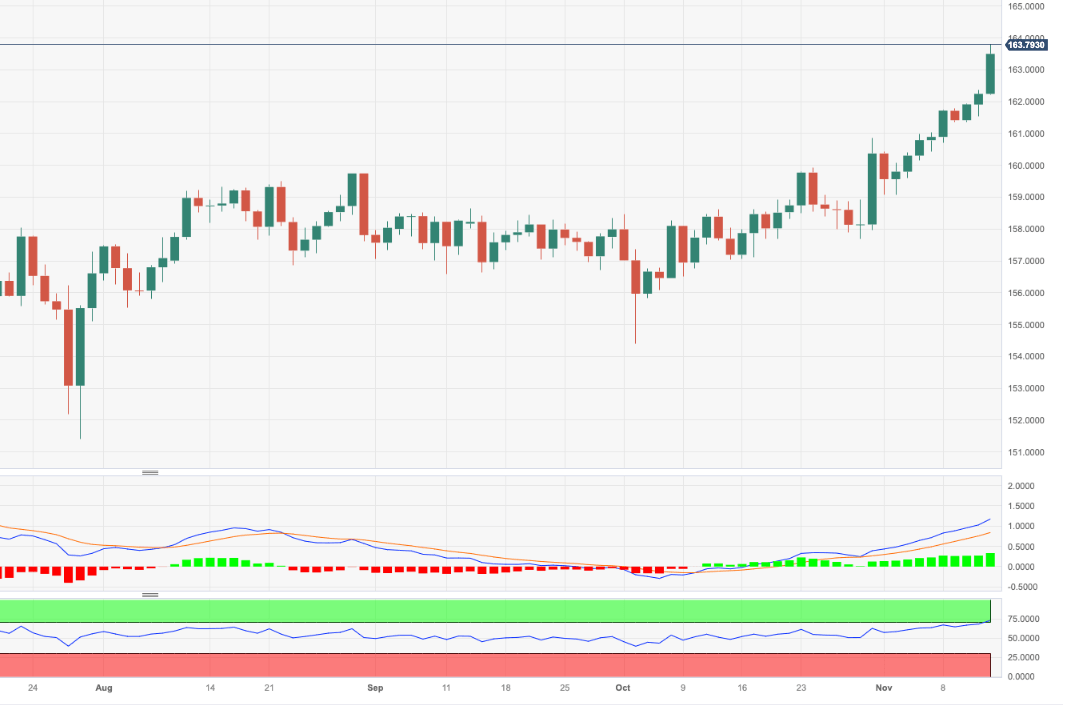

EUR/JPY Price Analysis: Correction in the offing?

- EUR/JPY advances to new highs near 164.00.

- Overbought conditions warn against further upside.

EUR/JPY climbs further and flirts with the 164.00 mark on Wednesday, new yearly peaks.

Further upside appears well on the cards for the cross in the short-term horizon. Against that, the surpass of the 2023 high of 163.94 (November 15) is expected to face the next significant resistance level not before the 2008 top of 169.96 (July 23).

In the meantime, the daily RSI enters the overbought territory near 74, opening the door to a potential near-term corrective move.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 152.46.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.