EUR/USD struggles to extend rally on robust US private employment data

- EUR/USD needs more fuel to sustain above 1.0400 as upbeat US ADP Employment data has provided some relief to the US Dollar.

- Signs of a restricted trade war between the US and China have improved the market mood.

- The ECB is expected to continue reducing interest rates amid confidence that the disinflation trend towards the 2% target is intact.

EUR/USD struggles to extend its upside move above 1.0430 in Wednesday’s North American session. The upside move in the major currency pair appears to be stalling as the US Dollar (USD) strives to gain ground after the release of upbeat United States (US) ADP Employment Change for January. The ADP Research Institute reported that the private sector hired 183K workers in January, higher than estimates of 150K and the prior release of 176K, revised significantly higher from 122K.

Upbeat private employment is expected to boost market expectations that the Federal Reserve (Fed) will keep interest rates in the range of 4.25%-4.50% for a longer period. Last week, Fed Chair Jerome Powell stated that monetary policy adjustments would become appropriate only when officials would see "real progress in inflation or at least some weakness in the labor demand".

Going forward, the next trigger for the US Dollar will be the US Nonfarm Payrolls (NFP) data for January, which will be released on Friday. The official employment data will demonstrate the current status of labor market vividly.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rebounds slightly after posting a fresh weekly low near 107.40. Earlier in the day, the USD slumped as it lost some risk premium, with investors assuming that the scope of a trade war won’t be wider.

Market participants expect the trade war to be mainly between the United States (US) and China as the latter has retaliated against 10% levies by imposing tariffs on various US exports, including farm equipment, some autos, and energy items such as Coal and Liquefied Natural Gas (LNG).

With the rest of the world, investors expect US President Donald Trump will use tariffs as a tool to have a dominant position in negotiating deals with trading partners. President Trump's postponement of 25% tariffs on Canada and Mexico stemmed from expectations that tariffs are more of a political maneuver.

Daily digest market movers: EUR/USD gains at USD's expense

- EUR/USD moves higher at the expense of the US Dollar as the Euro (EUR) exhibits a mixed performance against its major peers. The upside in the Euro remains limited amid firm expectations that the European Central Bank (ECB) will continue with its policy-easing spree, given that officials are confident about inflation sustainably returning to the central bank’s target of 2% this year.

- In Wednesday’s European session, ECB Vice President Luis de Guindos said in an interview with the Slovak newspaper Hospodarske Noviny that he sees “inflation approaching the ECB's target” but expects “little uptick in next few months on energy”. When asked about for how long the ECB will continue reducing its borrowing rates, de Guindos said, “Even if our current trajectory under the current circumstances is clear, nobody knows the level at which interest rates will end up."

- Last week, the ECB reduced its Deposit Facility rate by 25 basis points (bps) to 2.75% and guided that the monetary policy is still restrictive. Traders expect the ECB to cut interest rates three times more in the next three policy meetings.

- Meanwhile, market participants are cautious about the Eurozone outlook amid fears that the European Union (EU) will be the next on the list of US President Trump on whom he can threaten to impose tariffs actively. Over the weekend, Trump said that tariffs would definitely happen with the European Union because “they've really taken advantage of us".

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.31% | -0.28% | -0.74% | -0.24% | -0.31% | -0.52% | -0.28% | |

| EUR | 0.31% | 0.03% | -0.40% | 0.06% | -0.00% | -0.21% | 0.03% | |

| GBP | 0.28% | -0.03% | -0.44% | 0.03% | -0.04% | -0.24% | 0.00% | |

| JPY | 0.74% | 0.40% | 0.44% | 0.49% | 0.42% | 0.20% | 0.46% | |

| CAD | 0.24% | -0.06% | -0.03% | -0.49% | -0.06% | -0.27% | -0.03% | |

| AUD | 0.31% | 0.00% | 0.04% | -0.42% | 0.06% | -0.20% | 0.04% | |

| NZD | 0.52% | 0.21% | 0.24% | -0.20% | 0.27% | 0.20% | 0.25% | |

| CHF | 0.28% | -0.03% | -0.00% | -0.46% | 0.03% | -0.04% | -0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

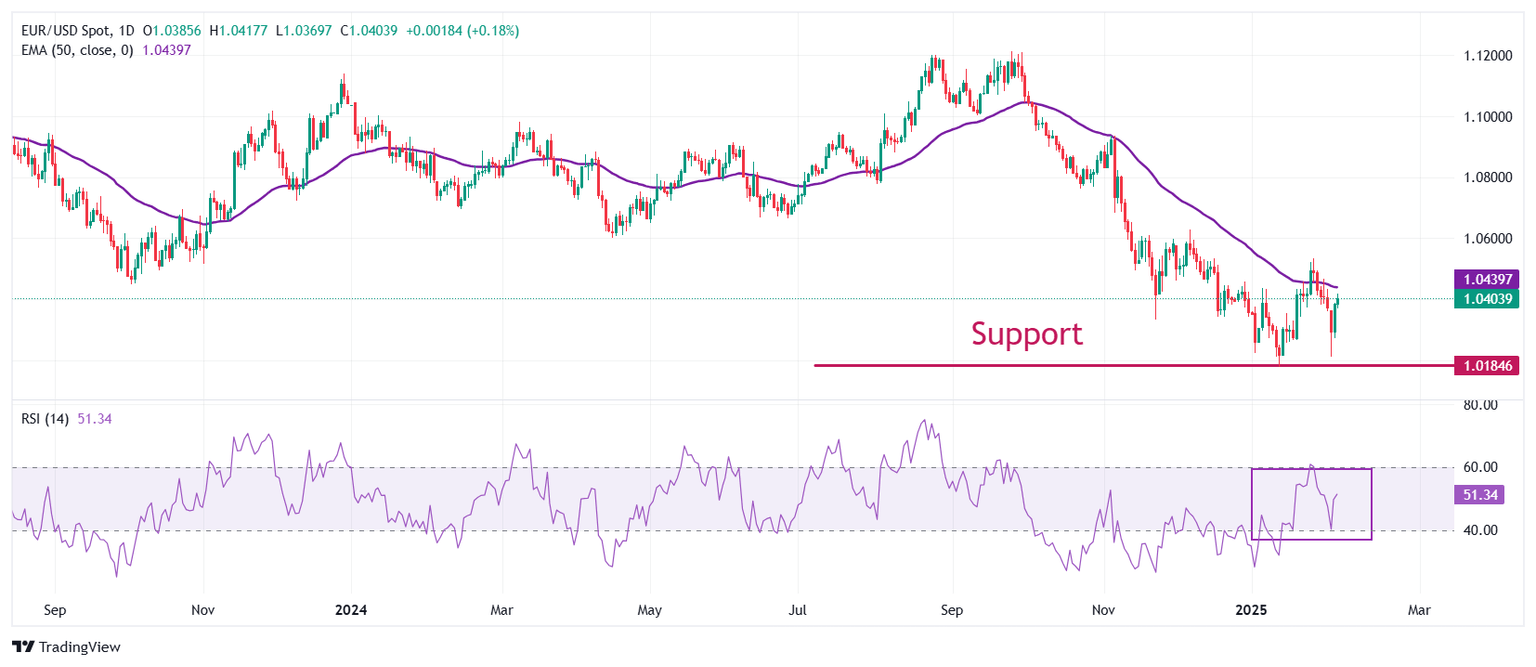

Technical Analysis: EUR/USD climbs above 1.0400

EUR/USD recovers from its three-week low of 1.0210 reached on Monday and jumps to near 1.0420. However, the pair is still below the 50-day Exponential Moving Average (EMA), which trades around 1.0440, suggesting that the overall trend is still bearish.

The 14-day Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, suggesting a sideways trend.

Looking down, the January 13 low of 1.0177 and the round-level support of 1.0100 will act as major support zones for the pair. Conversely, the psychological resistance of 1.0500 will be the key barrier for the Euro bulls.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.