AUD/JPY Price Analysis: 50-DMA probes bulls around three-week top

- AUD/JPY snaps two-day uptrend, refreshes intraday low of late.

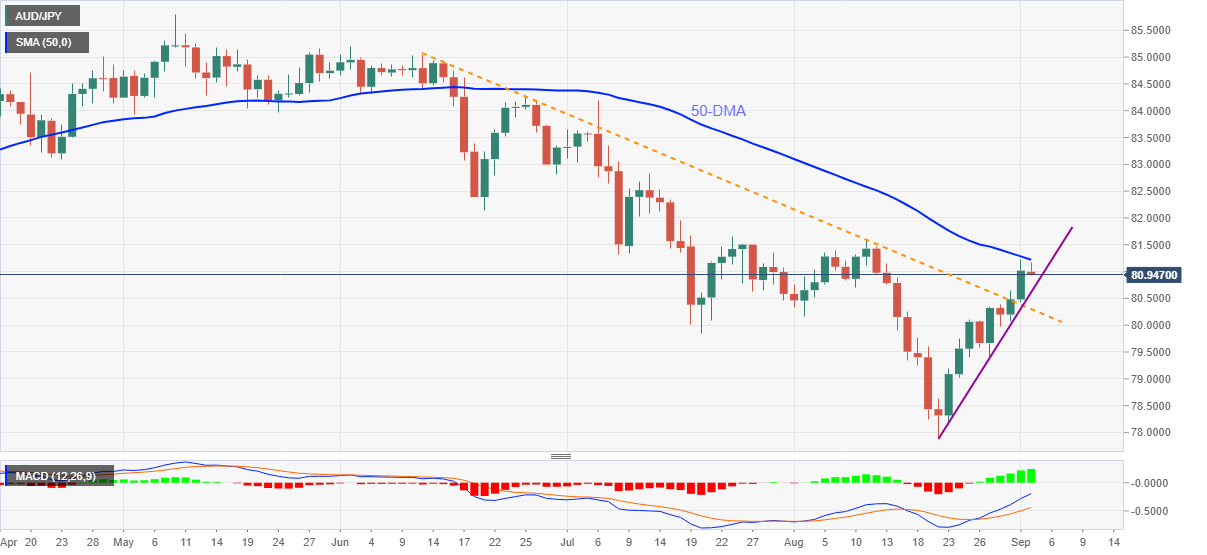

- Sustained break of three-month-old resistance, now support, joins bullish MACD to favor buyers.

- Bears need to break eight-day-old support line to retake controls.

AUD/JPY takes offers around 80.95, down 0.06% intraday, marking the first daily loss in three during early Thursday.

The Aussie cross rose to the highest since early August the previous day while extending the upside break of a descending trend line from June amid bullish MACD signals.

However, failures to the 50-DMA hurdle, around 81.25, trigger the latest pullback moves.

It’s worth noting that the AUD/JPY sellers remain cautious until the prices stay above an ascending support line from August 20 and a bit broader resistance-turned-support line, respectively near 80.60 and 80.30. Also challenging the pair bears is the 80.00 threshold.

Hence, the pair buyers have an upper hand and can cross the immediate hurdle, namely 50-DMA level of 81.25 to aim for a cross of the last month’s top surrounding 81.60.

Following that, June’s low near 82.15 will lure the AUD/JPY bulls.

Overall, AUD/JPY remains in the recovery mode and the latest pullback can be termed as consolidation.

AUD/JPY: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.