AUD/USD Price Analysis: Bounces off 10-DMA to welcome buyers near 0.6400 ahead of RBA

- AUD/USD picks up bids to pare short-term losses.

- Firmer oscillators back the recent bounce off nearby crucial DMAs, 13-day-old ascending trend line adds to the downside filter.

- Buyers need validation from a downward-sloping resistance line from mid-August.

AUD/USD bulls return to the table, after a three-day absence, as the Aussie pair prints the first daily gains around 0.6410 ahead of Tuesday’s monetary policy announcements from the Reserve Bank of Australia (RBA).

Also read: AUDUSD: The Aussie Dollar hovers around 0.6400 ahead of the RBA and the Fed decisions

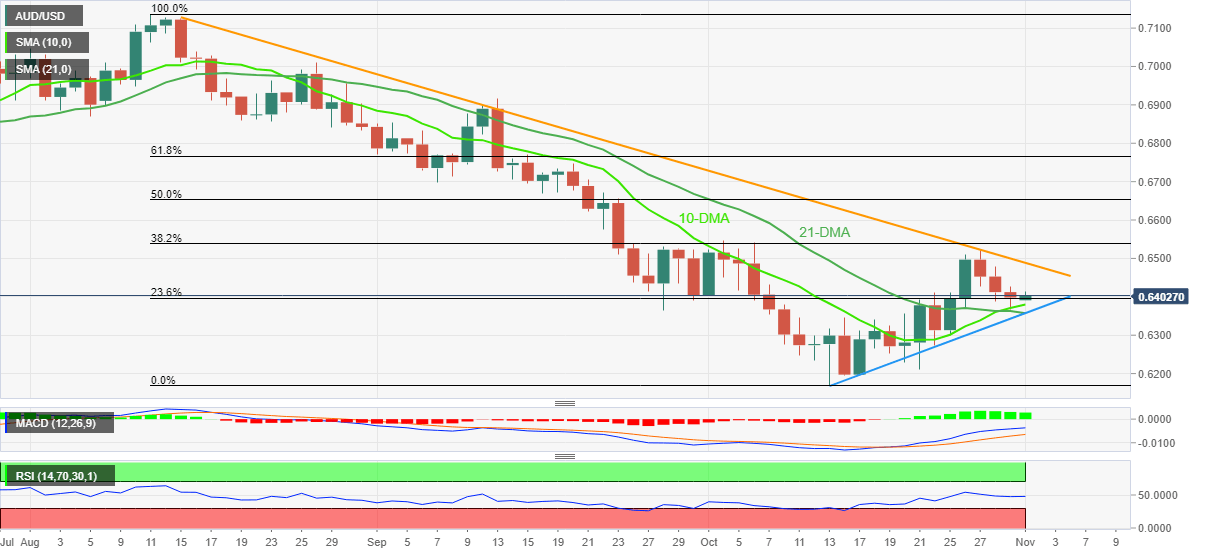

In doing so, the AUD/USD prices rebound from a 10-DMA support, around 0.6380 at the latest. Also supporting the quote’s recovery are the bullish MACD signals and the steady RSI.

However, the upside room appears limited as a descending resistance line from mid-August, close to 0.6490, could challenge the bulls. Following that, the previous week’s peak of 0.6522 and 38.2% Fibonacci retracement level of August-October declines, near 0.6540, will be crucial to cross for the AUD/USD pair buyers to keep the reins.

Alternatively, a downside break of the 10-DMA support near 0.6380 isn’t a sure signal for the bear’s return as a convergence of the 21-DMA and a two-week-long support line, close to 0.6355, will be a tough nut to crack for the AUD/USD sellers before retaking the control.

Even if the quote breaks 0.6355 support, multiple supports around 0.6350, 0.6280 and 0.6230 could challenge the pair’s further downside.

AUD/USD: Daily chart

Trend: Limited recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.