EUR/JPY Price Analysis: Bears eye a deeper test of daily support structure

- EUR/JPY bears taking control at the start of the week.

- Bears seeking a downside test deeper into daily support.

EUR/JPY has been pressured at the start of the week with the price falling from the upper 131 area to take out the late June support structure in the 131.20s.

The price has gone on to test the mid-June closing and opening lows with a focus now on the even lower 130.04 June lows.

The following illustrates the risk to the upside from a daily basis and contrast on the hourly.

Daily chart

The daily M-formation is a bullish chart pattern that could see the price move in on the neckline in the near future.

However, there is space to the downside and the hourly chart is more bearish.

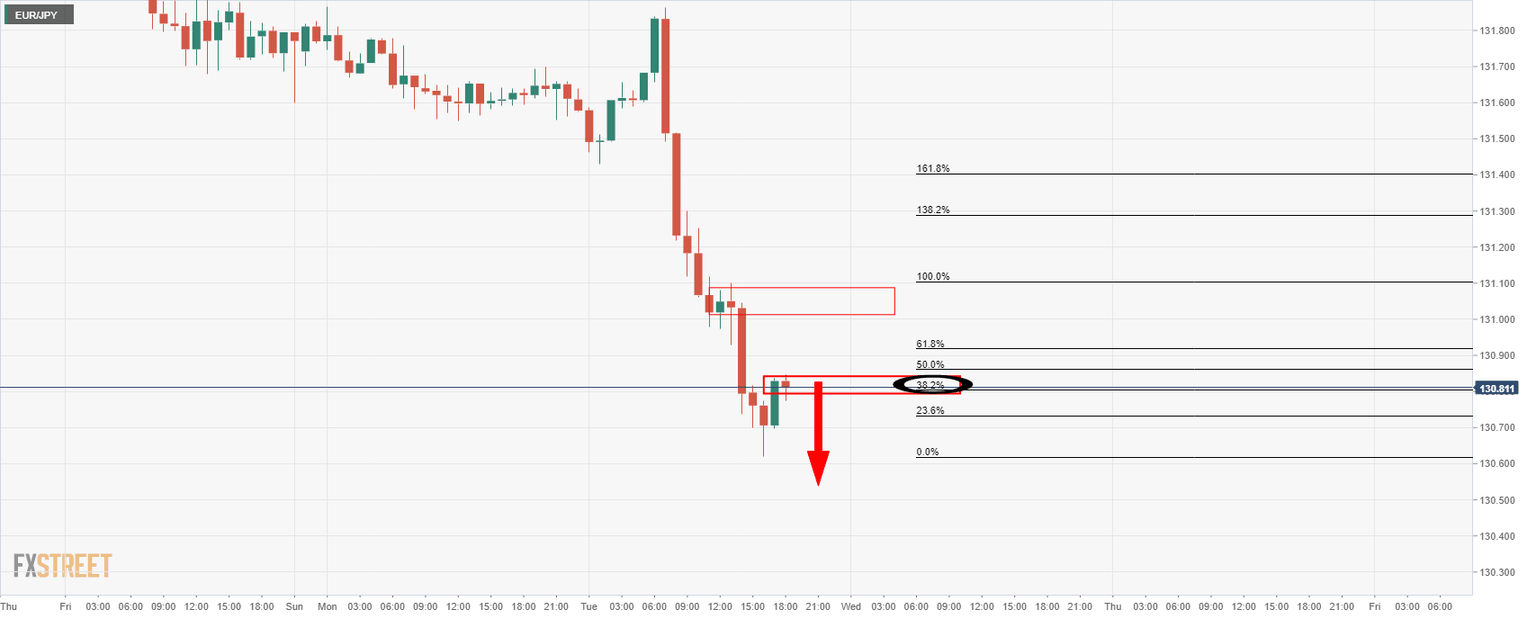

Hourly charts

The price has already corrected to a 38.2% Fibonacci of the last bearish hourly impulse. This could lead to renewed supply for a downside extension testing deeper into the daily support.

Alternative bearish outlook

If the price breaks higher from here, then the next resistance structure will be put under pressure.

Failures there will potentially lead to the downside extension.

With all that being said, a break of the resistance will put the neckline of the daily M-formation into focus again as the highest probable scenario.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.