EUR/GBP Price Forecast: Euro is testing support at 0.8800 area

- The Euro trims gains agians the Pound and tests support at 0.8800.

- The upbeat UK services data has provided some support to the Pound.

- EUR/GBP's bearish divergence migh be anticipating a downside correction.

The Euro is pulling back from two-year highs near 0.8830 to test support at the 0.8800 area. The British Pound is coping better with the risk-averse environment and trimmed some losses following the upbeat UK Services PMI figure, while the upward revisions on the Eurozone Services data have failed to support the Euro.

UK Services PMI has been upwardly revised to a 52.3 reading in October from 50.80 in September, beyond previous estimations of a 51.10 reading. In thee Eurozone, the HCOB Services PMI revealed an improvement to 53.0 in October, from 51.3 in September, surpassing the preliminary estimate of 52.6.

The Pound dropped across the board on Tuesday, diving to fresh two-year lows against the Euro, as the UK Finance Minister, Rachel Reeves, hinted at sizeable tax rises to repair Britain's strained finances at the upcoming Budget.

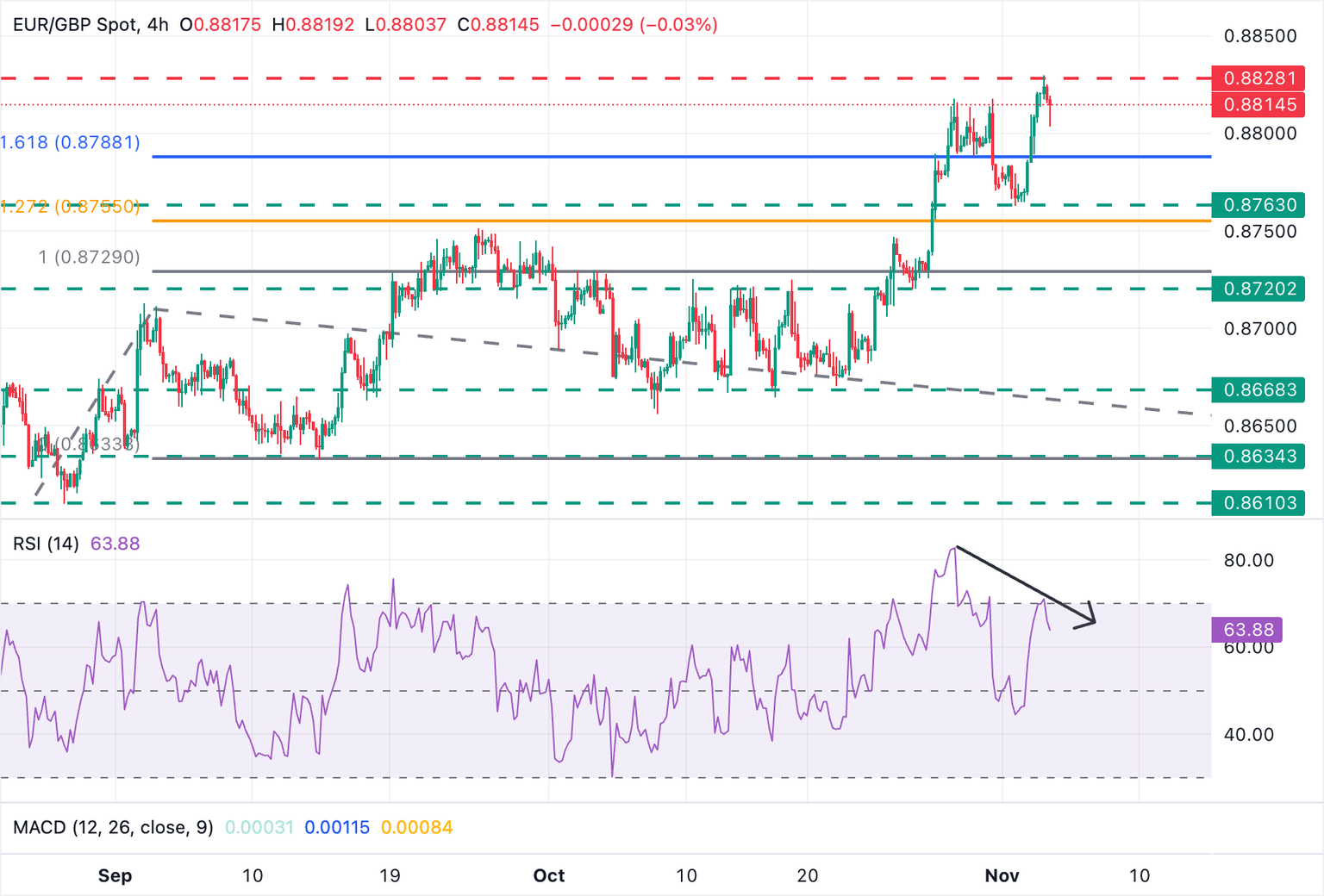

Technical Analysis: EUR/GBP charts show a bearish divergence

From a technical point of view, a look to the 4-hour chart reveals a bearish divergence on the Relative Strength Index, which suggests that the bullish trendf might be losing momentum, after having rallied nearly 1.8% over the last two and a half weeks.

The pair has tested support at the 0.8800 psycholiogical area earlier today, which, so far, remains in place. A confirmation below here would add pressure towards the Novemnbber 3 low, near 0.8760, and the October 27 low, at 0.8720

To the upside, above the mentioned long-term high, in the area of 0.8730, the 261.8% Fibonacci extension of the early September bull run, a common target for bullish cycles, is at 0.8880, ahead of the 0.8900 round level.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.03% | -0.06% | 0.02% | 0.28% | 0.10% | 0.09% | 0.00% | |

| EUR | 0.03% | -0.06% | 0.04% | 0.31% | 0.12% | 0.13% | 0.03% | |

| GBP | 0.06% | 0.06% | 0.10% | 0.35% | 0.16% | 0.16% | 0.07% | |

| JPY | -0.02% | -0.04% | -0.10% | 0.25% | 0.07% | 0.05% | -0.02% | |

| CAD | -0.28% | -0.31% | -0.35% | -0.25% | -0.18% | -0.20% | -0.28% | |

| AUD | -0.10% | -0.12% | -0.16% | -0.07% | 0.18% | -0.01% | -0.09% | |

| NZD | -0.09% | -0.13% | -0.16% | -0.05% | 0.20% | 0.00% | -0.08% | |

| CHF | -0.01% | -0.03% | -0.07% | 0.02% | 0.28% | 0.09% | 0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.