Apple ( AAPL) incomplete sequences forecasting the path ahead

In this technical article we’re going to look at the Elliott Wave charts of Apple Stock ( AAPL) published in members area of the website. As probably most of the traders know, The Stock is in overall bullish trend. Recently we forecasted the pull back which has corrected the cycle from the 195.88 low. In further text we’re going to explain the Elliott Wave analysis.

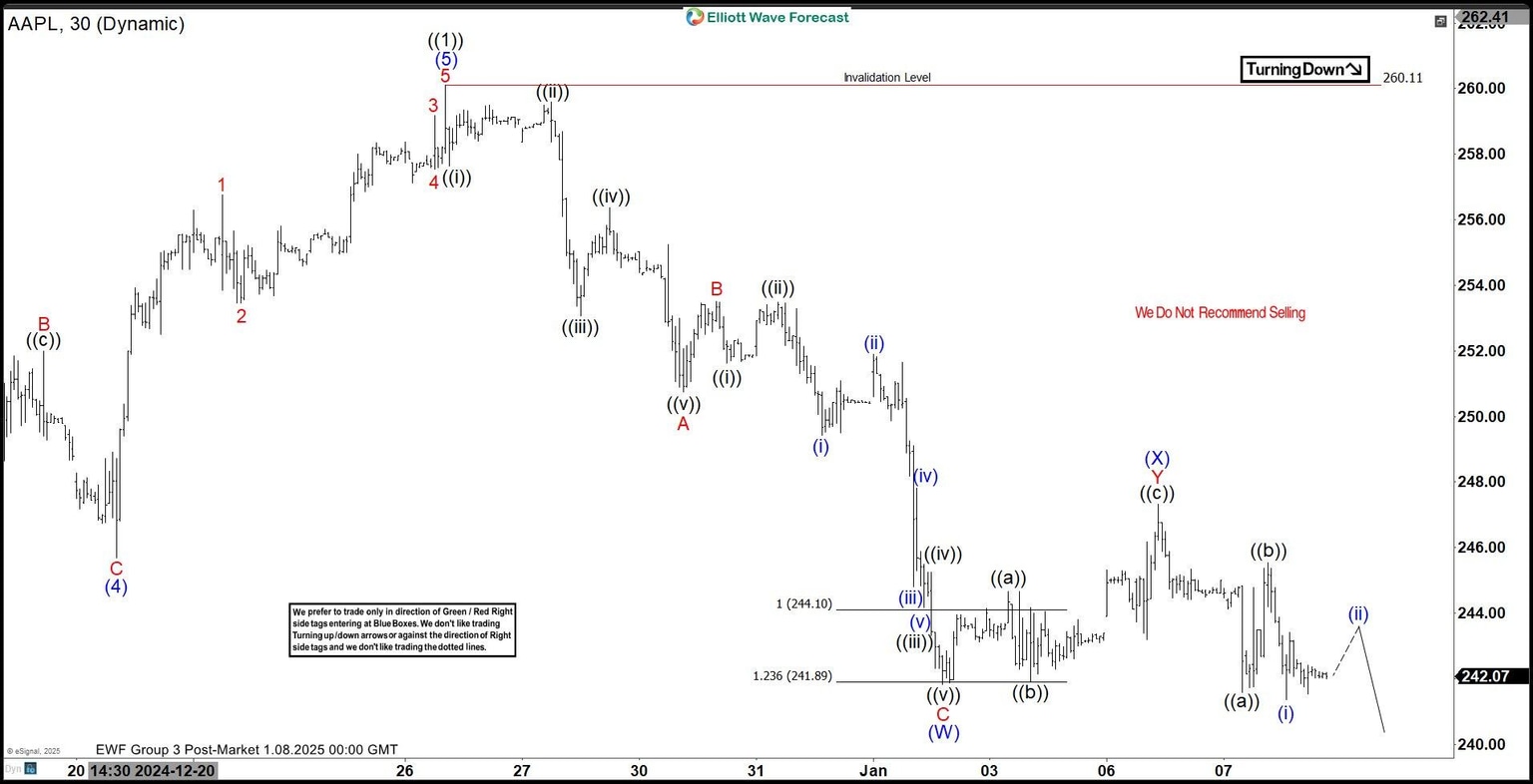

AAPL Elliott Wave one-hour chart 01.08.2025

Apple stock is showing incomplete sequences in the cycle from the 260.11 peak. A break of the (W) low created a lower low sequence, which calls for further weakness in the stock as long as the pivot at 247.35 (X) blue high holds. Apple could be heading toward the $229–$225 area.

Let’s analyze the price structure further.

We see a corrective structure from the peak, labeled as ABC red, followed by a three-wave bounce and another break lower. The current view suggests the correction may be unfolding as an Elliott Wave double-three pattern, labeled as (W)(X)(Y) blue, with wave ((x)) acting as a connector in the form of an Elliott Wave Zig Zag pattern.

We don’t recommend forcing trades at this stage. The strategy is to wait for the extreme zone to be reached before buying the stock again.

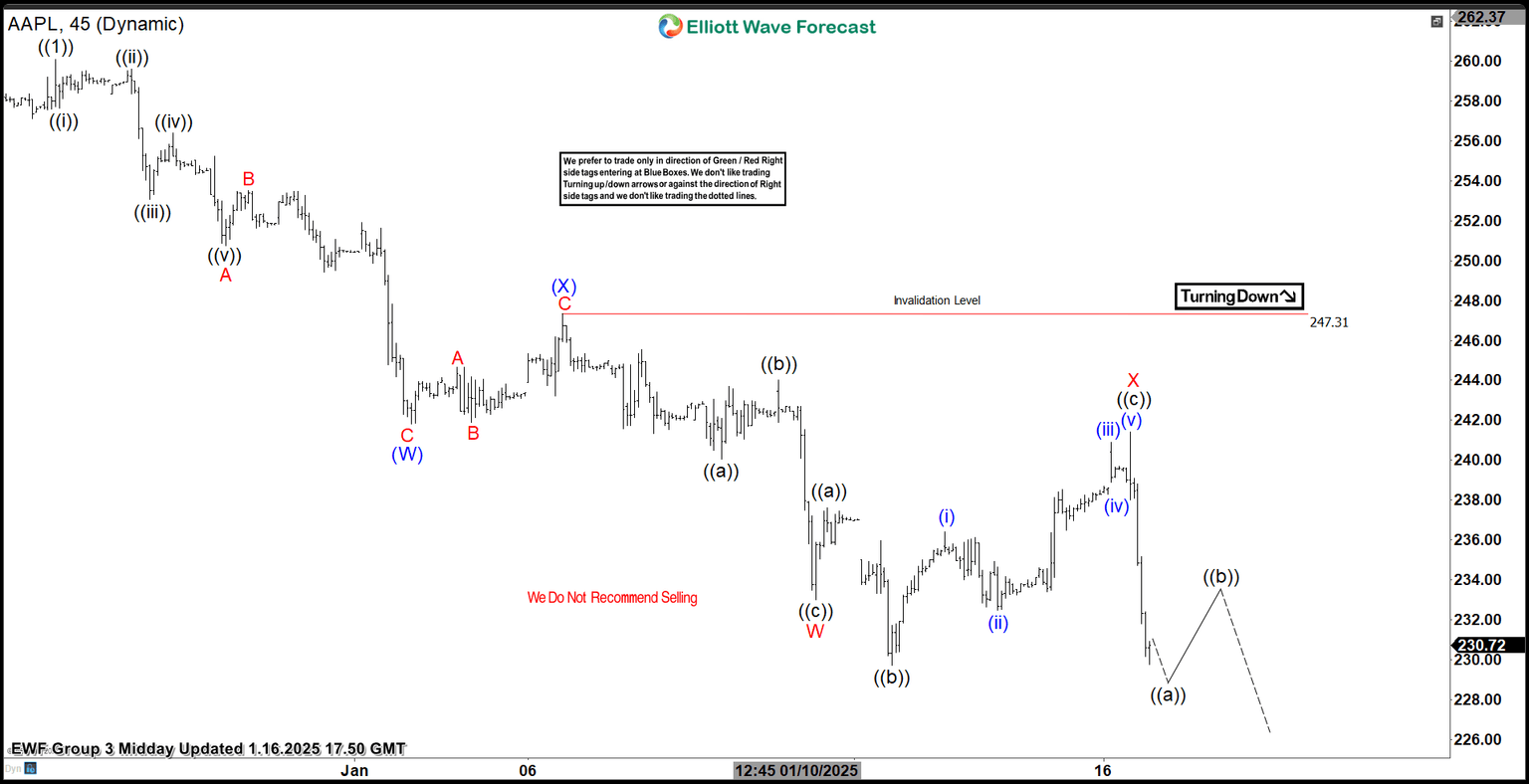

AAPL Elliott Wave one-hour chart 01.16.2025

The price remained below the 247.35 peak during short-term recoveries, and the stock made a further decline as expected. The price is heading toward our target area of $229–$225, where we would like to become buyers again. We don’t recommend selling the stock and prefer the long side from the mentioned extreme zone.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com