EUR/NOK flirts with multi-day highs around 10.0450

- EUR/NOK adds to Wednesday’s gains above 10.0000.

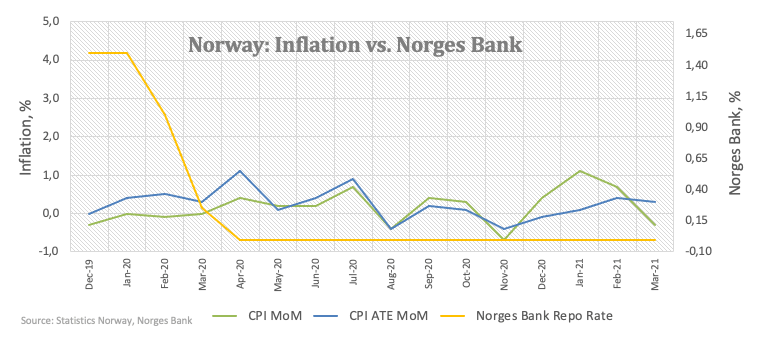

- The Norges Bank left the key policy rate unchanged at 0.00%.

- The Nordic central bank is expected to hike rate in H2 2021.

The Norwegian currency loses further ground and pushes EUR/NOK to the area of multi-day highs near 10.0450 on Thursday.

EUR/NOK higher post-Norges Bank

The krone depreciates further and adds to Wednesday’s losses despite the Norges Bank left unchanged the policy rate, as widely anticipated, and crude oil prices edge higher.

Indeed, the Scandinavian central bank matched forecasts and left the key rate unchanged at 0.00% at its meeting on Thursday. The Norges Bank once again acknowledged the solid fundamentals of the Nordic economy as well as the good pace of the vaccine rollout, all morphing into extra support to the already strong growth prospects.

The Norges Bank reiterated the likelihood that a rate hike could materialize in the second half of the year.

As said, NOK trades on the defensive despite the European reference Brent crude posts decent gains just below the $69.00 mark per barrel so far on Thursday, partially reversing Wednesday’s pullback.

What to look for around NOK

NOK extends the rebound from recent tops below the psychological 10.00 mark per EUR. As usual, price action around the krone is expected to track Brent dynamics and the hawkish stance from the Norges Bank. That, coupled with a faster economic recovery, the firm vaccine rollout and prospects of a solid rebound in the global activity are seen collaborating with the view of a stronger currency in the medium-term. It is worth recalling that the Norges Bank is predicted to be one of the first central banks to hike rates in the DM space.

EUR/NOK significant levels

As of writing the cross is up 0.32% at 10.0350 and faces the next resistance at 10.0849 (50-day SMA) seconded by 10.2749 (weekly high Mar.24) and then 10.4826 (monthly high Feb.26). On the other hand, a breach of 9.9116 (2021 low Apr.29) would expose 9.8163 (2020 low Jan.2) and finally 9.5552 (2019 low Apr.22).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.