EUR/JPY Price Analysis: Rising bets for a deeper pullback

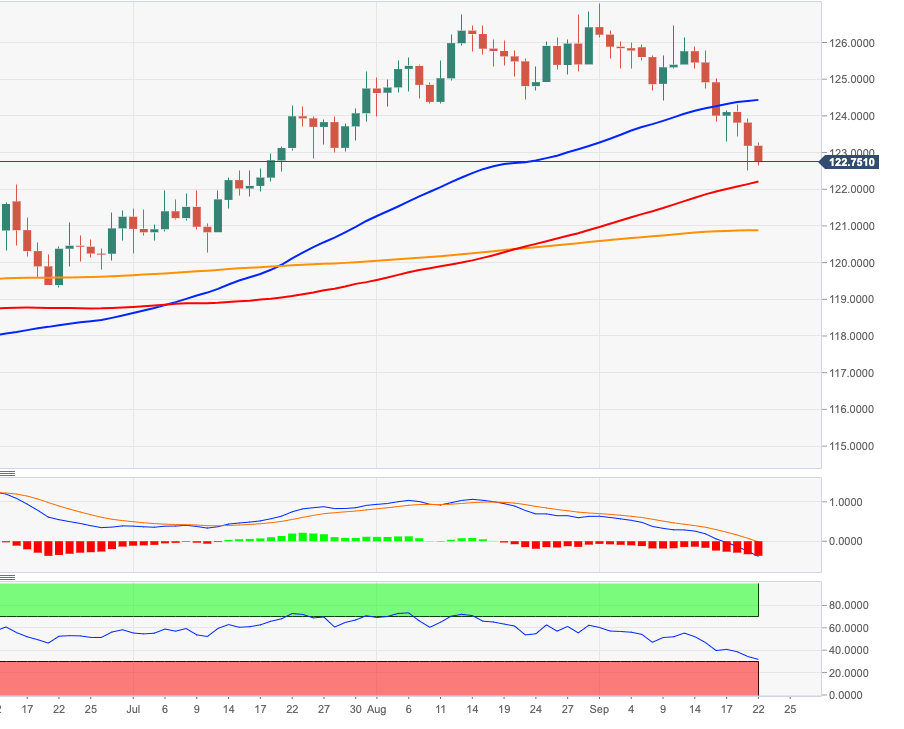

- EUR/JPY remains under heavy pressure below the 123.00 level.

- Interim support aligns at the 100-day SMA at 122.18.

EUR/JPY extends further the downtrend and is flirting with the key contention area in the 122.90/80 band on Tuesday.

The bearish impulse remains well in place and forced the cross to record fresh 2-month lows in the mid-122.00s at the beginning of the week. If the cross breach this area on a sustainable basis, then the next support comes in around 122.20, where is located the 100-day SMA. Further south emerges the more significant contention in the 200-day SMA, today at 120.86.

Below the 200-day SMA the outlook on the cross is expected to shift to bearish.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.