EUR/GBP Price Forecast: Downtrend unfolding

- EUR/GBP is extending its short and medium-term downtrends.

- There is a possibility it could stall temporarily as it has reached its first downside target.

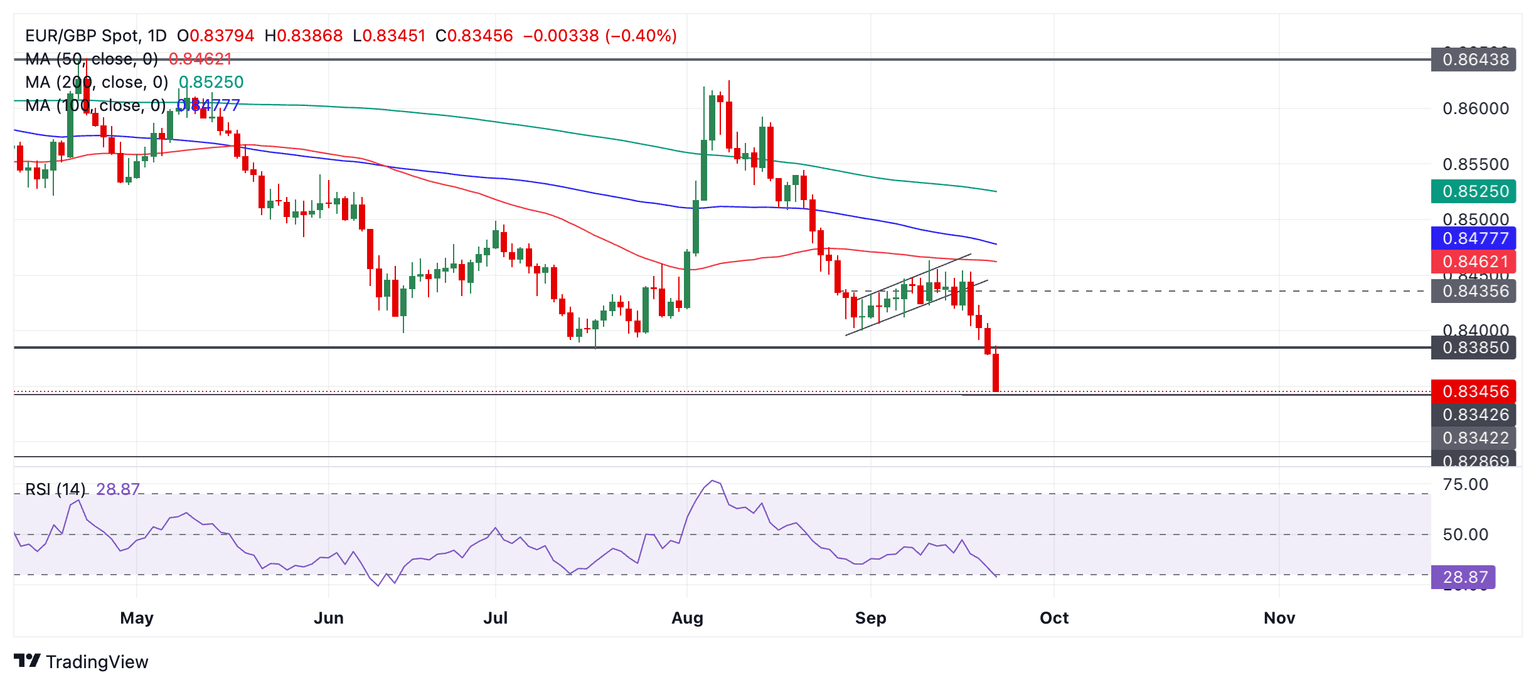

EUR/GBP has broken decisively below the July 18 (2024) low and reached the next key target level at 0.8343.

EUR/GBP Daily Chart

The trend is bearish both in the short and medium-term and given the principle that “the trend is your friend” this means the odds favor more downside.

EUR/GBP might stall at the current level but this is likely to be temporary.

If it closes below 0.8340 on a daily basis it will probably signal more downside towards the next target at 0.8287, the August 2022 low.

The Relative Strength Index (RSI) has entered the oversold region on an intraday basis. If it closes in oversold, it would advise traders not to add to their short positions as there is a risk of a pullback occurring.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.