BoJ minutes: One member said inappropriate to tweak policy target

The Bank of Japan (BoJ) minutes for the December meeting are out as follows:

One member said inappropriate to tweak policy target.

One member said there could be room to debate how rigidly BoJ should interpret price target.

One member said BoJ must conduct review of its policy framework at some point in the future.

One member said must ensure market players are prepared against risk associated with rate hike, when time for ending BoJ's easy policy comes.

Several members said effect of powerful monetary easing will continue even if BoJ widens band around its yield target.

One member said BoJ must humbly look at how much tweak to YCC will help improve market function.

A few members said BoJ must clearly explain widening of yield band is not a move eyeing exit from ultra-loose policy.

Govt rep said slowing overseas growth is a risk to japan's economy, must scrutinise impact of rising inflation, supply constraints and market volatility.

Govt representative requested recess during meeting, which chair approved.

Govt rep said "understands today's debate was about steps to make monetary easing more sustainable".

Govt rep said hopes BoJ continues to strive towards achieving price target in stable, sustainable manner.

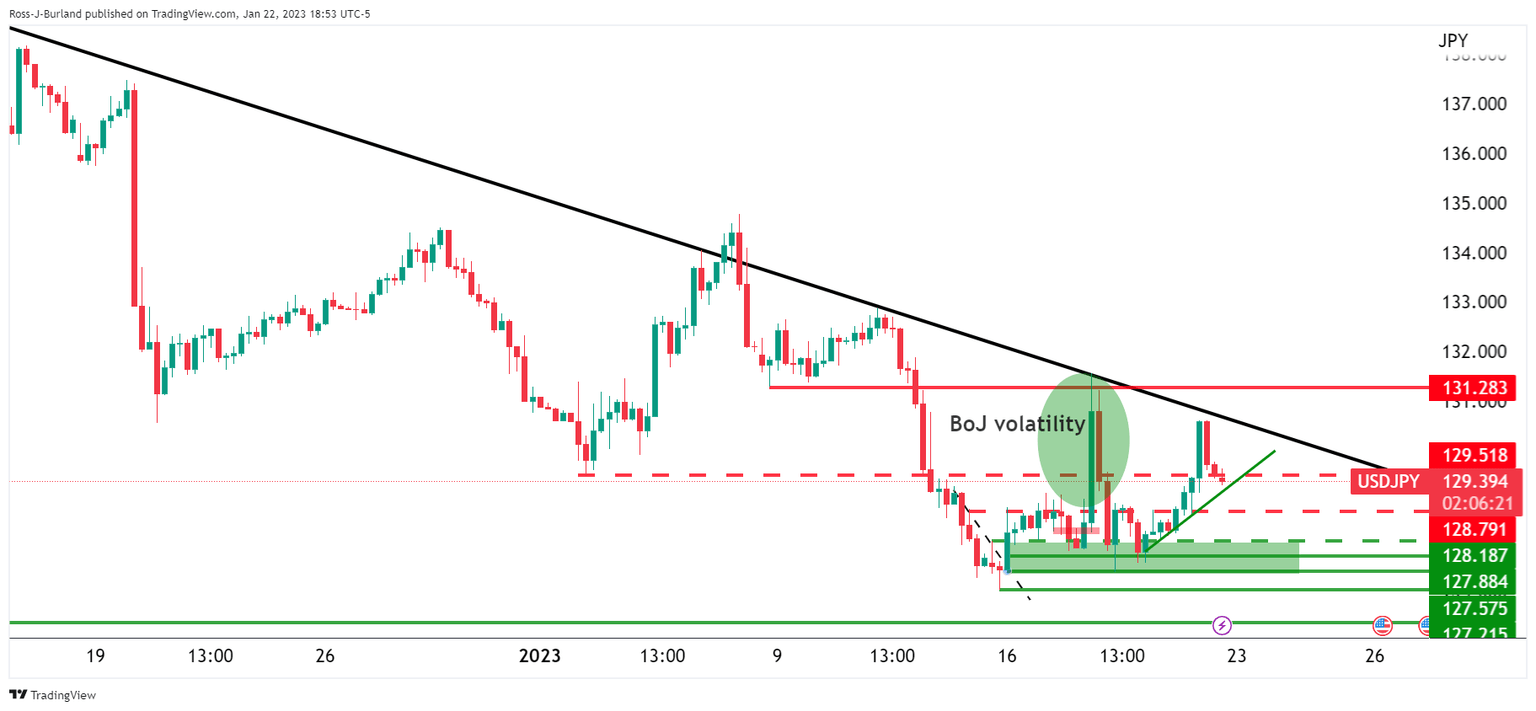

USD/JPY update

The Bank of Japan (BoJ) maintained its key short-term interest rate at -0.1% and that for 10-year bond yields around 0% during its January meeting by a unanimous vote while keeping its 0.5% cap for bond buying.

This was a surprise to investors as policymakers were said not to be seeking a looser grip on bond yields after the unexpected tweak of the yield curve control range in December. Instead, the BoJ reiterated it would take extra easing measures if needed. The central bank also explain that short-and long-term policy interest rates would stay at their present or lower levels which helped to keep USD/JPY buoyed above critical support:

About the BoJ minutes

The Bank of Japan publishes a study of economic movements in Japan after the actual meeting. These meetings are held to review economic developments inside and outside of Japan and indicate a sign of new fiscal policy. Any changes in this report tend to affect the JPY volatility. Generally speaking, if the BoJ minutes show a hawkish outlook, that is seen as positive (or bullish) for the JPY, while a dovish outlook is seen as negative (or bearish).

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.