ARK Innovation ETF Stock News: A dead cat bounce is imminent

- ARKK ETF is down nearly 50% year to date.

- ARKK Innovation has turned Cathy Wood into an investing star.

- The innovation ETF has been a shooting star as 2022 hits ARKK.

ARKK ETF continues to be pressured as the imminent Fed decision awaits. Investors in the fund are staring at losses nearing 50% for the year but so far the rush for the exit has not materialized. This can lead to a self-fulfilling move if investors do look for their cashback. That will necessitate selling to raise cash to return to shareholders putting more pressure on ARKK stock.

Read more stock market research

ARKK ETF stock news: Bear-market rally coming?

We feel there may be a slight recovery or a bear-market rally imminent. We base this using several positioning and sentiment indicators. However, this rally may be short-lived. Firstly, we have an incredibly bearish sentiment from a plethora of sentiment indicators.

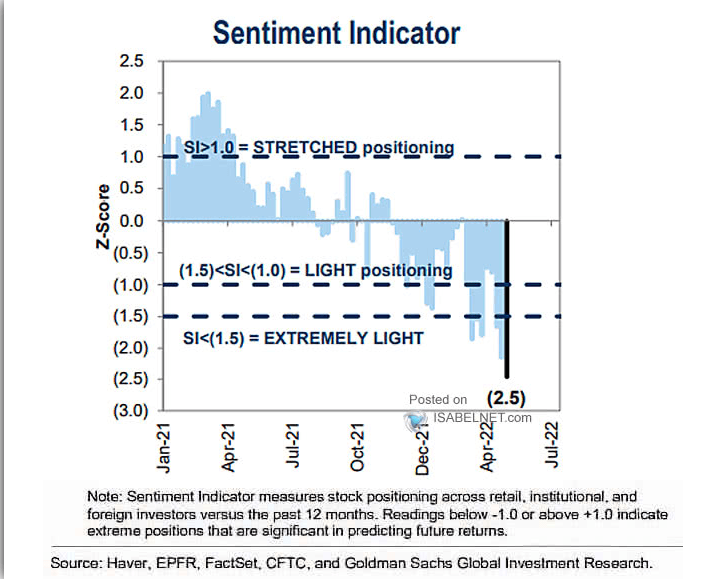

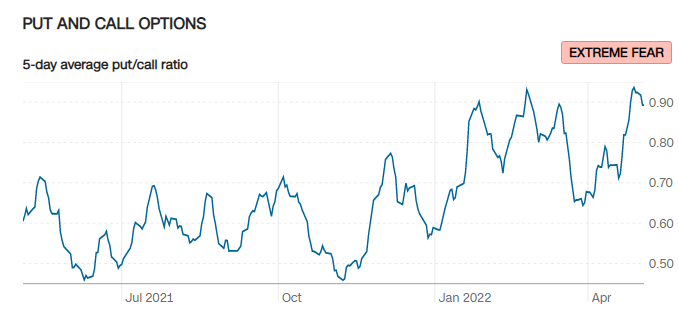

The CNN fear and greed index are showing huge levels of stress. The American Association of Individual Investors (AAII) is at noted bearish levels and so is Goldman Sachs's proprietary sentiment indicator. The put-call ratio has also moved to recent highs with everyone racing to buy puts as panic ensued.

Also of note is quite a bit of cash sitting on the sidelines until after Jerome Powell and the Fed hike rates today. Once that uncertainty is out of the way it could unleash an inflow to equities from both hedge funds and institutional investors, both of whom are underweight equities. Retail investors remain long.

Source: Goldman Sachs (via Isabelnet)

Source: CNN.com

Teladoc (TDOC stock) was the latest stock to hit ARKK as it reported terrible earnings last week and the stock cratered. Despite this, Cathy Wood has been buying the dip in TDOC stock saying it can be “one of the biggest stories in healthcare (...) a category killer during the next five to ten years (...) We see Teladoc in the same league as an Amazon.” Also of note is the buy-the-dip strategy among ARKK investors, the fund drew in more than $800M this year despite it collapsing by nearly 50%.

ARKK stock forecast: Big resistance too far away

A massive move lower has taken ARKK back to pre-pandemic levels. $49.83 was the key level and below here ARKK remains bearish. $72 remains the key resistance for bulls to regain control and that is likely too far away. A recovery as mentioned is likely but that rally will not advance far enough to break $72.

ARKK weekly chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.