AUD/USD Price Analysis: Challenges 0.6700 as risk-on mood solidifies

- AUD/USD is facing barricades near 0.6700 as USD Index has attempted a recovery.

- Sheer volatility is expected from the USD Index as investors are awaiting the US Retail Sales and PPI data.

- The Australian Dollar is likely to dance to the tunes of the Employment data, which will release on Thursday.

The AUD/USD pair has recovered to near the round-level resistance of 0.6700 in the Asian session. The Aussie asset is struggling to extend its gains ahead, however, the upside seems favored as the US Dollar Index (DXY) has lost its charm further after the decline in the United States Consumer Price Index (CPI) matched expectations.

The US Dollar Index (DXY) has shown a recovery move after printing a fresh monthly low at 103.44. Sheer volatility is expected from the USD Index as investors are awaiting the release of the US Retail Sales and Producer Price Index (PPI) data.

Meanwhile, the Australian Dollar is likely to dance to the tunes of the Employment data, which will release on Thursday. As per the consensus, the Australian economy has added fresh 48.5K jobs in February vs. 11.5K lay-offs registered in January. And, the Unemployment Rate is expected to drop to 3.6% from the former release of 3.7%.

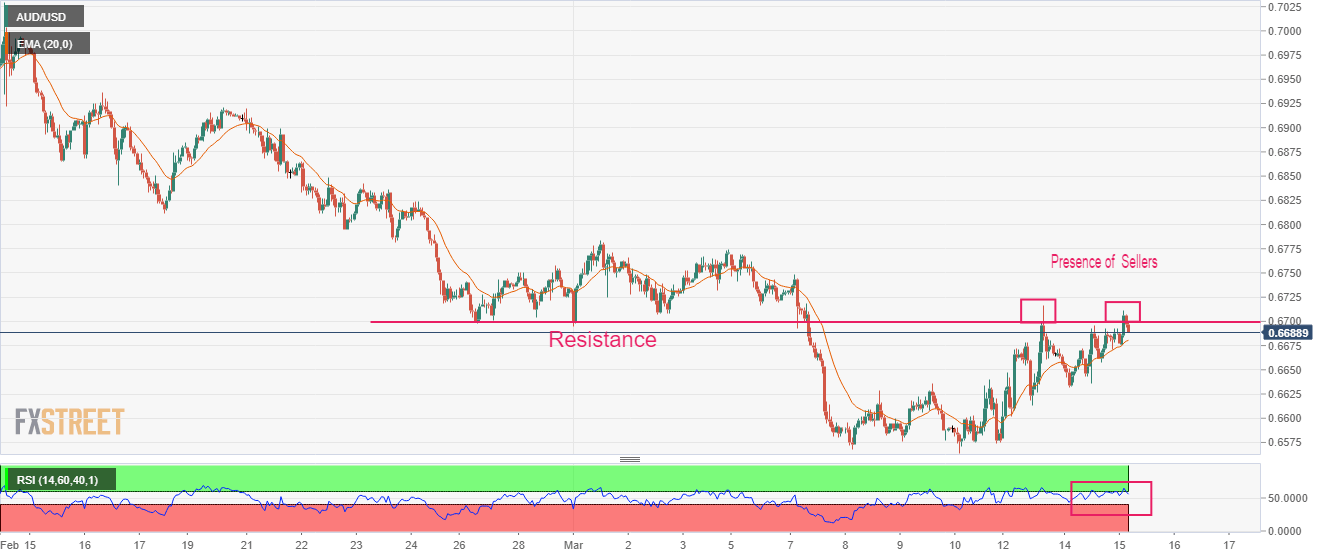

AUD/USD has scaled to near the horizontal resistance plotted from February 27 low at 0.6700. The Aussie asset is facing selling pressure from the market participants and investors should build positions after a decisive move.

Advancing 20-period Exponential Moving Average (EMA) at 0.6680 is providing a cushion to the Australian Dollar.

Meanwhile, the Relative Strength Index (RSI) (14) is hovering near 60.00. A break into the bullish range of 60.00-80.00 will trigger the upside momentum.

Should the asset break above March 13 high at 0.6717, Aussie bulls would drive the asset toward March 03 high at 0.6775. A breach above the latter would expose the asset to further upside toward February 17 low at 0.6821.

On the contrary, a breakdown of Wednesday’s low at 0.6568 will drag the asset toward the horizontal support plotted from October 4 high at 0.6547 followed by the round-level support at 0.6500.

AUD/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.