Bed Bath & Beyond Stock News and Forecast: BBBY stock surges 69%

- Bed Bath & Beyond (BBBY) stock surges on report of Ryan Cohen stake.

- Ryan Cohen is the Chewy savior and current GameStop CEO.

- BBBY stock is up over 67% in Monday's premarket trading.

UPDATE: BBBY investors were not bluffing in Monday's premarket. The home decor retailer is up more than 69% to $27.38 at the start of the session. This is even higher than the premarket this morning where it traded between 44% and 67%. BBBY has been a retail trader favourite for about a year, but the genesis of this surge began with meme stock extraordinare Ryan Cohen taking a reported 10% stake in BBBY and trying to get the board to launch a new strategy to benefit shareholders. As the current CEO of GameStop, the original meme stock, Cohen has a surplus of retail backers behind his every move who believe he has the secret sauce to turn moribund retail companies around.

It appears The Wall Street Journal first broke the story on Sunday that Chewy (CHY) co-founder and current GameStop (GME) CEO Ryan Cohen has taken a near 10% stake in Bed Bath & Beyond through RC Ventures LLC.

Bed Bath & Beyond Stock News

In a letter to BBBY's board, RC Ventures says it has a 9.8% stake and expresses disappointment with the performance of BBBY stock relative to sector benchmarks. "We believe Bed Bath needs to narrow its focus to fortify operations and maintain the right inventory mix to meet demand, while simultaneously exploring strategic alternatives that include separating buy buy Baby, Inc. (“BABY”) and a full sale of the company," according to the letter.

Bed Bath & Beyond has just released a reply to the letter: "Bed Bath & Beyond's Board and management team maintain a consistent dialogue with our shareholders and, while we have had no prior contact with RC Ventures, we will carefully review their letter and hope to engage constructively around the ideas they have put forth.[...] Our Board is committed to acting in the best interests of our shareholders and regularly reviews all paths to create shareholder value. 2021 marked the first year of execution of our bold, multi-year transformation plan, which we believe will create significant long-term shareholder value."

Retail trades have been enthused and jumped on BBBY stock this morning, pushing it up a staggering 67% at the time of writing. This is even more impressive when you consider the bearish overall market we are currently experiencing.

Bed Bath and Beyond Stock Forecast

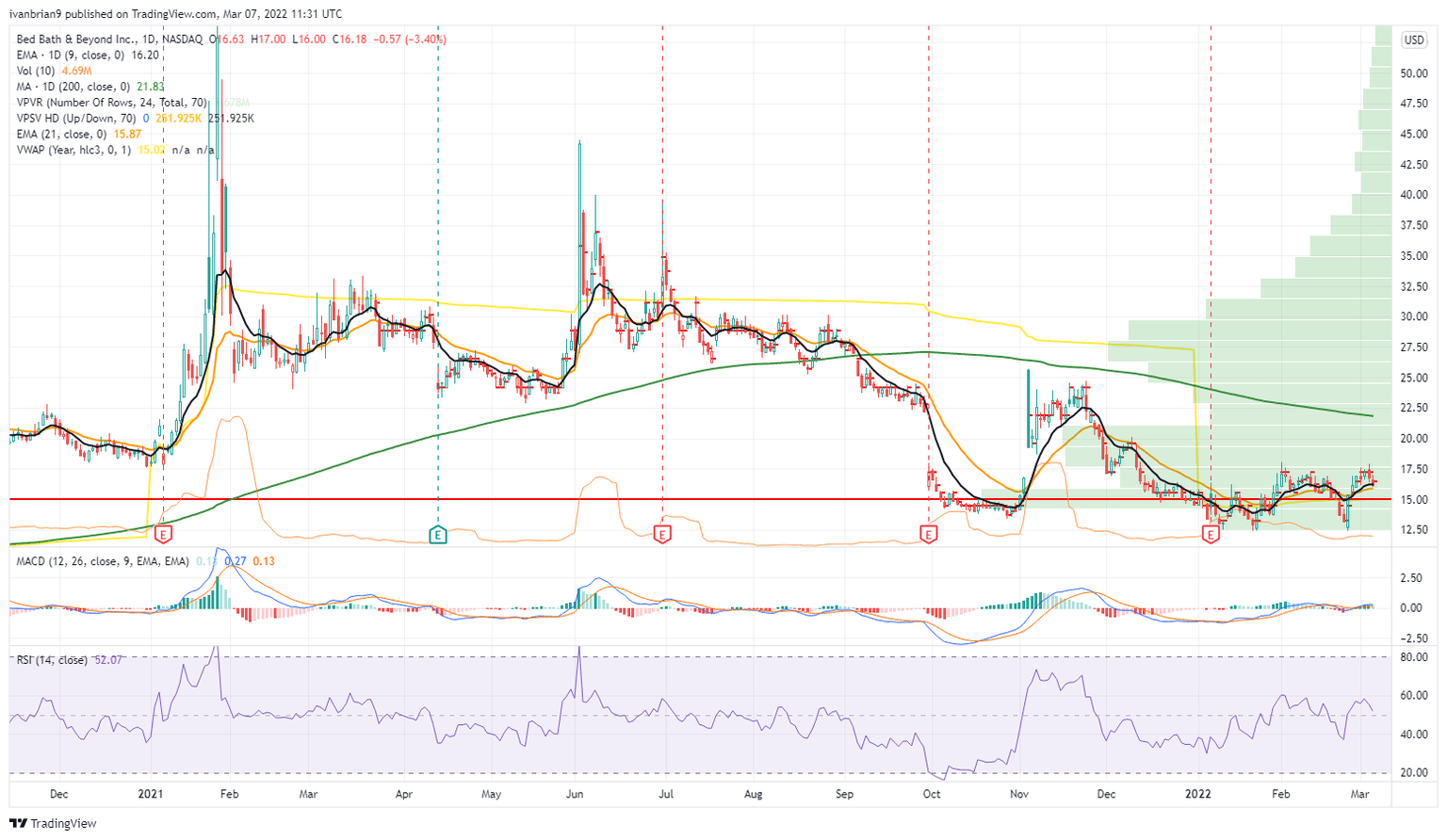

This premarket move brings BBBY up to a potential double top at $24. This is the spike high from back in November when BBBY stock announced a partnership with Kroger. That price spike was not sustained, and this raises the possibility that the same will happen this time around. We also note above $26 that volume increases a lot, meaning more price resistance. We feel this news certainly has potential, but it is the very early stage and as such the 67% share price move is way overdone.

BBBY stock chart, daily

The author is short BBBY.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.