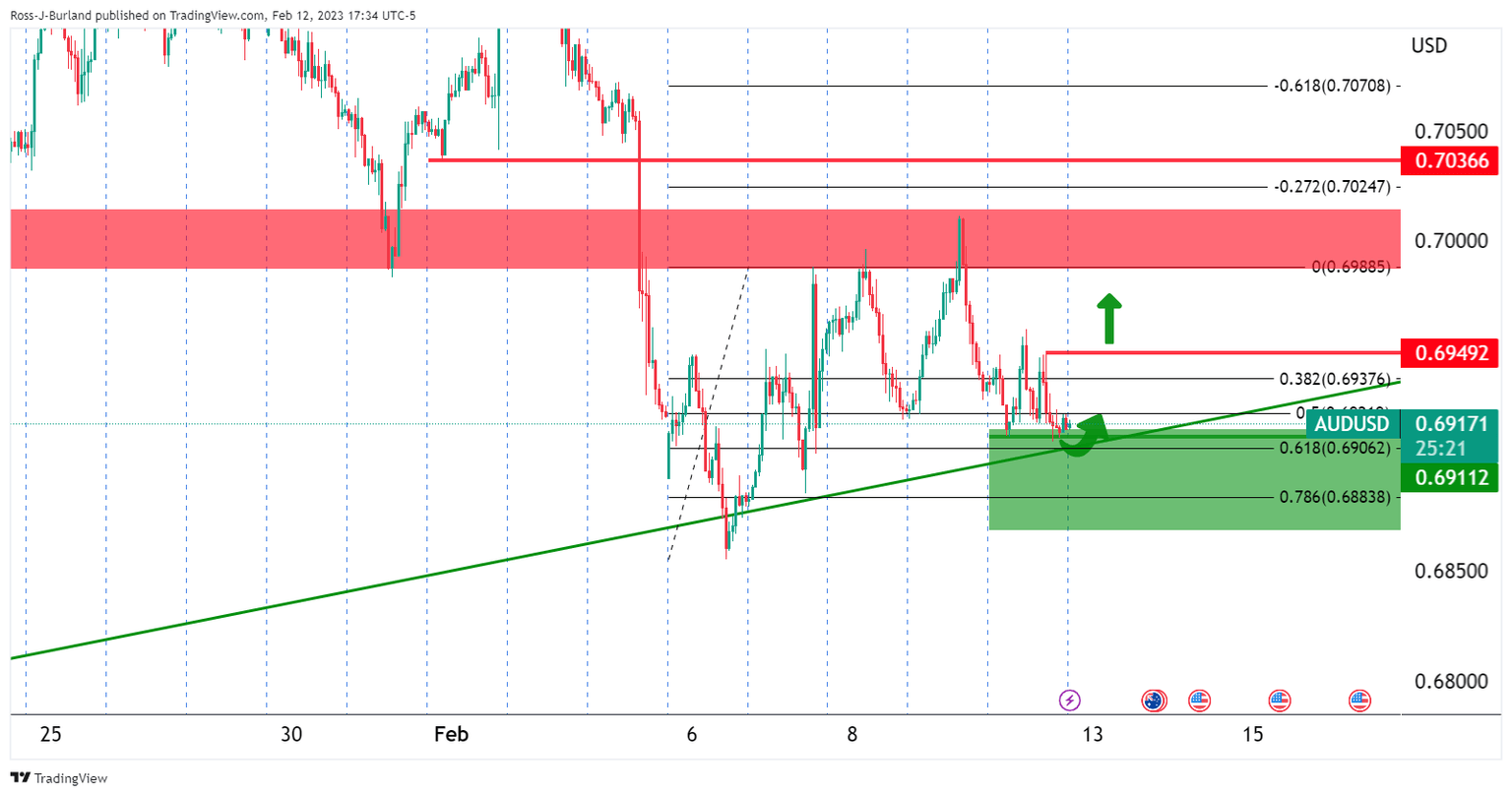

AUD/USD Price Analysis: Key support in play with eyes on 0.6900/50 for the opening range

- On the hourly chart, 0.6950 is a key level that if broken, could seal a bullish thesis for the days ahead.

- Bears eye a move to test key structure around 0.6920/00.

AUD/USD bears were unconvincing on Friday and we have seen little in the way of a commitment so far in the open on Monday, albeit in very early days in an illiquid open.

With that being said, we are down low in the 100 pip box between 0.6900 and 0.7000 and we may continue to work the lows for some time until the bulls make their major move, if at all.

The following illustrates an upside bias due to the daily M-formation and major support zone:

AUD/USD daily chart

We have already seen moves towards the neckline but they were faded pretty fast. However, arguably, this only makes for a stronger case to move up again as the initial tests have created a pool of liquidity.

Given that we still have not had a breakdown of structure to the downside, below 0.6920/00, and confirmation that a break thereof was not just a stop hunt, (to say 0.6870 and reversal), a bullish thesis can still be valid for the opening balance of the week:

AUD/USD H1 chart

On the hourly chart, we have 0.6950 to clear before a bullish thesis can be solidified, so it is a case of seeing how the opening range on Monday develops. However, while holding above the trendline and said support, there are prospects of a short squeeze to test 0.6950 for the day ahead. That does not rule out a move into low-hanging fruit below 0.6900 and into the 0.6880s before hand.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.