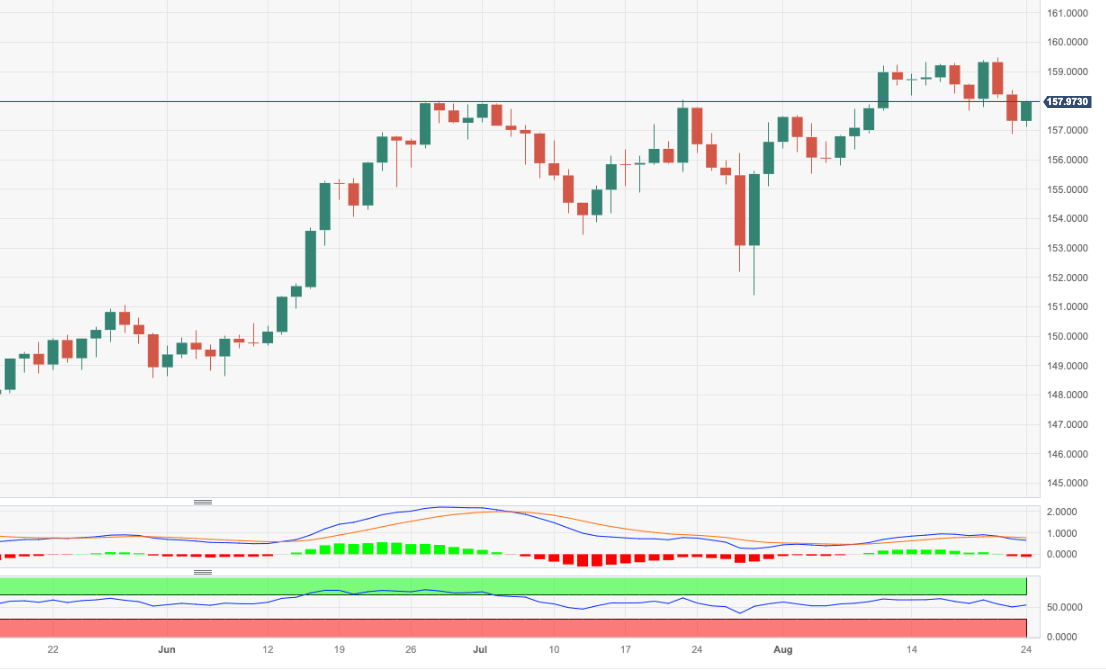

EUR/JPY Price Analysis: Bulls continue to target 160.00

- EUR/JPY reverses part of the recent two-day decline.

- Further recovery keeps targeting the 160.00 region.

EUR/JPY regains upside traction following two consecutive daily pullbacks on Thursday.

If the rebound gathers extra impulse, the cross should challenge recent 2023 peaks near 159.50 ahead of the key round level at 160.00. The surpass of the latter should not see any resistance level of note until the 2008 high at 169.96 (July 23)

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 147.58.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.