AMC Stock Price and News: AMC Entertainment Holdings Inc continues to suffer from Gamestop hangover

- AMC shares collapse again on Thursday, down 20%.

- AMC suffers as the Gamestop rally fizzles out.

- AMC shares are nearly back to where it all began!

AMC Entertainment Holdings continued its recent fall on Thursday as the share price fell below $7.50. The retail meme stocks that have been the main focus of attention in 2021 have all suffered this week as the retail-fueled buzz fizzles out.

See FXStreet New Equities homepage

Short interest continues to decline

S3 Partners, who analyze short interest in real-time, tweeted on a number of retail interest stocks. Their analysis shows the short interest declining sharply for Gamestop (GME), AMC, Blackberry (BB) last week.

AMC one of the hot stocks of 2021

AMC shares had been one of the biggest beneficiaries of the Reddit-fueled trading phenomenon of 2021, the rise of retail!

AMC is in the entertainment business, it owns, operates, and has interests in Cinema theatres in the US and Europe. Obviously, this has been one of the hardest-hit businesses from the coronavirus pandemic. Cinemas globally have been severely restricted or shuttered for months. As a result of this, the company was heavily shorted with up to 20% of shares floated. Anything over 10% short interest is considered high, obviously, Gamestop at over 100% was astronomical!

See also: Gamestop (GME) latest stock news

The Bull case

AMC was clearly struggling but adding to the potential short squeeze argument was the fact that AMC managed to raise $917 million in late January to avoid bankruptcy. This fundraise and the shot interest created the perfect storm for the /wallstreetbets community to set AMC in their sights and AMC duly rallied. AMC rose an incredible 301% on January 27!

The Bear case

That 301% gain on January 27 was peak AMC however. The shares topped out at $20.36 and have been falling since. The very next day January 28th AMC shares fell over 50%.

Restrictions placed by multiple brokerages on purchases and new positions in GME, AMC, and others took away a lot of the retail buying power that had pushed the stock prices higher. Since then it has been a sudden sharp decline back below $7.50 on Thursday.

Declining short interest in Gamestop (GME), AMC, and others has not helped. The cost of borrowing these shares has meant new shorts can enter the market at elevated prices. Increased attention has led to SEC attention and US Treasury Secretary Janet Yellen met with regulators on Thursday to discuss the recent moves in AMC and related shares.

AMC Technical analysis

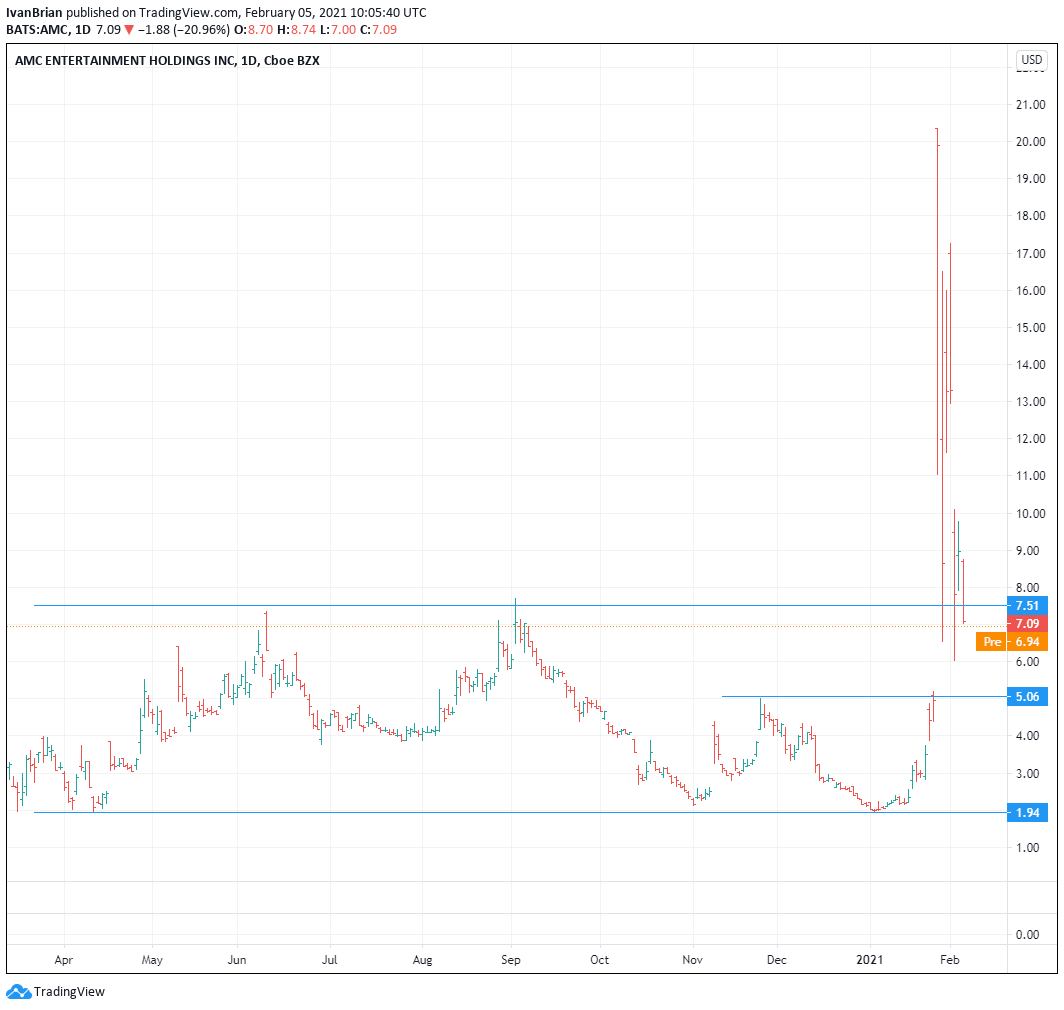

AMC broke key support at $7.50 on Thursday. This is the key breakout level of the recent explosion. As of Friday AMC shares have recovered slightly as Robinhood removed all restrictions on trading, so this $7.50 level remains key support. Below the next target, support is at $5, the start of the explosion and high from November 2020.

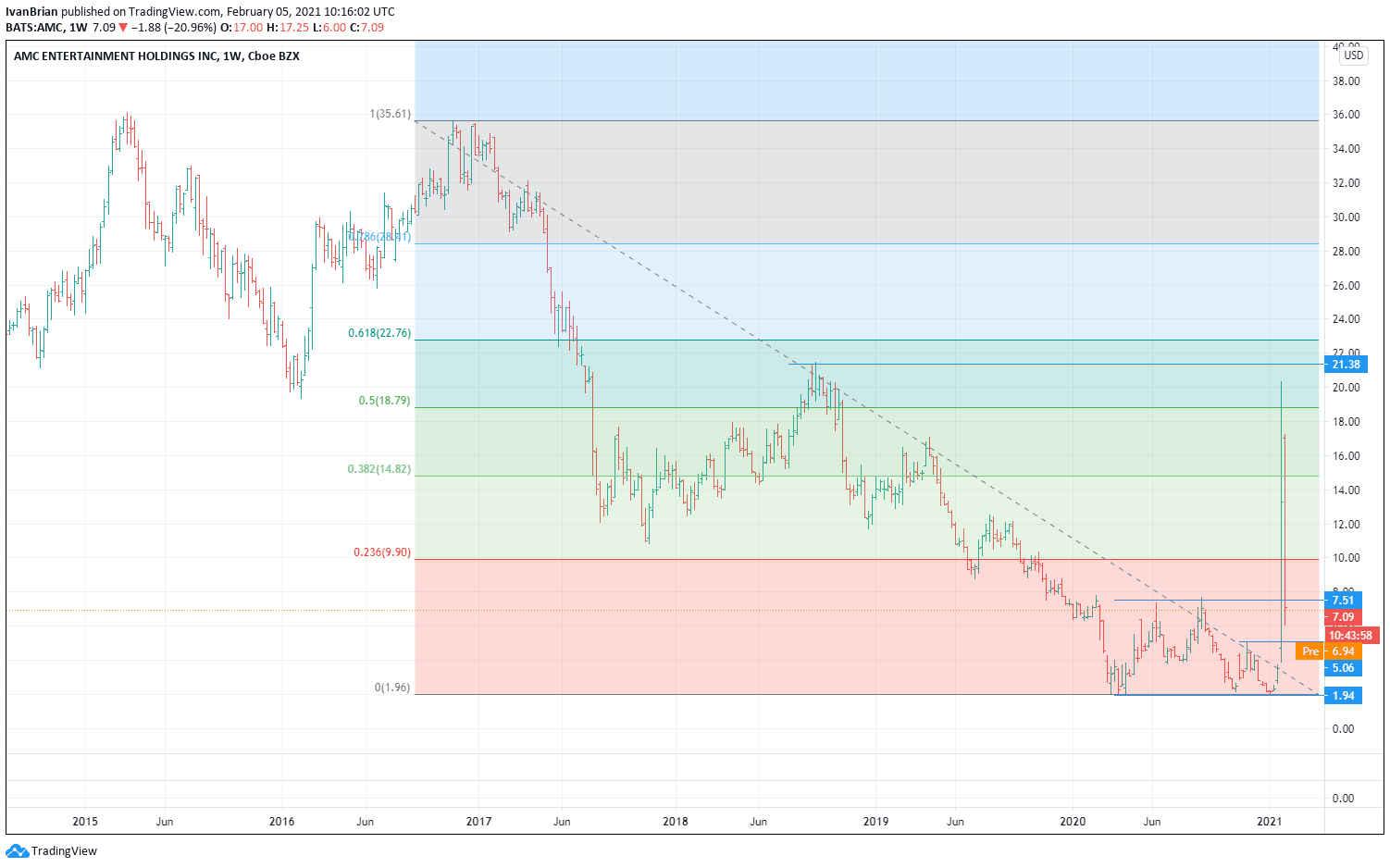

The longer-term chart gives us a bigger picture of the resistance at $21.38 (Oct 2018 high) that kept the recent explosion capped.

Fibonacci retracement levels come into play from the downtrend, starting at the November 2016 high to the January 2021 low. This gives resistance levels at $9.90 and $14.82 to any new rally before a test of the Oct 2018, $21.8 high.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions, or any losses, injuries, or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.