EUR/GBP Price Analysis: Bears struggle to keep the reins below 0.8800

- EUR/GBP Price Analysis: Bears struggle to keep the reins below 0.8800

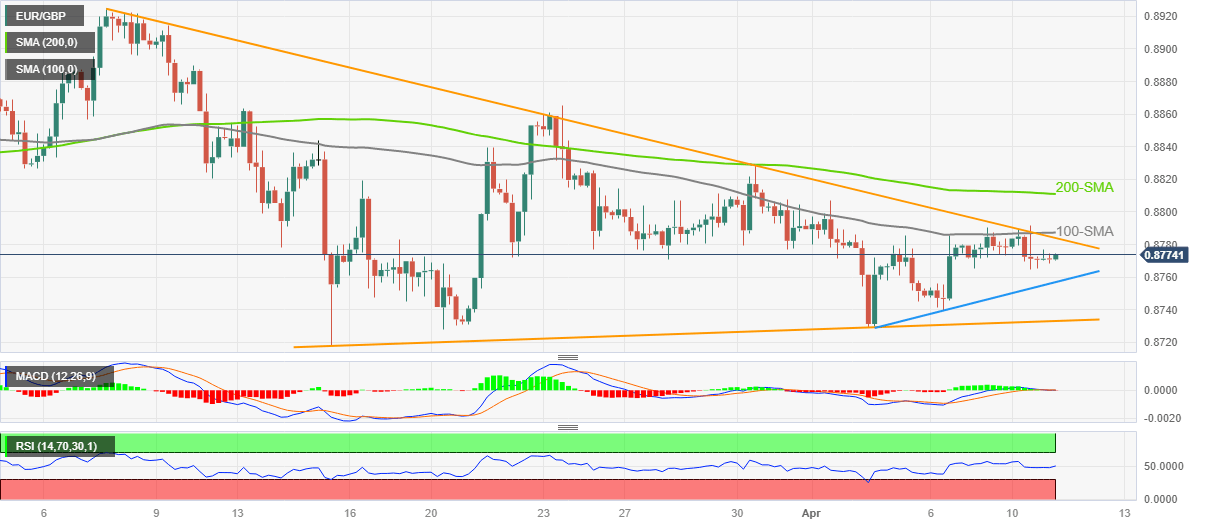

- EUR/GBP remains sidelined after reversing from 100-SMA, one-month-old resistance line.

- One-week-old ascending trend line, sluggish MACD signals restrict downside moves.

- Bulls need validation from 200-SMA to retake control.

EUR/GBP treads water around 0.8775 heading into Tuesday’s London open, following a pullback from the short-term key technical hurdles the previous day.

Even so, the cross-currency pair’s sustained trading past a one-week-long ascending trend line joins sluggish MACD signals and steady RSI (14) to prod the bears.

As a result, a slower grind towards a downward-sloping resistance line from early March, around 0.8785, can’t be ruled out. However, the 100-SMA level of 0.8790, and the 0.8800 round figure could challenge the EUR/GBP bulls afterward.

In a case where the quote rises past 0.8800, the 200-SMA level of 0.8811 acts as the last defense of the bears, a break of which can propel the prices towards the late March swing high of around 0.8865.

On the flip side, the aforementioned one-week-old ascending support line, near 0.8755 by the press time, limits immediate declines of the EUR/GBP.

Following that, an ascending support line from March 15, close to 0.8730, becomes crucial to watch as a break of which won’t hesitate to challenge the Year-To-Date (YTD) low of 0.8718 marked in March.

Overall, EUR/GBP is likely to grind higher but the upside room remains limited.

EUR/GBP: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.