AUD/USD Price Analysis: Bulls and bears battle it out at critical hourly support

- AUD/USD bears are lurking but there could be more from the bulls in the meantime.

- The price is under pressure but should hourly support hold, the 0.7000s will be eyed.

As per the prior analysis, AUD/USD Price Analysis: Bulls seeking higher grounds into key data events, the price has rallied as anticipated but is yet to pierce the 0.7000s.

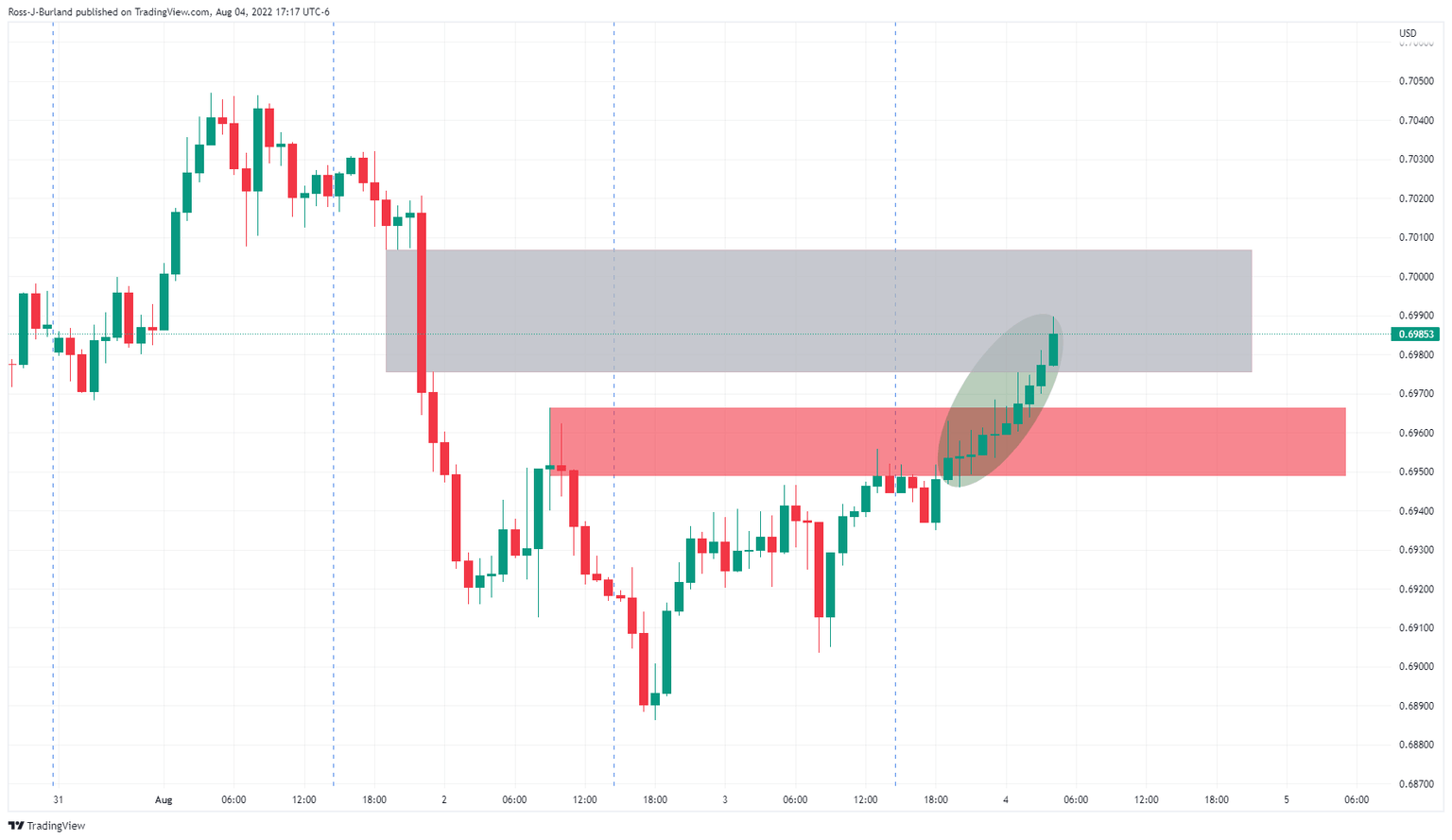

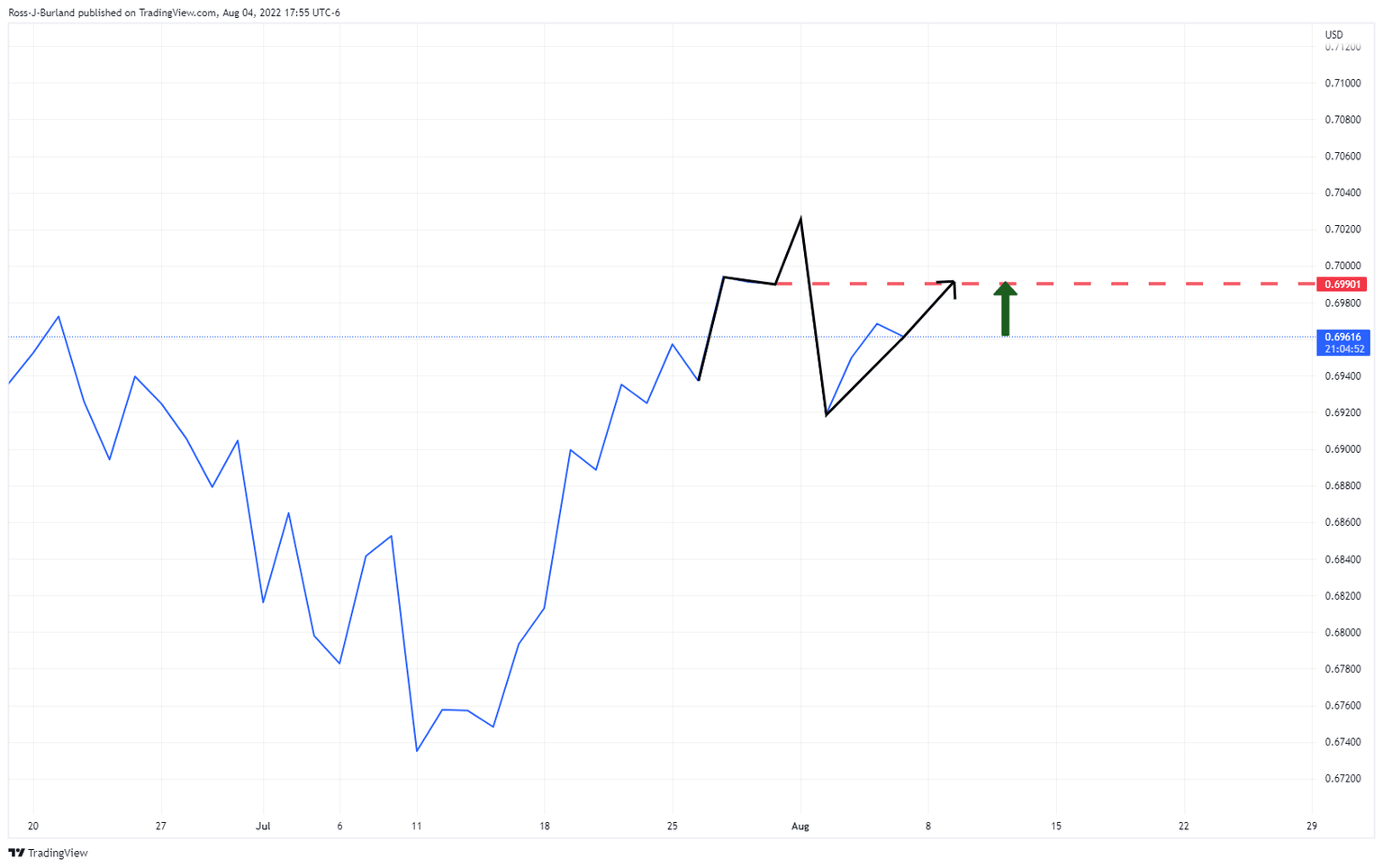

AUD/USD H1 chart

The price was trapped between a supporting trendline and horizontal resistance. There was a price imbalance that will be mitigated in due course, but so far, the bulls have stayed in control above 0.6950 in the main:

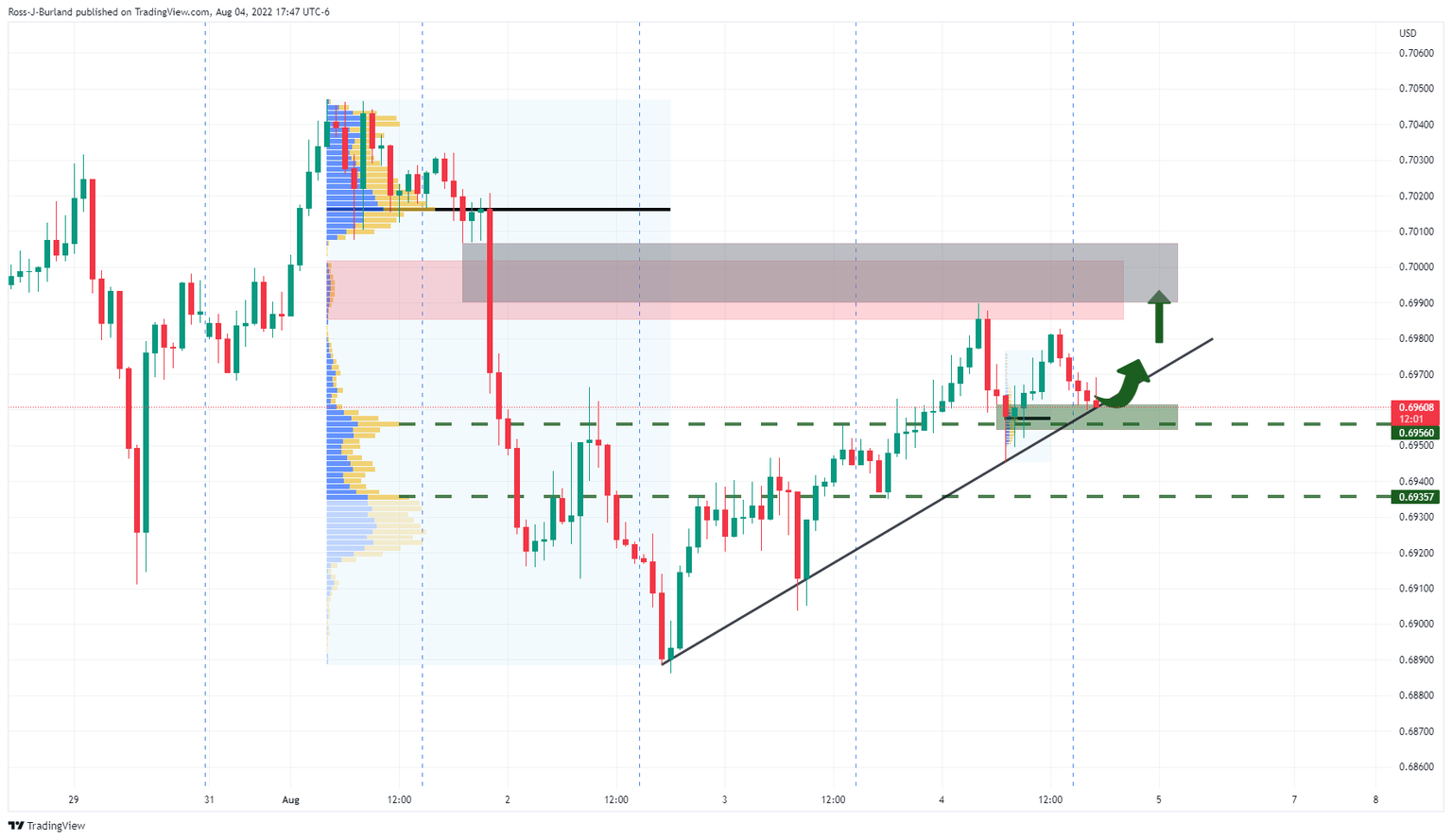

AUD/USD live market

The price has since been knocked back by the bears from a higher volume area and is trapped between there and the support as illustrated above. However, the recent grind lower is relatively weak and should the bulls commit above 0.6950, there will be prospects of another bullish run for the day ahead.

A break of 0.6980 resistance opens risk to 0.7000 in order to mitigate the price imbalance above between 0.6990 and 0.7007. The point of control of the prior bearish trend is located a little higher up at around 0.7020.

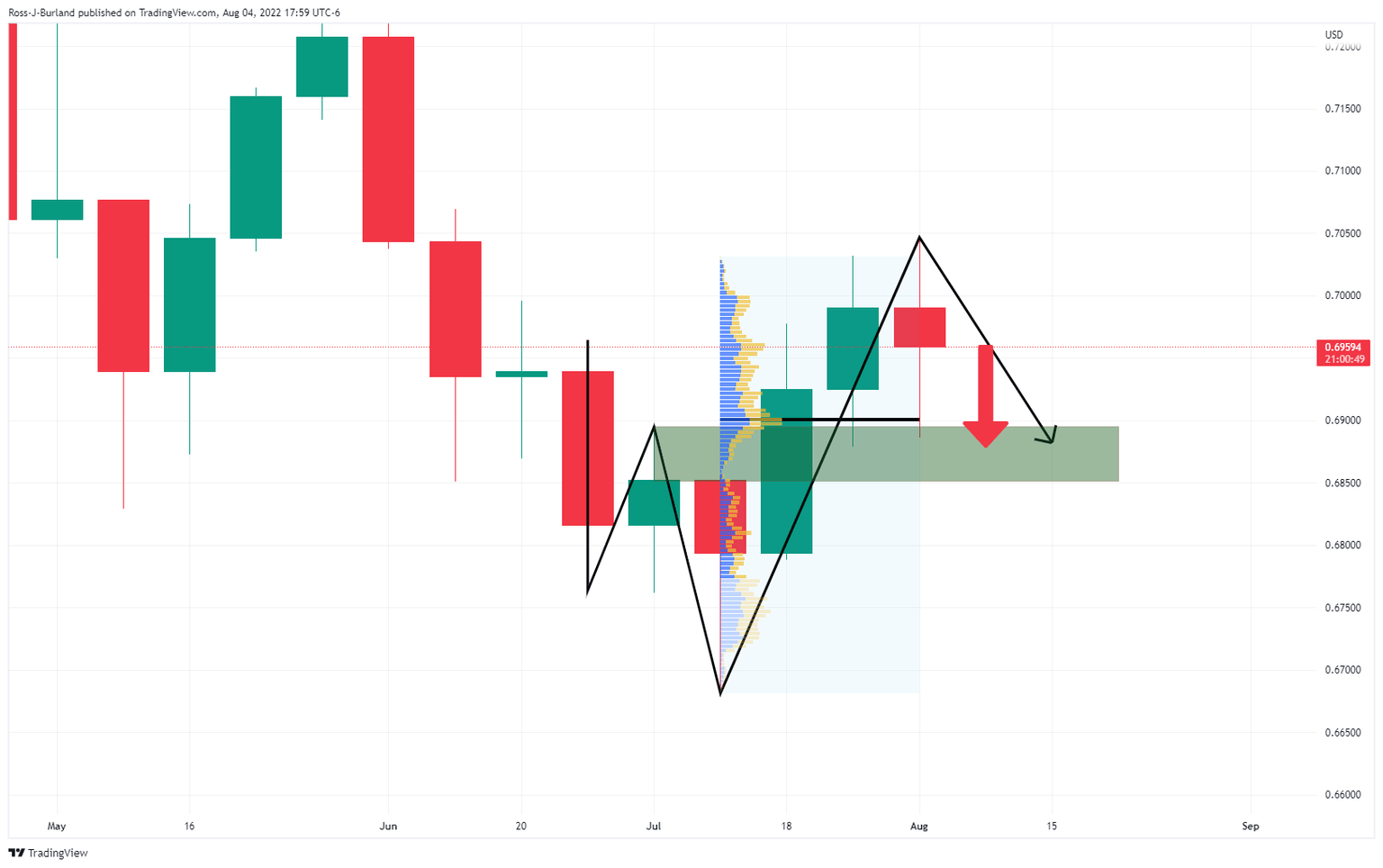

AUD/USD daily chart

In moving higher, the price will be on track to complete the reversion to the M-formation's neckline as illustrated in the line chart above.

AUD/USD weekly chart

However, this could be a pump and dump scenario considering the W0formation on the weekly chart:

While the price has already checked the neckline of the formation, there could still be more to come from the bears before the week is out and much will depend on the Nonfarm Payrolls event ahead of next week's US inflation data.

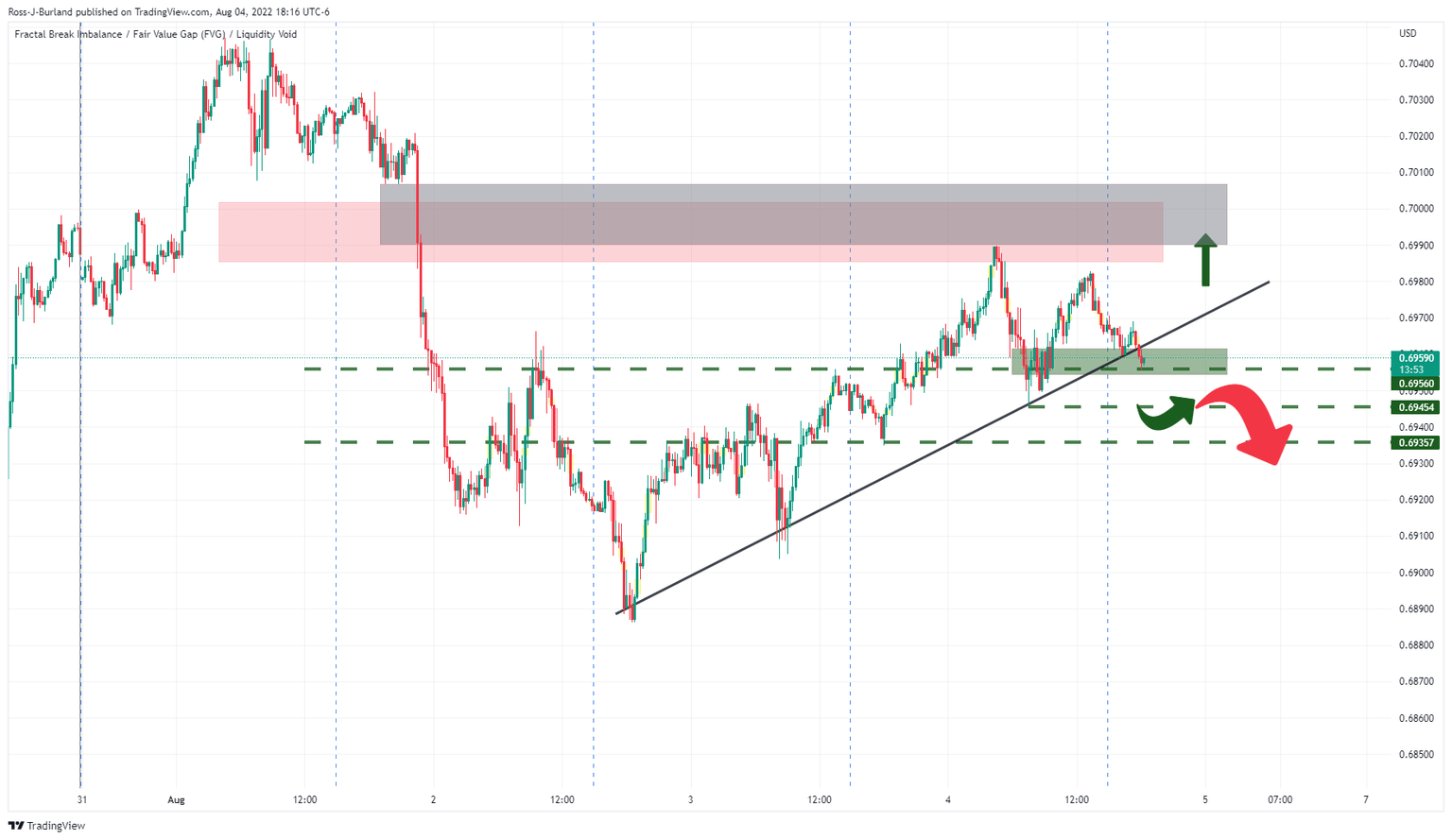

Meanwhile, should the price simply deteriorate, the 15-min chart's structure could be important:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.