EU Diplomat: Some member states becoming jittery as we enter Brexit endgame

“Some member states are becoming jittery as we enter Brexit endgame,” Reuters reports, citing a European Union (EU) diplomat.

Additional takeaways

“Still unclear if negotiators can bridge gaps on three key issues.”

“Briefing for envoys was an exercise to calm nerves in Paris and elsewhere that Barnier will continue to defend core EU interests, including on fisheries.”

“We are quickly approaching make or break moment, intensive negotiations continuing in London.”

Separately, another senior EU diplomat was reported, as saying that the ambassadors told Barnier that he should keep negotiating, but the substance is of more importance than the December 31 timetable.

“Several member states are open to continuing talks after Dec. 31 deadline if a good deal can't be reached by then,” the diplomat added.

The senior EU official said: “The member states told Barnier not to rush into a deal under the pressure of timing.”

These comments come after Chief EU Brexit Negotiator Michel Barnier earlier told EU envoys that a deal hangs in the balance and there may still be a no-deal outcome.

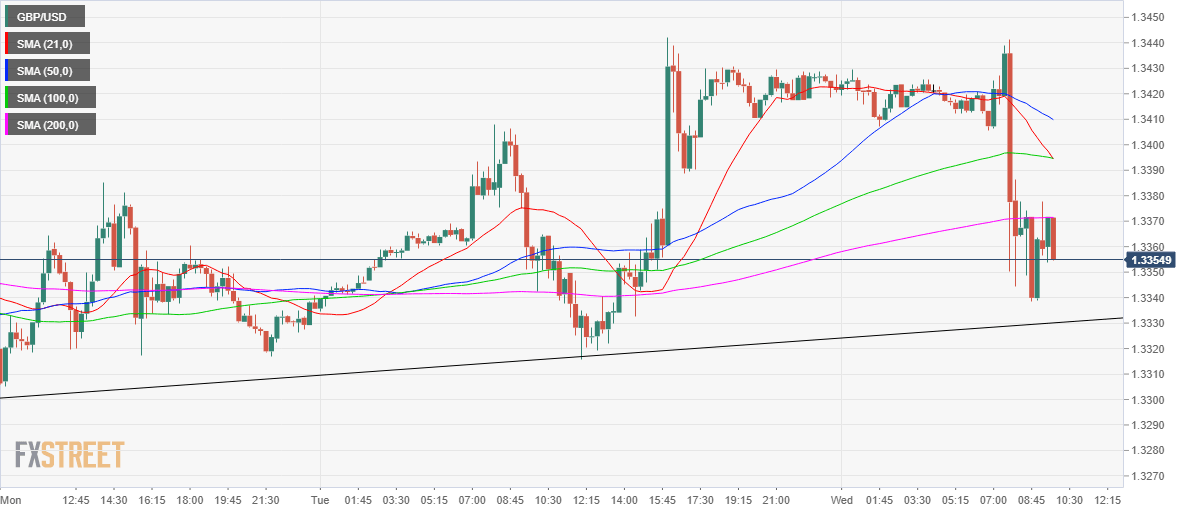

GBP/USD recovering lost ground

As the EU diplomat offers clarification on Barnier’s statement, GBP/USD is recovering from daily lows of 1.3339, now trading at 1.3365. The spot is down 0.40% on the day.

GBP/USD: 15-minutes chart

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.