BHP Group Limited – BHP Elliott Wave technical analysis [Video]

![BHP Group Limited – BHP Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/supermicro-02_XtraLarge.jpg)

ASX: BHP Group Limited – BHP Elliott Wave technical analysis

Greetings, our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with BHP GROUP LIMITED – BHP. We observe upside potential in ASX:BHP, as wave 2)–orange has ended as a Zigzag, and wave 3)–orange shows room to extend. This analysis outlines the price target and what invalidates the view.

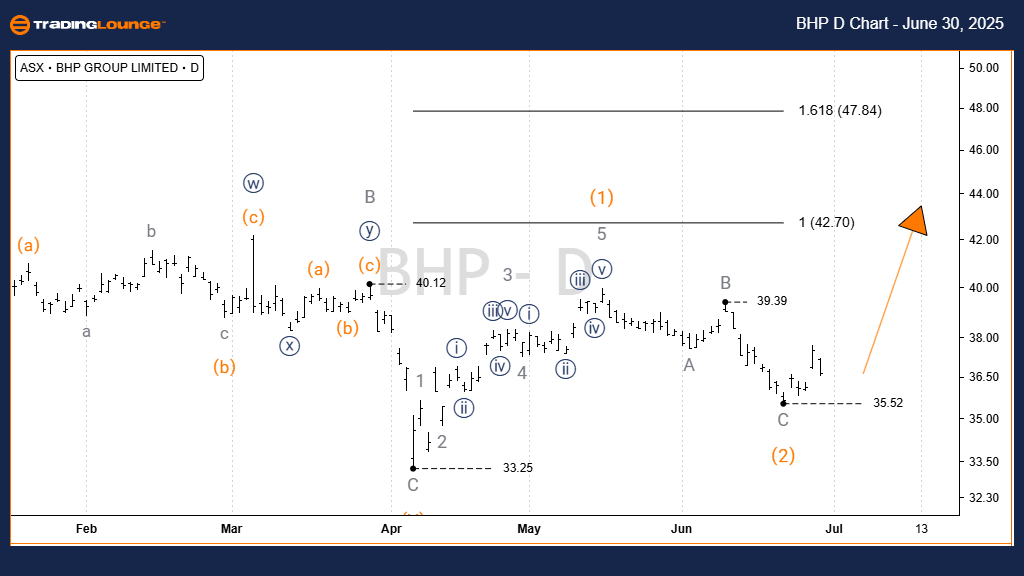

One-day chart (semilog scale) analysis

Function: Major trend (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Wave 3)–orange.

Details:

Since the low at 33.25, wave 1)–orange completed as a five‑wave structure. Then wave 2)–orange likely finished as a three‑wave Zigzag labeled A–B–C–grey. This implies wave 3)–orange may be unfolding, targeting the 42.70–47.84 range. For this bullish view to hold, price must stay above 35.52.

Invalidation point: 35.52.

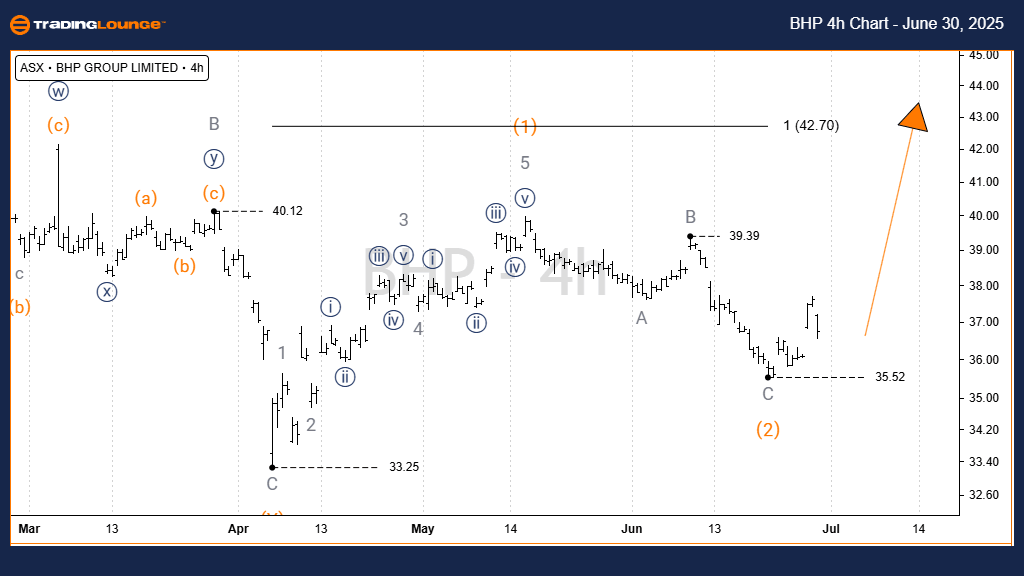

ASX: BHP Group Limited – BHP four‑hour chart analysis

Function: Major trend (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Wave 3)–orange.

Details:

On the 4‑hour timeframe, our assessment remains unchanged from the 1‑day chart. A Long Trade setup may be triggered once price moves above the Entry level.

Invalidation point: 35.52.

Conclusion

Our Elliott Wave analysis and short‑term outlook for ASX: BHP aim to grant readers objective, professional insights. We specify price levels for confirming or invalidating our wave count, boosting confidence in our view. These data‑driven signals help traders capitalize effectively on market trends.

BHP Group Limited – BHP Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.