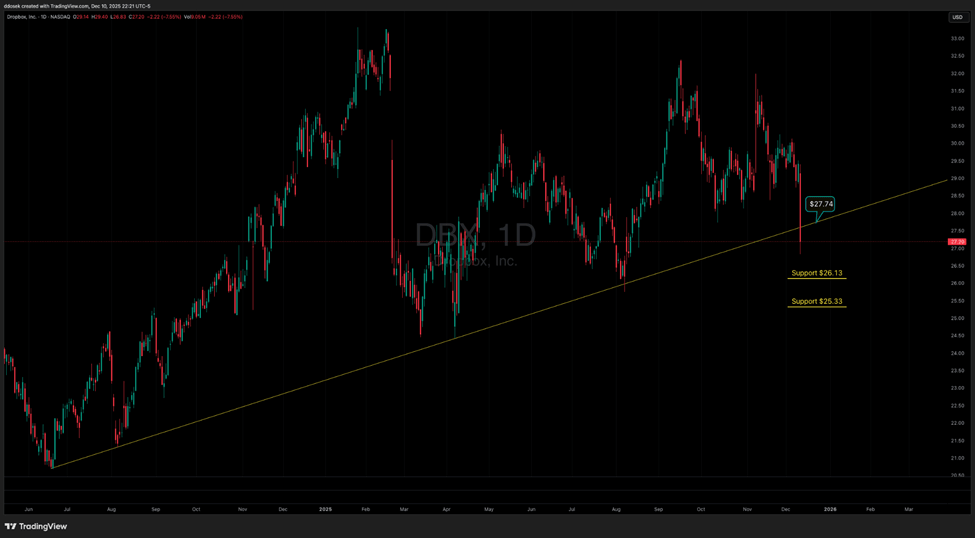

DBX cloud crash: Dropbox stock sinks below critical trendline—Can $26.13 hold the line?

Dropbox, Inc. ($DBX), the San Francisco-based tech giant known for its cloud collaboration and file management platform, suffered a notable loss on Wednesday, plunging 7.55% in a single session. This steep drop now places DBX down nearly 15% from its high on November 7th.

From a technical perspective, the significance of Wednesday’s descent cannot be overstated: the close breached and settled beneath a critical long-term inclining trendline that originated in June 2024. This was the fifth time the trendline had been tested since last year, making the failure to hold particularly decisive, for now. Although price action sometimes results in a "false" breakdown—where the stock quickly recovers above the support trendline and saves the chart’s uptrend—closing beneath Wednesday’s low would solidify the current decline. If that move occurs, the probability increases for the price to aggressively test the $26.13 support level, with a potential further move to $25.33.

Should DBX find a floor and successfully bounce from either of those support levels, the initial major target for bulls to regain momentum will be the $27.74 resistance zone. However, whether the stock tests lower support or not, the current line in the sand for DBX to signal a renewed upward trend remains that broken inclining trendline, now standing as a key hurdle near $27.74.

Author

Drew Dosek

Verified Investing

Passionate technical and cycle analyst committed to empowering traders through data-driven insights.