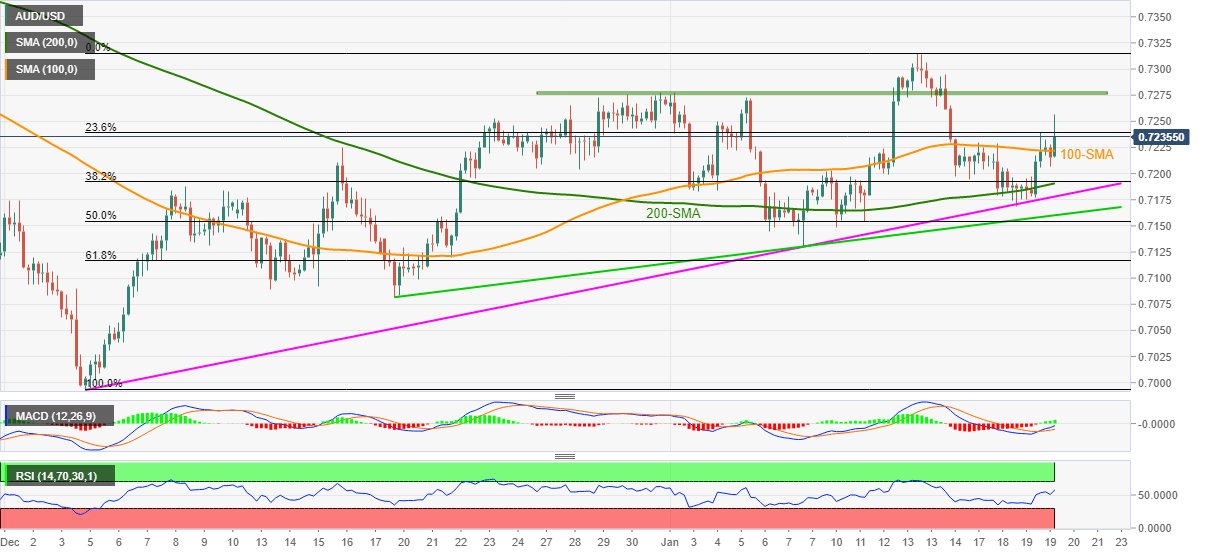

AUD/USD Price Analysis: Bulls eye 0.7280 despite recent pullback

- AUD/USD eases from intraday high but stays above 100-SMA.

- Bullish MACD conditions, firmer RSI keeps buyers hopeful to challenge three-week-old horizontal resistance.

- 200-SMA, seven-week-old support line restricts short-term downside.

AUD/USD bulls take a breather around 0.7235, up 0.21% intraday, following the early Asian session run-up to refresh weekly top. Even so, the quote remains above short-term key SMA during Thursday.

Not only the sustained break of 100-SMA and a successful rebound from 200-SMA but firmer RSI and MACD also favor AUD/USD buyers.

That said, a horizontal area comprising multiple levels marked since December 30, near 0.7280, becomes the key hurdle before directing AUD/USD bulls to the monthly peak of 0.7315.

Meanwhile, pullback moves remain dismal beyond the 100-SMA level of 0.7221, a break of which will highlight the 200-SMA level of 0.7190 for bears to watch.

It should be noted, however, that the quote’s weakness past 0.7190 will be challenged by upward sloping trend lines from December 03 and 20, respectively near 0.7180 and 0.7160.

To sum up, AUD/USD bulls have the controls but need validation from 0.7280.

AUD/USD: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.