Elliott Wave view: APPLE (AAPL) continue rally in bullish sequence

Short Term Elliott Wave view in APPLE (AAPL) suggests that rally from 8.05.2024 low is incomplete & should continue upside as the part of daily bullish sequence. It is showing 3 swing higher since August-2024 low & expect more upside against 11.04.2024 low. It ended (1) at $237.49 high as diagonal & (2) correction at $219.71 low. Within (1), it placed 1 at $232.92 high, 2 at $213.92 low, 3 at $233.09 high, 4 at $221.14 low & finally 5 ended at $237.49 high as (1). Within (2) correction, it placed A at $227.30 low, B at $234.73 high & C at $219.71 low near 0.382 Fibonacci retracement of (1). Above (2) low, it favors upside in (3) of ((1)) & can extend towards $261.29 or higher levels before major pullback may seen.

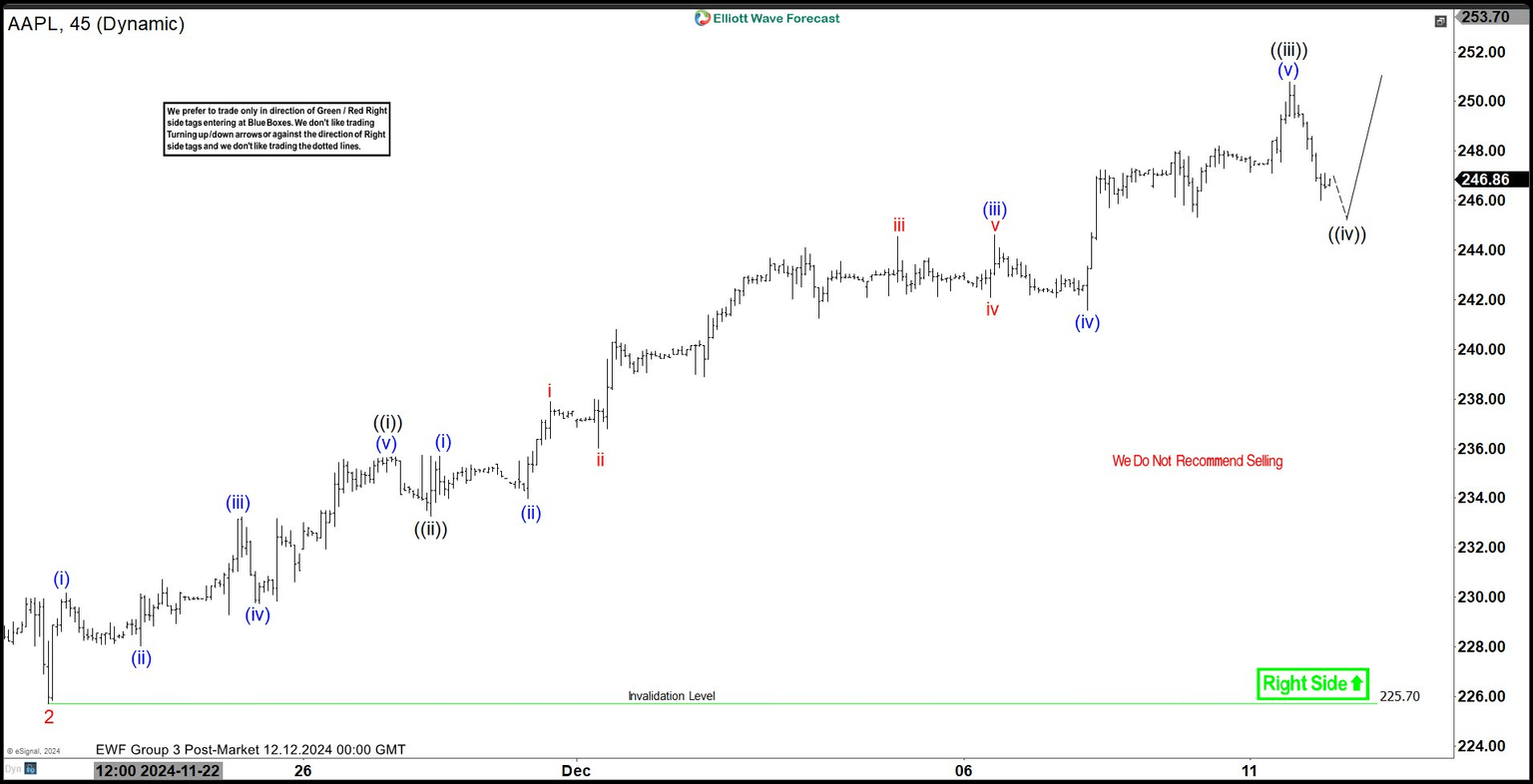

APPLE (AAPL) 45 minutes Elliott Wave chart

Above $219.71 low, it placed 1 of (3) at $230.16 high, 2 at $225.71 low & favors upside in 3 of (3). Within 3, it placed ((i)) at $235.65 high, ((ii)) at 233.26 low & ((iii)) at $250.80 high as extended wave. Short term, it favors upside in ((v)), if ended ((iv)) at $246.02 low, which already reached between 0.236 – 0.382 Fibonacci retracement area of ((iii)). It needs price separation to confirm the view of further upside. Alternatively, if it extends lower from current level, it can either extend ((iv)) or 4 pullback in (3) as discussed in video. But in either the case, it should extend higher to finish sequence started from 11.04.2024 low as (3). We like to buy the pullback in 3, 7 or 11 swings at extreme areas, when reached. It expects more upside towards $261.29 or higher levels, while dips remain above 11.04.2024 low.

AAPL Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com