Canadian Dollar backslides on fresh risk aversion

- The Canadian Dollar tumbled against the US Dollar on Tuesday.

- After a long weekend, American markets have returned with a notable risk-off tilt.

- PMI figures for both US and Canadian markets revealed increasing business concerns around tariffs.

The Canadian Dollar (CAD) took another backstep against the US Dollar (USD) on Tuesday, officially kicking off the September market window with a firm step into the bearish side as risk appetite withers.

Global markets are facing renewed concerns about government financing and debt levels, as well as knock-on inflation impacts from the Trump administration’s ever-changing tariff policies. Businesses and firms in the manufacturing sector broadly reported an upswing in earnings through the third quarter, but mostly on the back of price increases as inventories eat of supplies at an increased pace.

Daily digest market movers: Fresh market concerns knock Canadian Dollar lower

- The Canadian Dollar fell over one-half of one percent at its lowest against the US Dollar on Tuesday, before recovering to a more stable 0.2% decline.

- Investor risk appetite faces a challenge in September as government budget deficits swell across developed economies and tariff impacts continue to grow.

- The Institute for Supply Management (ISM) noted that respondents to their latest Purchasing Managers Index (PMI) noted that price gains are a result of demand outstripping supplies, with firms reticent to engage in hiring.

- Many firms are noting sharp contractions in new orders, especially among businesses that deal with imports from Brazil and India, especially in the agriculture and construction materials segments.

- The Standard & Poor’s (SP) Canadian PMI reported a general softening in Canadian manufacturing declines, but Canadian firms continue to grapple with tariff effects, and are struggling to readjust supply chains in the face of souring trade with the US.

Canadian Dollar price forecast

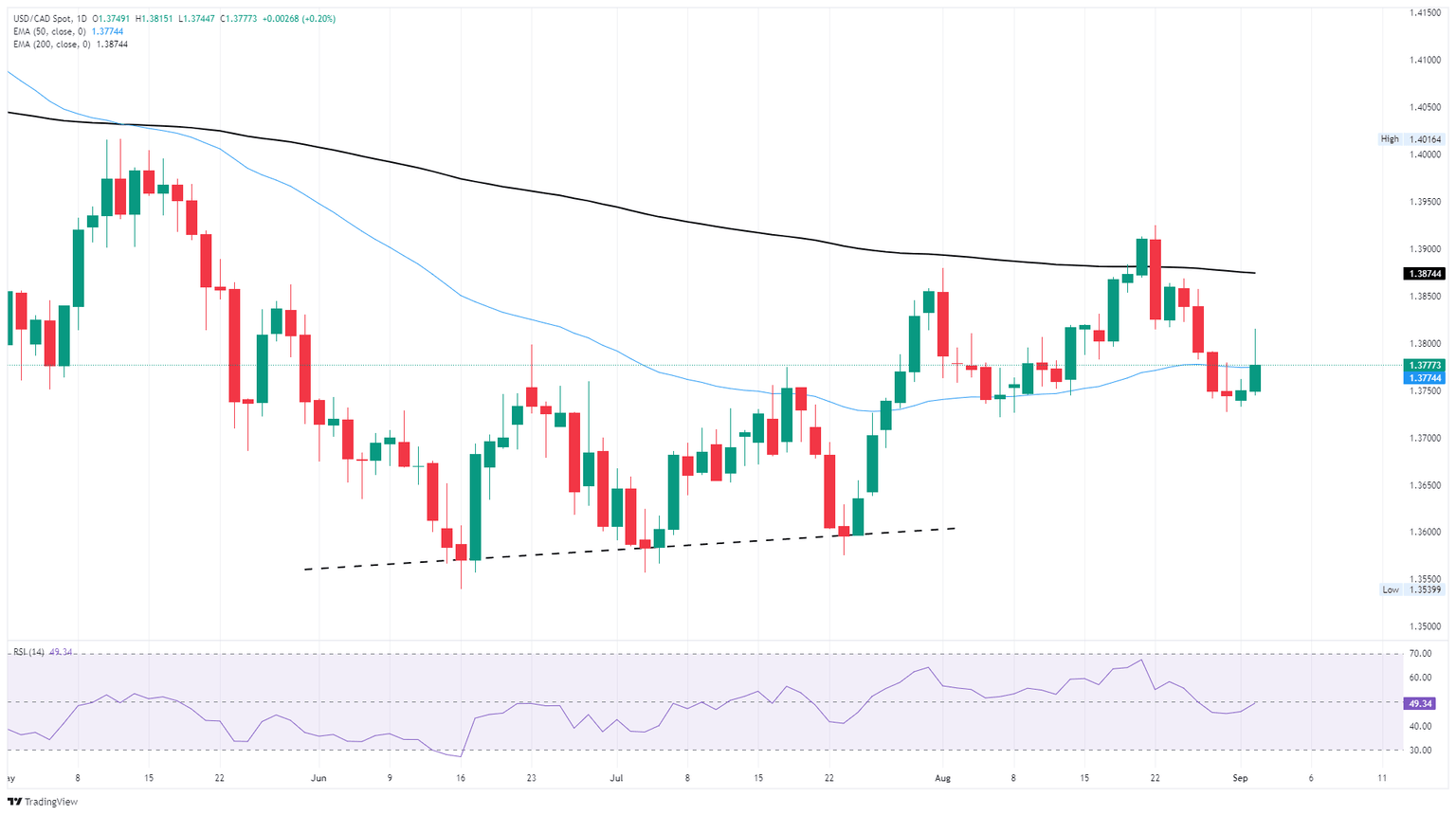

Tuesday’s bearish plunge in the Canadian Dollar has bolstered USD/CAD bids, sending the pair back into the 50-day Exponential Moving Average (EMA) as bullish pressure behind the Loonie dries up. A sharp adjustment to global risk appetite to kick off September has sent the safe-haven US Dollar higher, and USD/CAD is now challenging the 1.3800 once again.

USD/CAD remains fairly contained below the 200-day EMA near 1.3875, but further downside remains equally unlikely after a soft double-bottom from the 1.3730 region.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.