Amazon (AMZN) reaching inflection area [Video]

![Amazon (AMZN) reaching inflection area [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/SupportResistance/mail-delivery-gm485657336-72153037_XtraLarge.jpg)

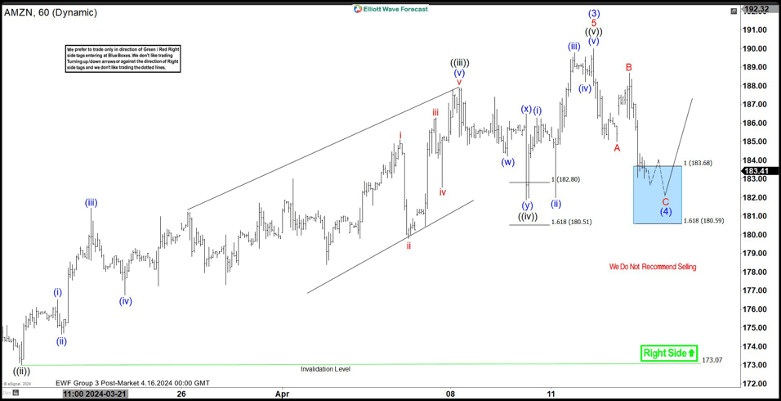

Short term Elliott Wave view in Amazon (AMZN) suggests the rally from 10.26.2023 low is unfolding as a 5 waves impulse. Up from 10.26.2023 low, wave (1) ended at 155.63 and pullback in wave (2) ended at 144.05. The stock extended higher in wave (3) which is proposed complete at 189.99 as the 1 hour chart below shows. Wave (4) pullback is currently in progress as a zigzag structure. Once wave (4) is complete, expect the stock to extend higher in wave (5).

Down from wave (3), wave A ended at 185 and rally in wave B ended at 188.69. Wave C lower is expected to complete at the blue box area of 180.59 – 183.68. This can also end wave (4) in higher degree. The stock should then either extend to new high in wave (5) or else at least rally in 3 waves. Please note however that the 23.6 – 38.2% retracement of wave (3) is still lower at 172.2 – 179. Thus, if the pullback is really in wave (4), there’s a chance that the pullback may become a larger double correction or a larger zigzag structure in 3, 7, 11 swing before ending wave (4) and turning higher.

Amazon (AMZN) 60 minutes Elliott Wave chart

AMZN Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com