AUD/USD Price Analysis: Slides towards monthly support line near 0.6880

- AUD/USD sellers keep reins during five-day downtrend to refresh fortnight low.

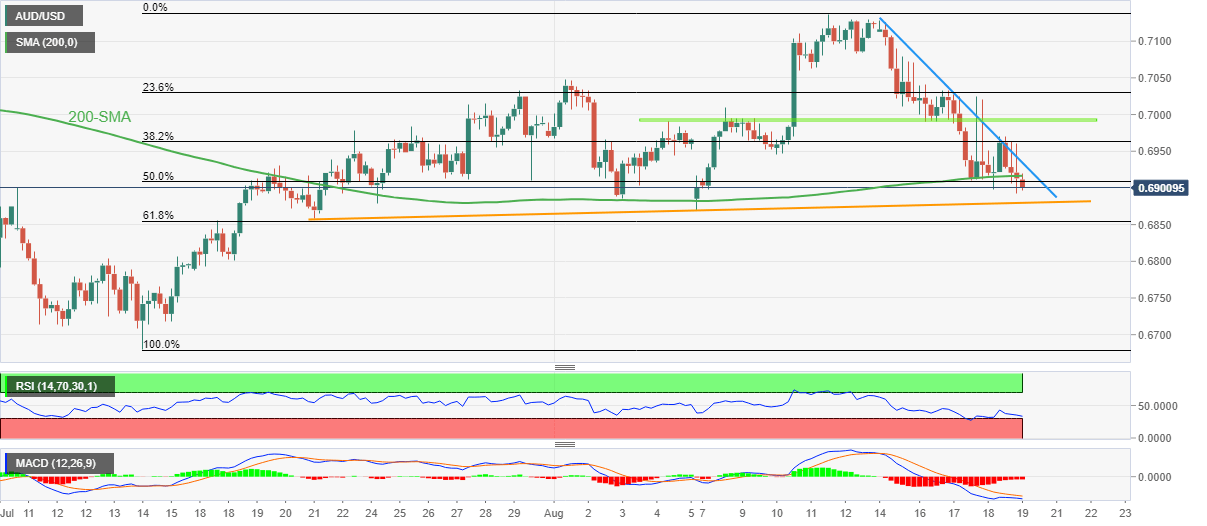

- Clear downside break of 200-SMA, bearish MACD signals direct sellers towards the key support line.

- Weekly resistance line adds to the upside filters, 61.8% Fibonacci retracement level becomes additional support.

AUD/USD remains on the back foot as sellers attack the 0.6900 threshold while poking the two-week low during Friday’s Asian session. In doing so, the Aussie pair drops for the fifth consecutive day while recently breaking the 200-SMA to the downside.

In addition to the downside break of the 200-SMA, bearish MACD signals also favor AUD/USD downside towards an upward sloping support line from July 21, at 0.6880 by the press time.

It’s worth noting, however, that the RSI (14) is approaching the oversold territory and may become a reason for the Aussie pair to bounce off the stated support line.

Even if the quote remains weak past 0.6880, the 61.8% Fibonacci retracement of July-August upside around 0.6850 could become an additional challenge for the AUD/USD bears before targeting the July 13 swing high near the 0.6800 round figure.

Alternatively, the 200-SMA and one-week-old descending resistance line, respectively near 0.6915 and 0.6935, could challenge intraday buyers of the AUD/USD pair.

Following that, a two-week-old horizontal resistance area near the 0.7000 psychological magnet will be crucial for the pair buyers to cross to retake control.

Overall, AUD/USD remains on the bear’s radar but the downside room appears limited.

AUD/USD: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.