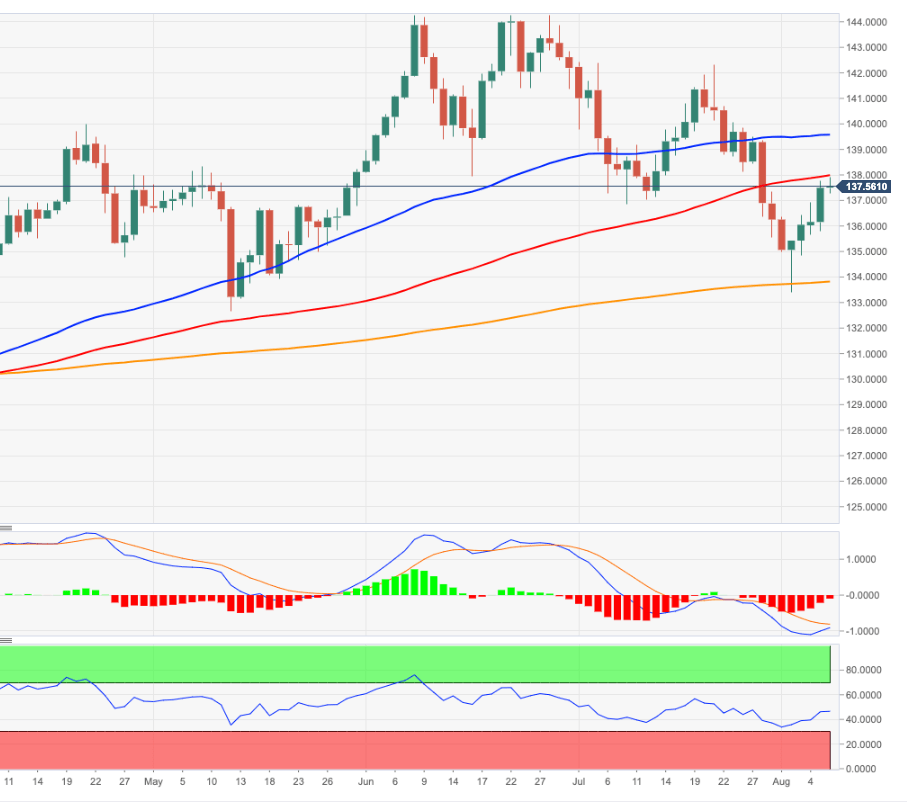

EUR/JPY Price Analysis: Next on the upside comes the 55-day SMA

- EUR/JPY extends the recovery to the vicinity of 138.00 on Monday.

- Further up now emerges the interim 55-day SMA around 139.50.

EUR/JPY remains on recovery-mode and already flirts with the 138.00 area at the beginning of the week.

Considering the ongoing price action, further upside in the cross appears likely for the time being. That said, the next temporary target aligns at the 55-day SMAs, today at 139.54.

While above the 200-day SMA at 133.79, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.