CAD/JPY Price Analysis: Bulls and bears battel it out in key territory

- CAD/JPY bulls are moving in but there are downside prospects.

- The day ahead has red news in both Asian and the US.

CAD/JPY is on the watchlist for the rest of the week as the price moves out of an important trendline on both the longer-term and shorter-term charts. The following outlines the scenarios for the rest of the week and next:

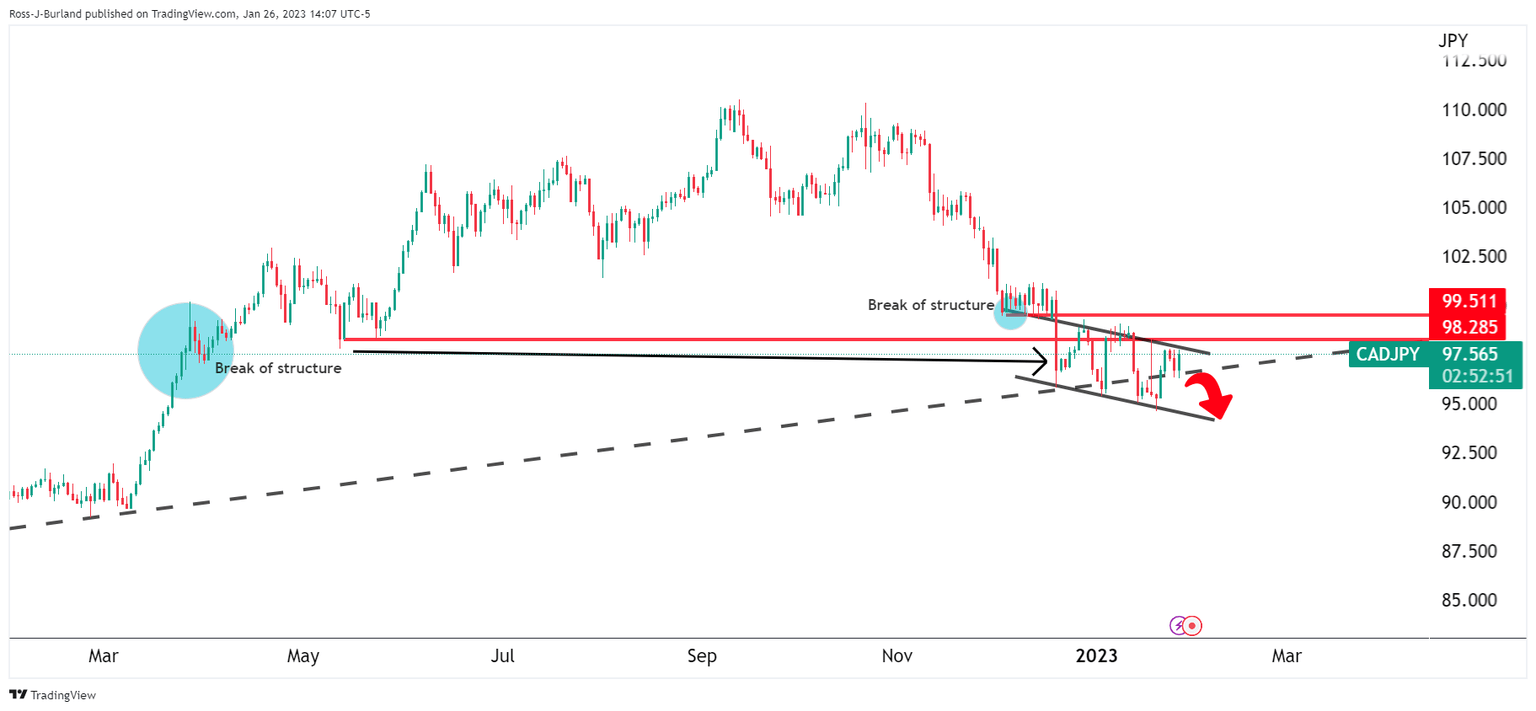

CAD/JPY daily chart

Bears are on the prowl on the break of stricture and the price is coiled below it as illustrated above. A breakout could be imminent:

The price has been chipping away at the now-broken trendline. The downside target at the extreme is located near 91.70 while the upside targets are the 99.70s and 101.10s:

Meanwhile, the channel is compelling and the downside is favourable for the nearer term despite being on the backside of the recent bearish trend:

The Daily W-formation sees support near 96.00 within the descending channel for a downside target that guards prospects of a move lower towards the bottom of the channel.

CAD/JPY H1 and H4 charts

The 4-hour chart is forming a W-formation which is a reversion pattern. However, we have equal highs for which the price could penetrate prior to a bearish 4-hour close. Nonetheless, the downside bias is favoured into the low 97's.

Looking at the hourly chart, the following outlines a potential schematic for the rest of the week as we head into the US red news calendar event on Friday morning:

The thesis is that while the outlook is bearish, the price discovery will be a theme between now and the data on Friday which also includes Japan's Consumer Price Index. The pump up from the low 96's may still be in process and the Asian session will lay out the foundations for the London and US session to base from.

In terms of liquidity, the following illustrates where stops are likely placed:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.