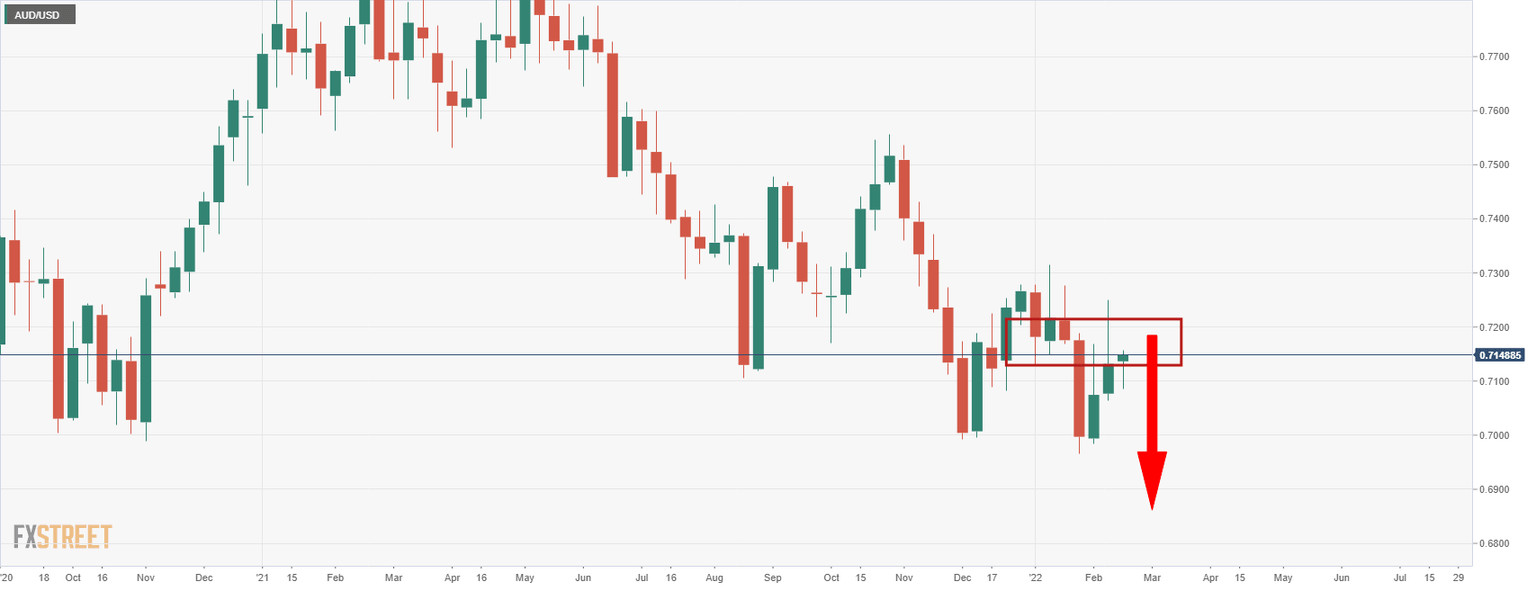

AUD/USD Price Analysis: Bears eyeing break of critical H4 support

- AUD/USD bears are moving in on the 4-hour chart.

- Weely structure is critical at this point and bears will note the resistance.

AUD/USD is pressing up against an important resistance on the longer-term charts. The bears could be looking to move in at this juncture and the 4-hour chart analysis illustrates the key levels in the following top-down analysis.

AUD/USD prior analysis

The price had been respecting the 21 EMA and support structure as illustrated above and bulls would have been seeking to engage at a discount at this juncture.

AUD/USD weekly chart

On the other hand, on the weekly chart, the bears were taking note of the resistance and this leaves the price vulnerable still for the days ahead.

AUD/USD live market

The price did indeed resect the support and rallied from there, as forecasted in the prior analysis above. The big bearish candle is now the focus with the price so far capped by a 38.2% Fibo retracement of the bearish impulse.

The focus is on the downside for a restest of the support near 0.7150. Below there, the bears could be encouraged to move to the longer-term charts and assess the landscape as follows:

The 4-hour chart, left, shows where price could head to, 0.7150, and a break of which will open the risk of the beginnings of a significant shift longer-term in the price's trajectory, according to the weekly chart, right.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.