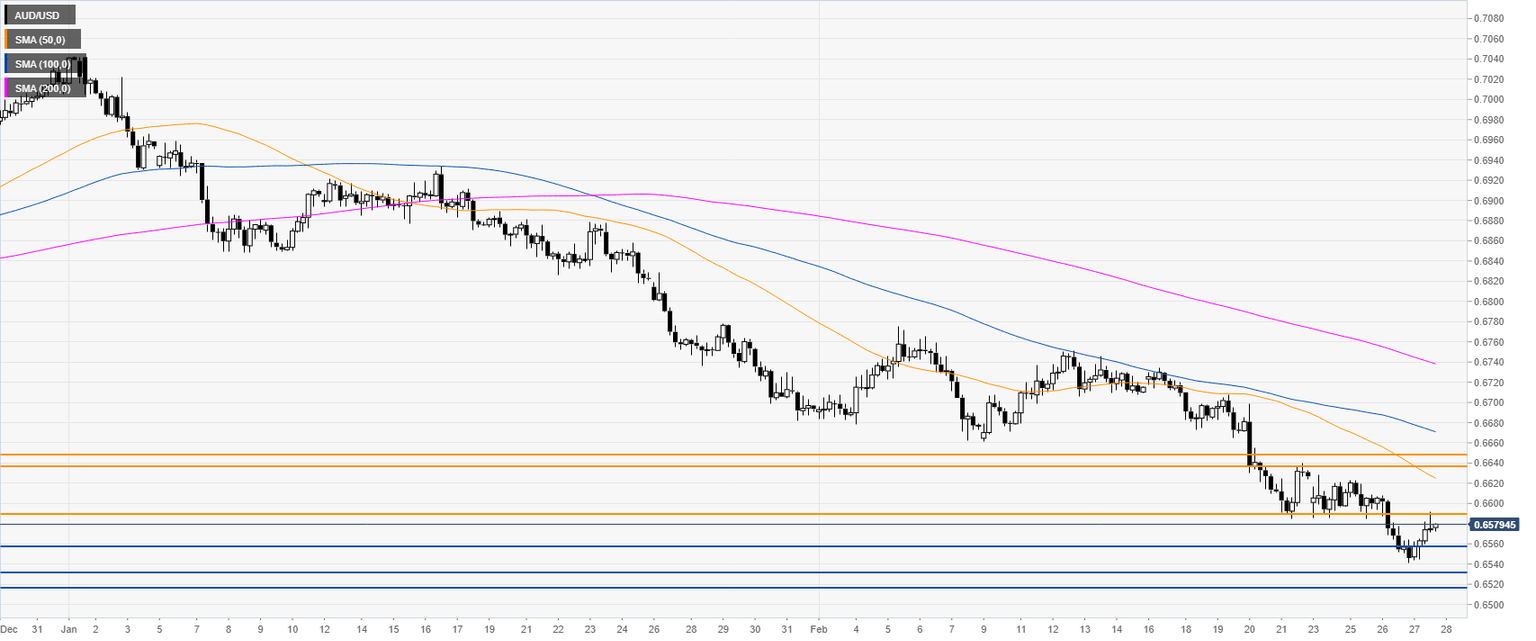

AUD/USD Price Analysis: Aussie gets small rebound from one-decade low

- AUD/USD rebounds modestly from one-decade low.

- A bullish correction up cannot be ruled out.

AUD/USD daily chart

AUD/USD four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst