EUR/JPY Price Analysis: Next on the upside comes the 2022 high

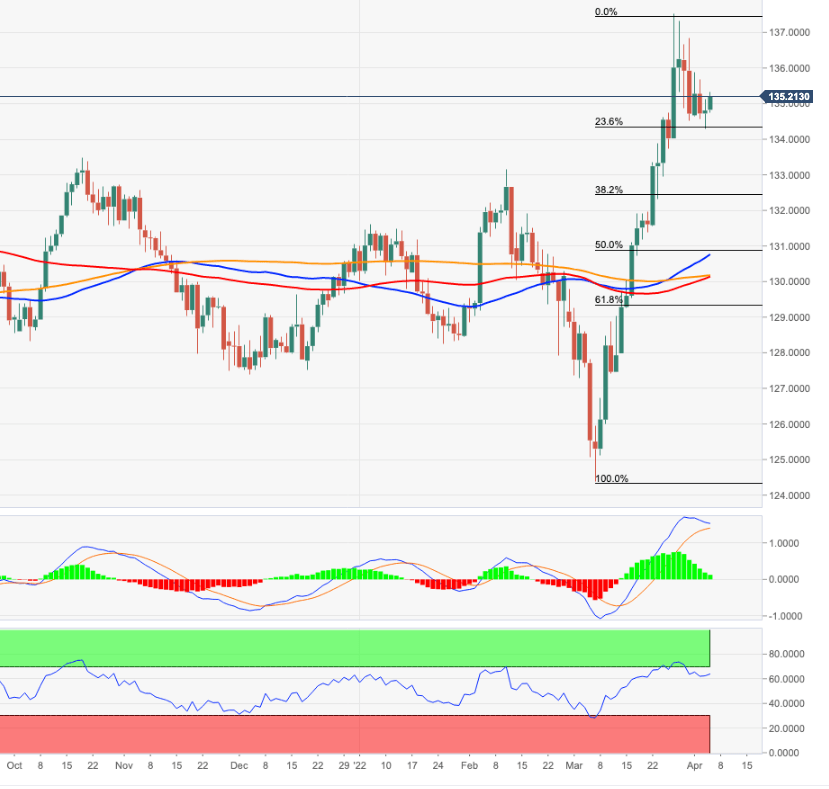

- EUR/JPY adds to Tuesday’s advance above 135.00.

- Immediately to the upside comes the YTD high at 137.54.

EUR/JPY extends the rebound from weekly lows in the 134.30 zone and retakes the 135.00 mark and above.

The underlying upside momentum in the cross remains unchanged for the time being. However, EUR/JPY could attempt to consolidate before resuming the uptrend. That said, the next hurdle remains at the 2022 high at 137.54 (March 28) prior to a probable visit to the August 2015 peak at 138.99 (August 15) and ahead of the round level at 140.00.

In the meantime, while above the 200-day SMA at 130.14, the outlook for the cross is expected to remain constructive.

EUR/JPY daily charts

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.