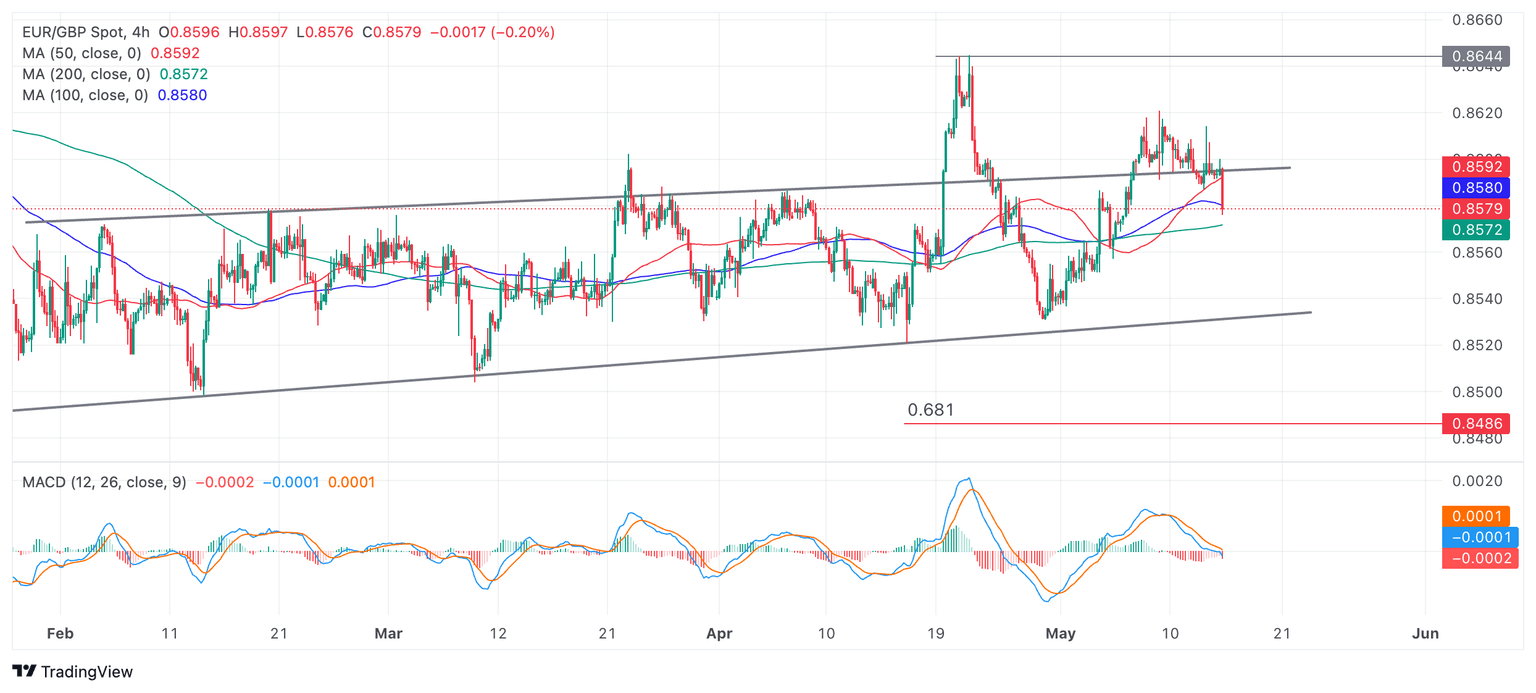

EUR/GBP Price Analysis: Falling back down inside its multi-month range

- EUR/GBP is breaking back inside a medium-term range after briefly breaching to the upside.

- The pair is extending its sideways trend and could fall all the way back down to the range lows.

- The MACD has crossed below its signal line giving a bearish signal.

EUR/GBP is falling back inside its multi-month range after temporarily breaking out to the upside on May 7.

The move back down inside the range continues the pair’s sideways trend. This trend is tipped to continue given the old market saying that “the trend is your friend”.

EUR/GBP 4-hour Chart

After breaking out above the top of the range on May 7, EUR/GBP formed a multiple topping pattern. It has now broken down through the neckline of the topping pattern and begun a steep descent back inside the middle of the range. There is a chance the pair could now fall back all the way down to support at around 0.8540.

The Moving Average Convergence Divergence (MACD) indicator crossed below its red signal line on May 10, giving a sell signal. This led to more downside for EUR/GBP and an eventual break lower.

For a change of the sideways trend to be confirmed, EUR/GBP would need to make a decisive break below the range lows or above the April 23 high.

In the case of a break below the range floor such a move would open the way to a downside target at 0.8486 – the 0.681 Fibonacci ratio of the height of the range extrapolated lower from the channel’s base. This is the method used by technical analysts to estimate range breakouts. Further weakness could even see price reach the next target at 0.8460, the full height of the range extrapolated lower (1.000).

A decisive break would be one characterized by a long red candlestick that broke completely below the range floor and closed near its low, or three consecutive red candlesticks that broke clearly through the level.

The top of the range has already been breached several times suggesting it has weakened and provides a less reliable support or resistance level. For confirmation of a new uptrend now, it would not be enough for EUR/GBP to simply break above the top of the range, rather it would have to make a higher high above the April 23 peak at 0.8645.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.