AUD/USD bears take another bite out of the bull's dominance post FOMC minutes

- AUD/USD is moving lower after the hawkish FOMC minutes.

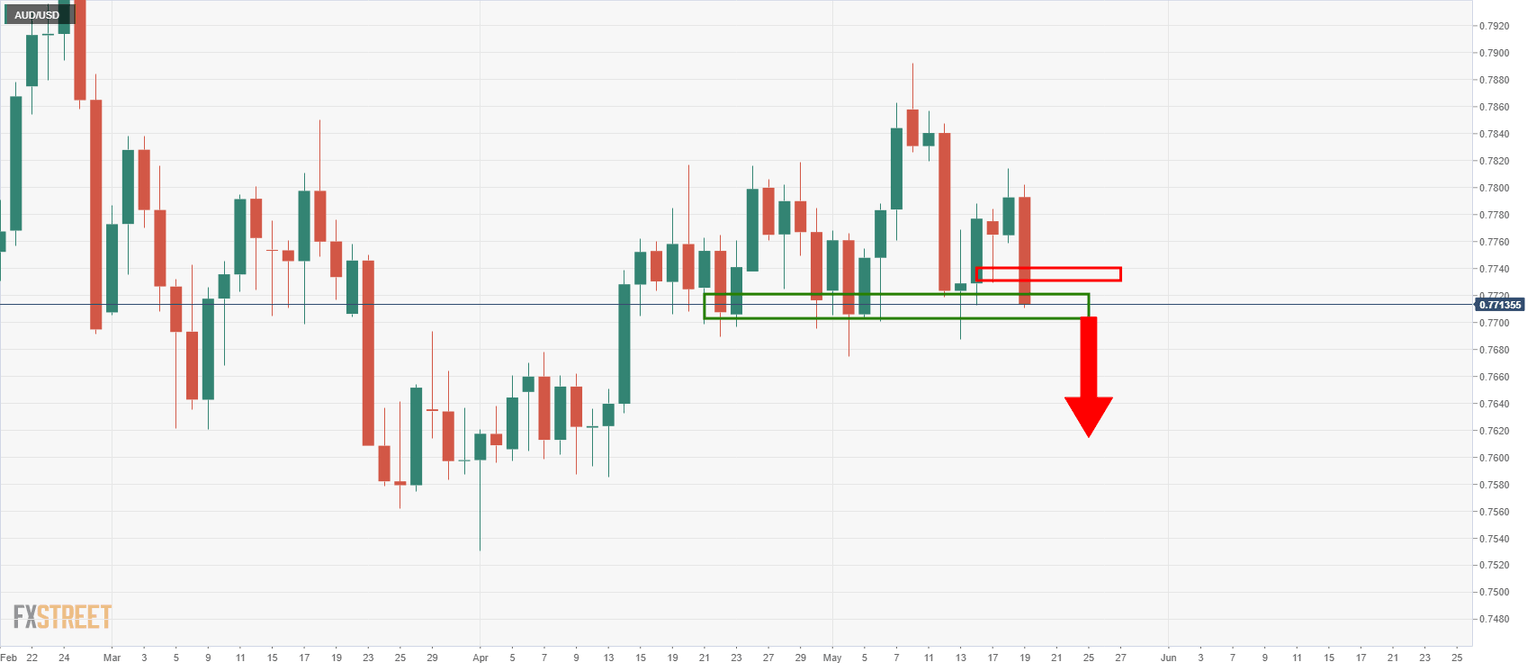

- Bears are seeking a break of key 0.77 area for lower lows.

AUD/USD is on the back foot following the Federal Open Market Committee's minutes. At the time of writing, AUD/USD is down 0.93% having travelled from a high of 0.7797 to a low of 0.7716.

The minutes showed that there are prospects for adjustments to the pace of purchases if the economy continues to make rapid progress towards the Committee's goals.

Some officials saw taper talk starting at upcoming meetings but note that the economy remains far from its goals.

Nevertheless, it was a hawkish enough set of minutes to support a bid in the greenback and send US yields higher.

Meanwhile, AUD/USD strengthened days back following Tuesday’s Reserve Bank of Australia (RBA) Minutes.

Overall, the rise in commodities, such as Iron ore – one of Australia’s main exports – has been supportive to the Aussie as well.

With that being said, there are question marks over how sustainable the trade relationship is between the nation and China.

Beijing’s economic planning agency, the National Development and Reform Commission (NDRC), is advocating for a need to diversify its supply chains for metals and other resources, according to Bloomberg news.

Nonetheless, the focus is on the here and now.

Analysts at Westpac, while noting trade relationship risks between China and Australia, stated that global risk appetite is likely to improve in coming months given central bank policy settings which is supportive of the Aussie.

As for positioning data, Net AUD held in the positive ground for a second consecutive week.

Overall, analysts at Rabobank noted that ''despite record highs in various commodity prices, the value of AUD/USD has remained consolidative in recent weeks, only spiking higher after the shockingly weak April US payrolls data undermined the greenback.''

The bank does see the potential for AUD/USD to drift higher to 0.79 on a 6 to 12-month view, but argued that ''the strength of the dovish forward guidance of the RBA coupled with rising tensions between Canberra and Beijing is likely to continue to restrain the performance the AUD''.

AUD/USD technical analysis

Technically, bears will seek a break of 0.7700 support structure:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.