EUR/JPY Price Analysis: Advances and faces strong resistance at Tenkan-Sen, clings to 158.00

- EUR/JPY consolidates within the 157.00/158.50 range, with an upward bias influenced by ECB President Christine Lagarde’s hawkish tone on inflation.

- Technical indicators suggest a new trading range could form if the pair falls below 157.00, with key levels at August 3 low of 155.53 and August 23 low of 156.87.

- A breach above the Tenkan-Sen line at 158.18 could open the door for bulls, targeting the year-to-date high of 159.49, while a break below 158.00 may trigger a slide towards 157.00.

As the New York session closes, the Euro (EUR) recovers some ground against the Japanese Yen (JPY) after neutral to hawkish remarks by the European Central Bank (ECB) President Christine Lagarde emphasized the ECB’s commitment to inflation. Hence, the EUR/JPY pair resumes its uptrend, set to finish Friday’s session with gains of 0.31%.

EUR/JPY Price Analysis: Technical outlook

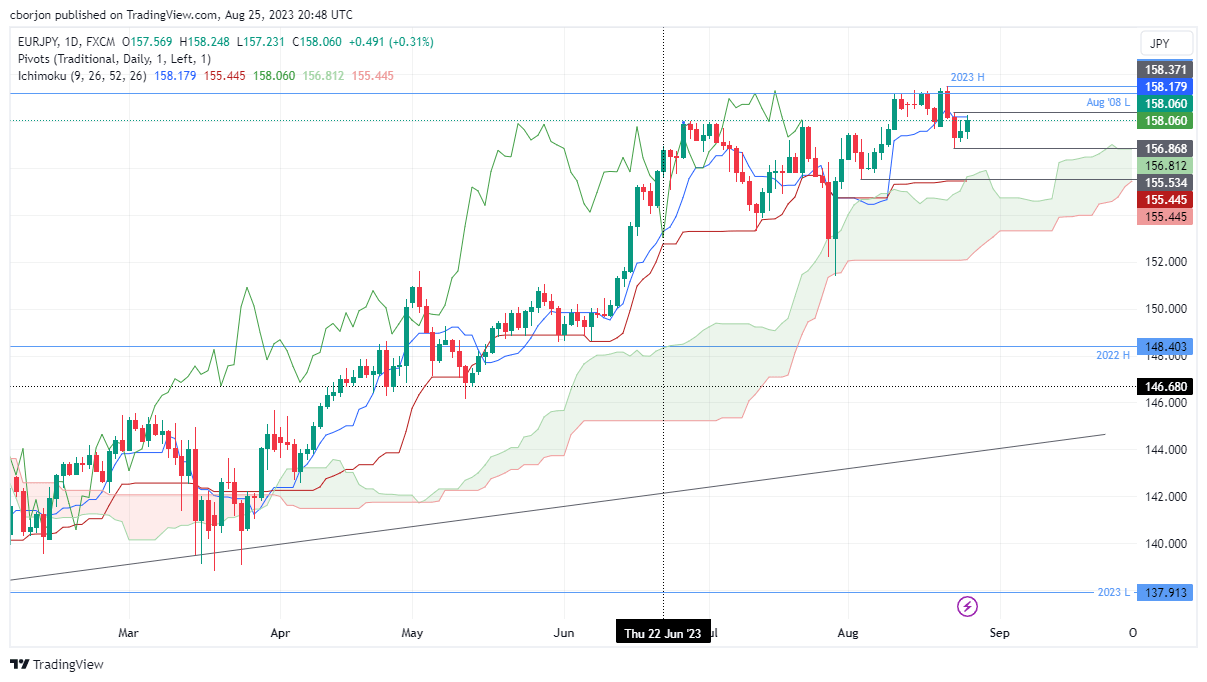

The EUR/JPY daily chart remains upward biased but is set to finish the week almost flat as the pair consolidates within the 157.00/158.50 area. Should be said that Friday’s uptrend was capped by the Tenkan-Sen line at 158.18, opening the door for a new trading range if the cross tumbles below 157.00. In that event, the pair’s new trading range would be the August 3 low at 155.53 and the August 23 low at 156.87.

Upside risks would emerge if the cross breaches 158.18. Once cleared, bulls would regain control, setting their eyes in the next target, the year-to-date (YTD) high at 159.49. Conversely, if sellers stepped in, achieving a decisive break below 158.00 could exacerbate a drop toward the 157.00 mark, followed by the August 23 low of 156.86.

EUR/JPY Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.