Aussie Trade Balance Oct: A$11.22B vs est A$11.150B; Aussie firm

The Australian Trade Balance released by the Australian Bureau of Statistics has arrived as follows:

Australia Trade Balance Oct A$11.22B (est A$11.150B; prev A$12.243B) - Australia Exports (MoM) Oct -3% (est -1%; prev -6%) - Australia Imports (MoM) Oct -3% (est 2%; prev -2%).

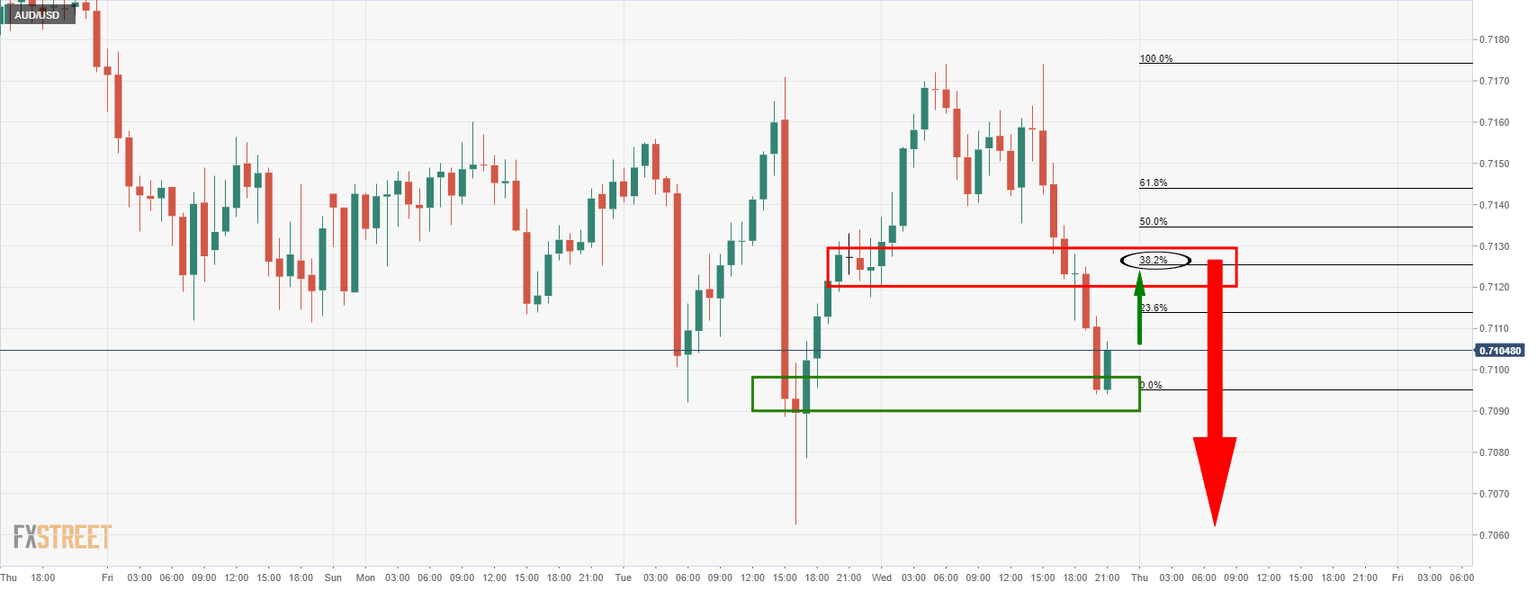

The Australian dollar is so far unchanged on the release, trading at 0.7110, up from a session low of 0.7100 and 0.1% higher on the day so far. From an H1 perspective, the bulls could be headed for a test of the 38.2% Fibonacci retracement level as follows:

AUD/USD Price Analysis: High forex vol points to continuation to weekly support

About the Aussie Trade Balance

The trade balance released by the Australian Bureau of Statistics is the difference in the value of its imports and exports of Australian goods. Export data can give an important reflection of Australian growth, while imports provide an indication of domestic demand. Trade Balance gives an early indication of the net export performance. If a steady demand in exchange for Australian exports is seen, that would turn into a positive growth in the trade balance, and that should be positive for the AUD.

Review Alex Nekritin's Article - Trading the Aussie with Australia Trade Balance

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.