EUR/USD ticks lower ahead of the US NFP Benchmark Revision

- The Euro edges lower but remains close to a two-month high, amid broad-based USD weakness.

- Investors' fears of a sharp downward revision to recent US Nonfarm Payrolls numbers are hurting the US dollar.

- In Europe, the political crisis in France is keeping the Euro from appreciating further.

The EUR/USD is posting marginal losses, trading near 1.175 ahead of Tuesday's US session opening, following a 1% rally over the last two trading days. The US Dollar remains on the defensive with investors anticipating a sharp downward revision of US employment figures, although the political crisis in France keeps weighing on Euro (EUR) bulls.

The US Bureau of Labour Statistics is expected to release the benchmark seasonally adjusted data of US employment figures for the 12 months to March 2025 at 14:00 GMT. The market forecasts a slash of up to 800,000 jobs, which would reflect a weaker-than-expected labour market and likely push the Federal Reserve (Fed) to accelerate its monetary easing cycle.

Such a scenario would add pressure to an already depressed US Dollar (USD), which has lost more than 1% against a basket of major currencies after the release of August's payrolls report on Friday. Futures markets are fully pricing in a Fed rate cut next week, with chances of a 50-basis-point reduction rising above 10%, according to the CME Group's FedWatch Tool.

In Europe, however, the uncertain political scenario in France is keeping the Euro (EUR) from appreciating further. Prime Minister François Bayrou was defeated in a confidence vote on Monday, and news reports suggest that President Emmanuel Macron is refusing to call a snap election and that he is looking to nominate a new PM "within days".

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.02% | -0.28% | -0.73% | -0.02% | -0.46% | -0.32% | -0.03% | |

| EUR | 0.02% | -0.27% | -0.74% | 0.00% | -0.37% | -0.28% | -0.01% | |

| GBP | 0.28% | 0.27% | -0.48% | 0.27% | -0.10% | -0.01% | 0.26% | |

| JPY | 0.73% | 0.74% | 0.48% | 0.72% | 0.32% | 0.42% | 0.70% | |

| CAD | 0.02% | -0.00% | -0.27% | -0.72% | -0.41% | -0.27% | -0.02% | |

| AUD | 0.46% | 0.37% | 0.10% | -0.32% | 0.41% | 0.09% | 0.36% | |

| NZD | 0.32% | 0.28% | 0.01% | -0.42% | 0.27% | -0.09% | 0.29% | |

| CHF | 0.03% | 0.01% | -0.26% | -0.70% | 0.02% | -0.36% | -0.29% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: A weak labour market and hopes of Fed cuts are bleeding the USD

- The US Dollar remains on its back foot with markets awaiting more bad news from the Nonfarm Payrolls benchmark revision. Unless there is a positive surprise, the labour figures are likely to show that the Federal Reserve's monetary policy is behind the curve, which will increase selling pressure on the US Dollar.

- In France, Prime Minister François Bayrou was toppled after just nine months in charge, leading the Eurozone's second-largest economy into a political impasse. President Macron's decision to find a replacement quickly has averted a significant impact on the Euro for now, but the situation might change fast if the political turmoil increases.

- During the European trading session, the only event worth mentioning will be the speech by the European Central Bank's (ECB) Governing Council member and Bundesbank President Joachim Nagel, although he is unlikely to say anything new about the bank's monetary policy as the ECB is within its quiet period ahead of Thursday's interest-rate decision.

- The highlight of the week will be the ECB's monetary policy decision, due on Thursday. The bank is widely expected to leave interest rates unchanged, but investors will analyse President Christine Lagarde's comments for further clues about the bank's next monetary policy steps.

- In the US, the focus on Thursday will be on August's Consumer Price Index (CPI) figures, which will be the last key release ahead of next week's Fed meeting. The risk is on a strong inflation reading. The combination of a deteriorating labour market and strong inflationary pressures would complicate the Fed's monetary policy setting and might boost US Dollar volatility.

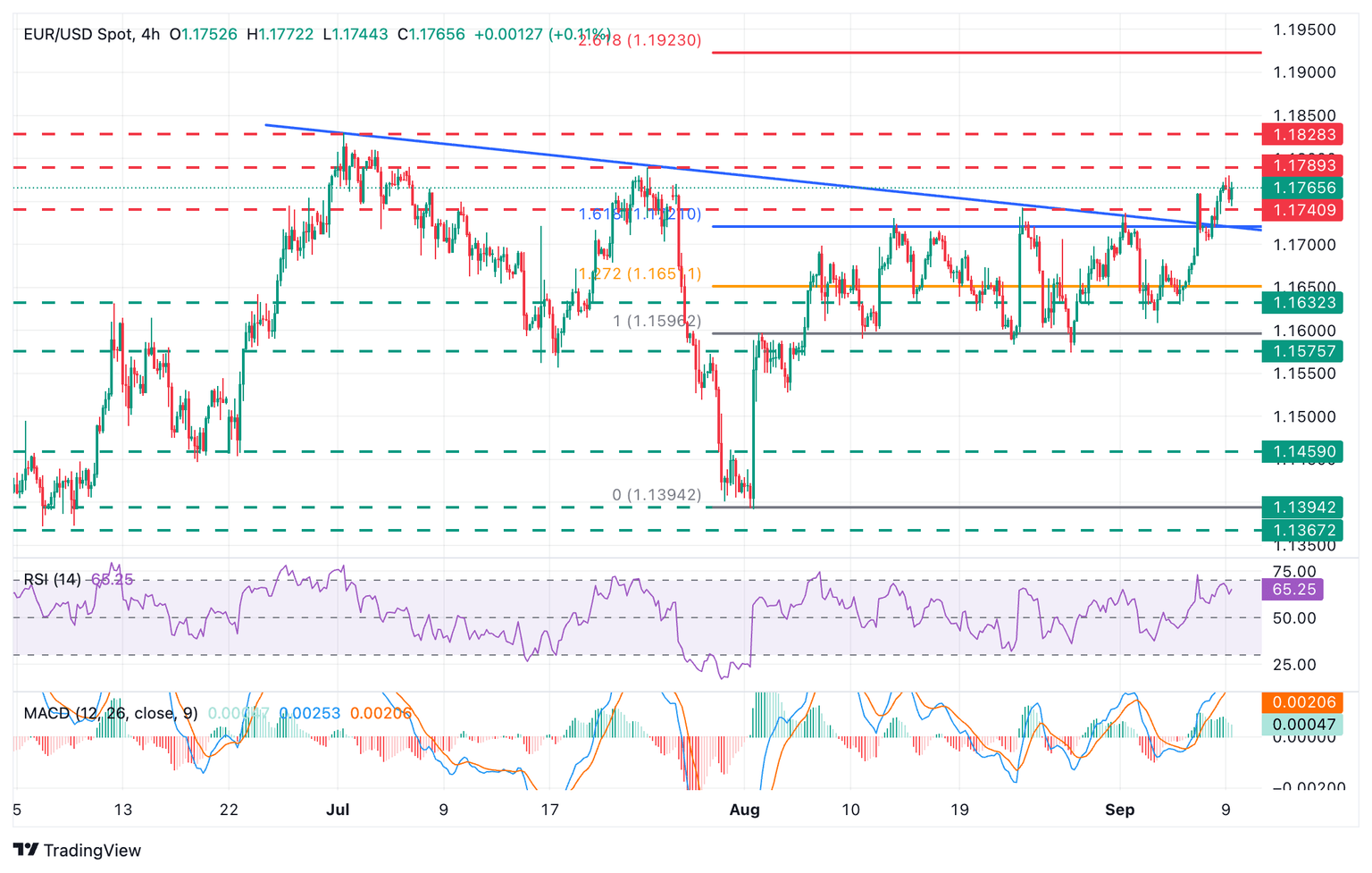

Technical Analysis: EUR/USD holds above mid-term trendline resistance

EUR/USD breached a key resistance area between the trendline resistance from July 1 highs and the top of August and early September's trading range, and is trading higher. Technical indicators are pointing higher. The 4-hour RSI is at high levels but not yet overbought. Further appreciation seems likely.

Bulls are aiming to retest the July 24 high near 1.1790, the last resistance area before the mentioned July 1 high at 1.1830. Further up, the 261.8% Fibonacci extension of the August 1 rally, at 1.1923, is a common target for bullish cycles.

To the downside, previous resistance at the 1.1740 area, which capped upside attempts on August 22 and September 1, and the reverse trendline from July 1 highs, now at 1.1720, are likely to act now as support. Below here, the September 8 low at 1.1705 is next.

Economic Indicator

Nonfarm Payrolls Benchmark Revision

The US Bureau of Labor Statistics (BLS) announces the preliminary estimate of the annual benchmark revision to the establishment survey employment series, which can lead to a revision as well for the Nonfarm Payrolls data in the twelve months to March. This preliminary revision could have implications for employment figures for the rest of the year.

Read more.Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.