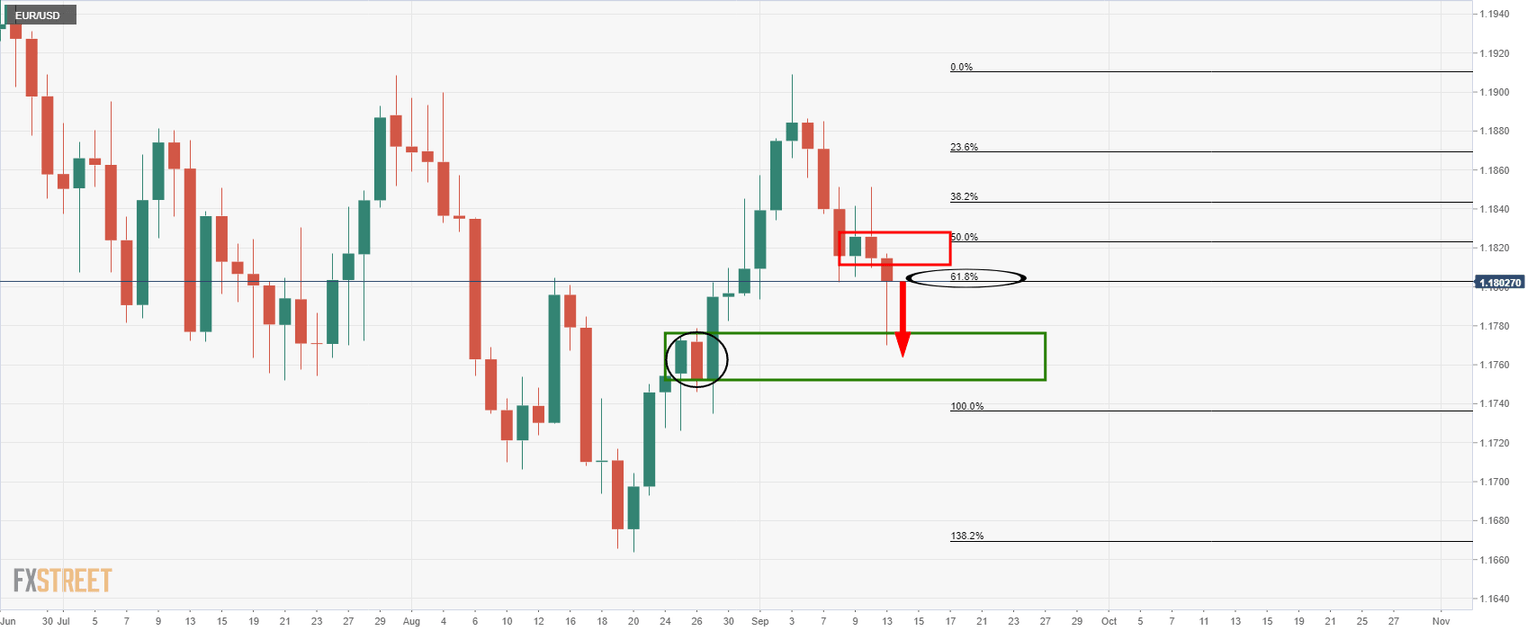

(Daily chart)

The price is looking to close the day negative and that leaves prospects of a retest of the lows for the sessions ahead.

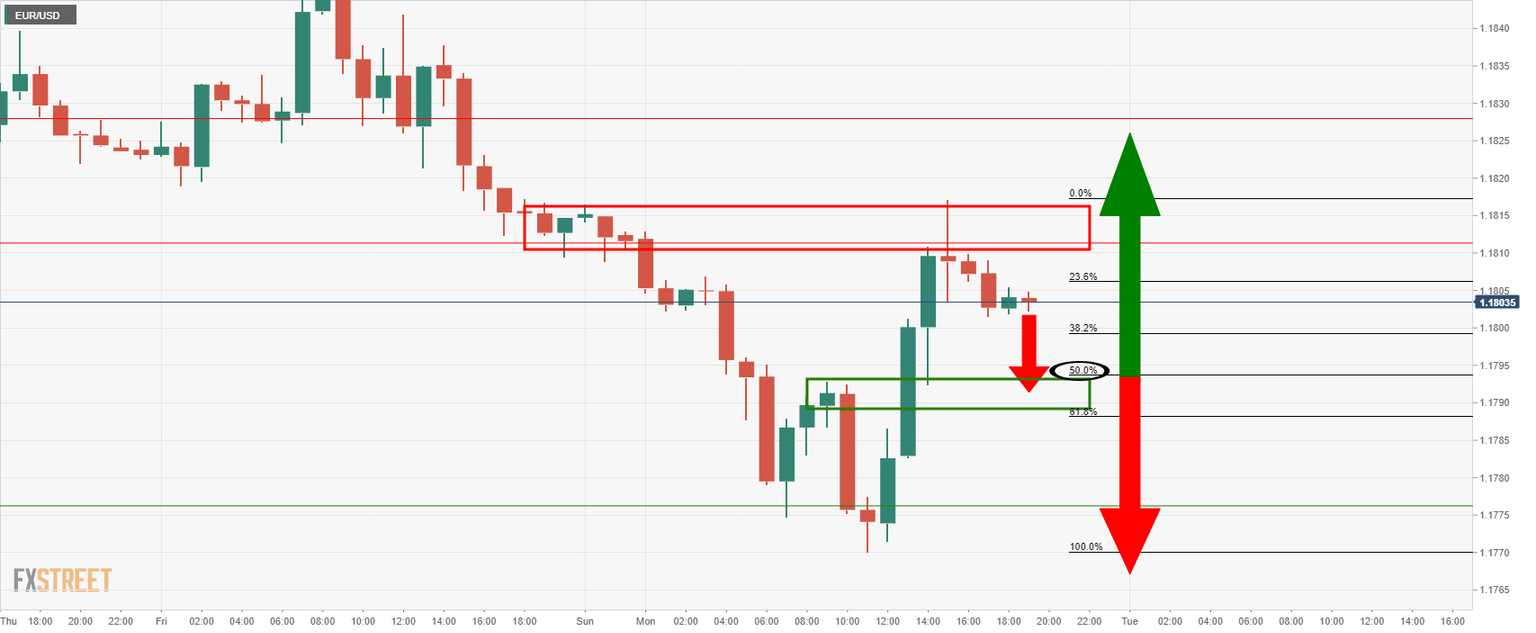

(Hourly chart)

From an hourly perspective, the bears can move in on the 50% mean reversion located near the neckline of the W-formation around 1.1790. Below there, the daily structure is located near 1.1780.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.