End of Hong Kong's financial sector greatly exaggerated – Global Times

The Global Times has reported that the Stock Exchange of Hong Kong (HKEX) is set to welcome six IPOs this week.

The article sets out to debunk the fearmongering headlines over the city's prospects in the lead up to the National Security Law.

Lead paragraphs

The Stock Exchange of Hong Kong (HKEX) is set to welcome six IPOs this week, the most in a single week for the city in over four months, highlighting the persistent attractiveness of the financial hub among companies and investors, despite fearmongering headlines over the city's prospects in the lead up to the National Security Law.

The six IPOs this week could raise a combined total of $1.7 billion and mark the busiest week since February, Bloomberg reported.The companies include e-cigarette device maker Smoore International Holdings, which is expected to raise about $919 million, and property management arm of Zhenro Properties Group, according to Bloomberg.

The Global Times argues that the IPOs come as certain foreign officials and media outlets have been hyping "concerns" among investors over the upcoming National Security Law, with some even claiming the end of Hong Kong as a global financial and commerce hub with foreign investors and business predicted to flee the city.

'This is completely false, and contrary to reality. Most of my friends and myself are not willing to stay in Hong Kong unless a national security law is enacted,' Angelo Giuliano, a financial consultant in Hong Kong from Switzerland who has been outspoken in condemning the unrest in the city, told the Global Times on Monday.

Giuliano said that after months of violent riots, Hong Kong needs a national security law to protect the city and its citizens against the violence, terrorism and foreign interference. 'We really need to get this law to restore peace and prosperity to Hong Kong,' he said.

Market implications

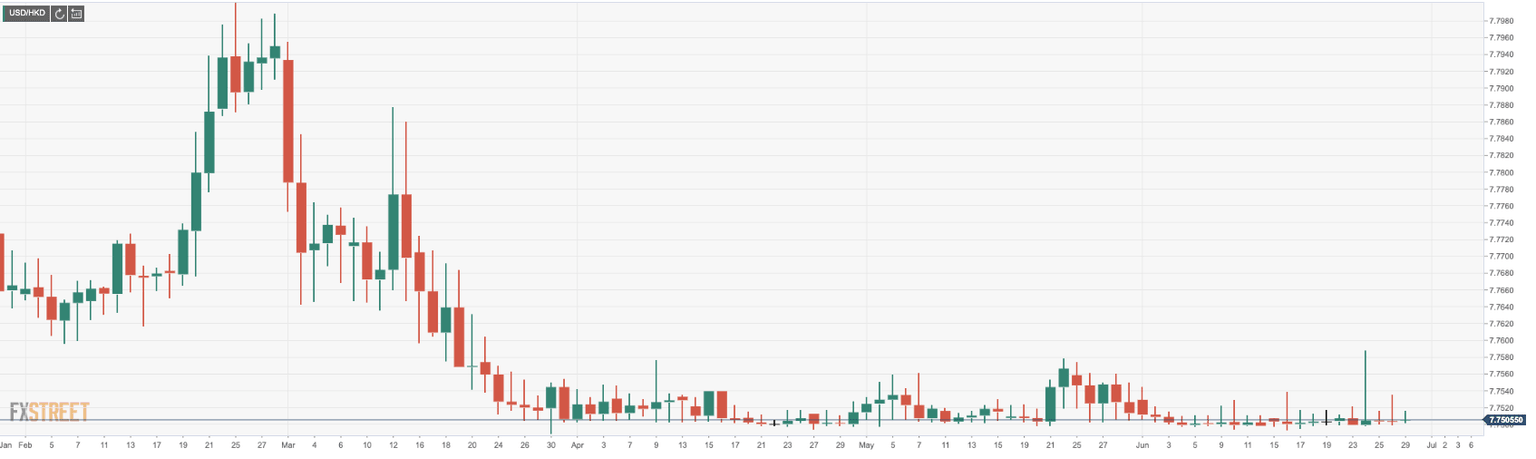

In recent weeks there has been speculation that the 36-year old Hong Kong Dollar / USD peg breaks. Yohay Elam, Senior Analyst at FXStreet wrote in a long article on this here.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.