Block (SQ Stock) Earnings Preview: What to expect from Block Q1 results?

- Block, formerly known as Square, reports earnings after the close on Thursday.

- SQ stock needs a good report to change the sentiment.

- SQ share price is down 34% year to date and 55% in the past 6 months.

Square – sorry make that Block (SQ) – earnings are out after the close on Thursday. Investors will look for clues on whether it is time to reenter the high-growth name which has seen its stock price fall sharply in 2022. Factors outside the control of the company have been at play with rising interest rates making investors wary of holdings in high-growth names.

Read more stock market research

As an interesting aside it will be fascinating to see how often Block CEO Jack Dorsey is questioned about any possible distraction in relation to his backing of Elon Musk's bid for Twitter (TWTR). Jack Dorsey for those not in the know was the founder and former CEO of Twitter.

Block (SQ) stock news: Spectacular revenue but slowing profits

Block is a payment system that was originally called Square. It is a card reader that makes mobile payments seamless and effortless. The square hardware is a small square white box that attaches to the side of a smartphone and allows payments via credit and debit card. It has grown hugely in popularity due to its portability. Square was innovative in the way it allows sellers to onboard in a matter of minutes. Simply download the app and Square (SQ) sent sellers the small square hardware. This enabled multiple small businesses to begin accepting card payments. The company was renamed Block to reflect founder and CEO Jack Dorsey's interest in Blockchain. Dorsey felt Square reflect a singular focus on payments whereas Block would allow the company to expand its footprint to other areas.

While revenue growth has been spectacular, growing from $1.1 billion in 2019 to $4 billion at the end of 2021, it has come at a cost. Profitability has been slowing and Net Income and EBITDA (earnings before interest tax, depreciation, and amortization) have gone into the red for the last quarter.

For this quarter, earnings per share (EPS) is expected at $0.20 and revenue is expected to reach $4.14 billion.

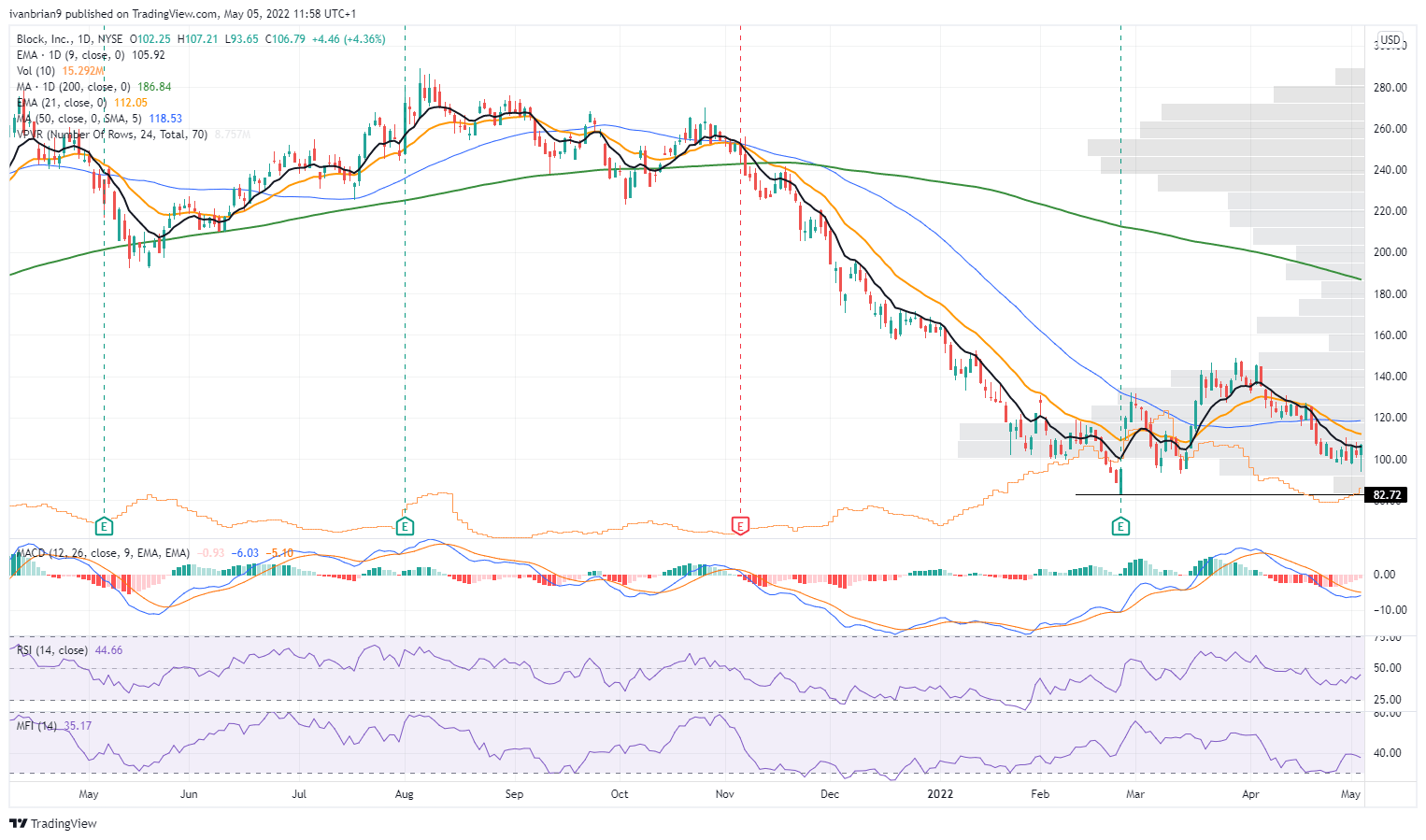

Block (SQ) stock forecast: Needs to stay above $82.72 for a bullish comeback

The last low from Dec 2021 earnings gives us the major support at $82.72 for SQ stock. Holding above this level is key. Above $140 we enter a volume gap which could see SQ share price make accelerate to test the 200-day moving average at $180. Block earnings will be the key catalyst here.

Above $140, SQ stock is bullish. Below it remains locked in a bearish spiral.

Block (SQ) stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.