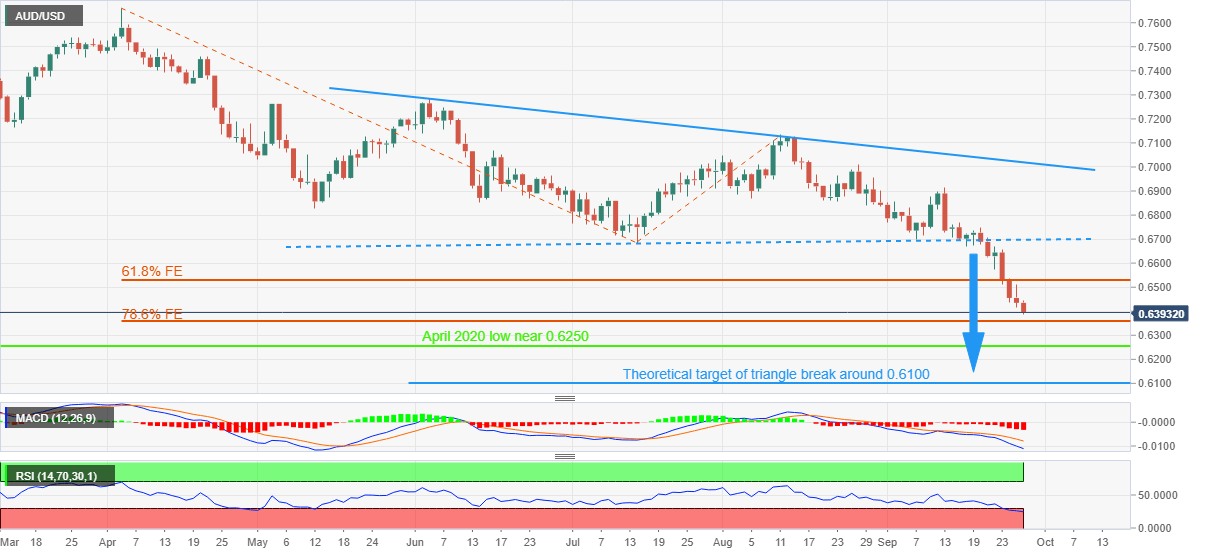

AUD/USD Price Analysis: Renews two-year low around 0.6400 on triangle breakdown

- AUD/USD remains on the back foot around the lowest levels since May 2020.

- Clear break of three-month-old triangle, bearish MACD signals favor sellers.

- 78.6% Fibonacci Expansion probes further downside amid oversold RSI.

- Recovery remains elusive below 0.6700, 61.8% FE guards immediate recovery.

AUD/USD takes offers to refresh 28-month low around 0.6400, down for the fourth consecutive day to early Wednesday morning in Europe.

In doing so, the Aussie pair justifies the previous week’s downside break of the symmetrical triangle formation established in early June. Also favoring the sellers are the bearish MACD signals.

However, the oversold RSI (14) could challenge the AUD/USD bears as they approach the next key support around 0.6355, comprising the 78.6% Fibonacci Expansion (FE) of the pair’s April-August moves.

If at all the quote remains weak past 0.6355, the 0.6300 round figure and April 2020 low near 0.6250 may offer intermediate halts during the triangle’s theoretical target surrounding the 0.6100 threshold.

Alternatively, recovery moves may aim for the 61.8% FE level surrounding 0.6530 before eyeing the July 2022 bottom, the previous yearly low around 0.6680.

It’s worth noting, however, that the AUD/USD recovery remains unconvincing below the stated triangle’s support line, now resistance around the 0.6700 round figure.

Overall, AUD/USD bears are likely to keep reins even if the downside appears limited.

AUD/USD: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.