CFTC Positioning Report: EUR net longs regain traction

These are the main highlights of the CFTC Positioning Report for the week ended on January 12th:

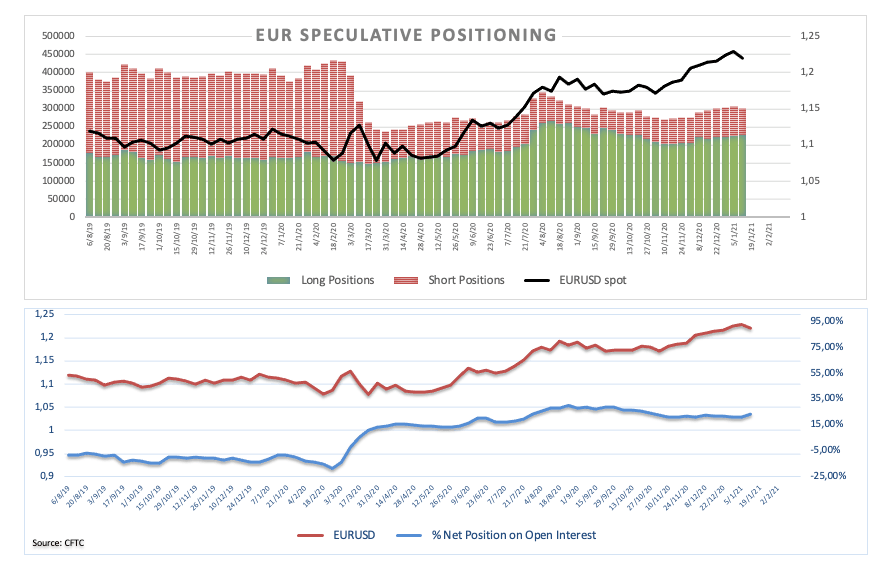

- Speculators added gross longs for the fourth consecutive week and pushed the net positions in EUR to new 5-week highs nearly 155.9K contracts. Real interest rates favouring Euroland plus prospects of a strong recovery in the region kept benefiting the single currency. However, the later pick up in the demand for the greenback would likely motivate some changes in the next report.

- Net shorts in the greenback dropped to multi-week lows on the back of the perceived higher fiscal spending under the Biden’s presidency and its impact on inflation and US yields. The moderate rebound in the demand for the greenback in the second half of last week pushed the DXY to fresh yearly highs.

- JPY net longs remained in levels last seen in early October 2016 on the back of repatriation flows. This trend has probably run out of some steam in light of the recent appreciation of US 10-year yields.

- GBP net longs increased to 10-month tops after the BoE reiterated it is not ready no embark on a policy contemplating negative interest rates for the time being. In addition, the vaccine rollout in the UK plus optimism following the UK-EU deal continued to support the quid.

- In the commodity universe, net longs in crude oil climbed to levels last recorded in early August 2020. Auspicious news from Saudi Arabia, shrinking US crude oil supplies, prospects of a strong rebound in the Chinese economy and the generalized constructive view on the commodity have been all supporting the upside in prices to the vicinity of the $54.00 mark per barrel.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.