Alibaba Stock News and Forecast: BABA back above $100 on Chinese stimulus hints

- Alibaba stock is surging in Hong Kong on Friday as Chinese equities all rally.

- BABA stock and others boosted by China vowing to increase economic stimulus.

- BABA also soaring after Bloomberg report speculating on regulatory crackdown easing.

Update: Alibaba stock is trading just north of the psychological $100 mark after staging a big rally on Friday's Asian session trading. The Chinese e-commerce giant shares are up over 11% on the day at the time of this update. This surge accelerates the gains BABA stock had already enjoyed during the week, after bottoming on Monday at $82.12. News from China on a potential stimulus plan from the government have been the main bullish catalyst on the company founded by Jack Ma and currently led by CEO Daniel Zhang.

Alibaba (BABA) stock is soaring on Friday as Chinese equities participate in a strong, broad-based rally. The Chinese authorities are apparently looking at more economic stimulus measures to boost economic activity and demand. Recent covid lockdowns and manufacturing shutdowns have created a sense of doom among equity investors in China so this latest rally may just be a relief rally.

Alibaba (BABA) stock news: Chinese stimulus help on its way

Alibaba stock was one of the big gainers in Hong Kong this morning with reports that China is pledging to meet economic objectives, according to Benzinga. This will likely mean more monetary stimulus to boost demand. This helped get consumer-focused stocks such as BABA moving higher.

Sentiment was further added to with a Bloomberg report speculating that the regulatory crackdown on technology stocks may be about to end. China vowed to support the growth of platform companies following a quarterly economic meeting according to the report. There were also rumors swirling of an imminent meeting between Chinese authorities and tech firms about ending regulatory measures on tech firms. This also caused BABA stock price to surge higher in March when it was rumored that China would allow US auditors access to Chinese tech companies.

This is a requirement of the Holding Foreign Companies Accountable Act (HFCAA) and Sarbanes Oxley Act which requires US companies to have their audits overseen by the US Public Company Accounting Oversight Board. The SEC can use the HFCAA to force companies to delist from US exchanges. The SEC has already drawn up a list of potential companies for delisting under the act which included many familiar Chinese tech stocks. From the latest evidence, we believe Alibaba (BABA) was not listed by the SEC for potential delisting.

There have been more rumors this week of further discussions between the US and Chinese regulators about allowing US auditors access to Chinese accounts to avoid potential delistings.

Alibaba (BABA) stock forecast

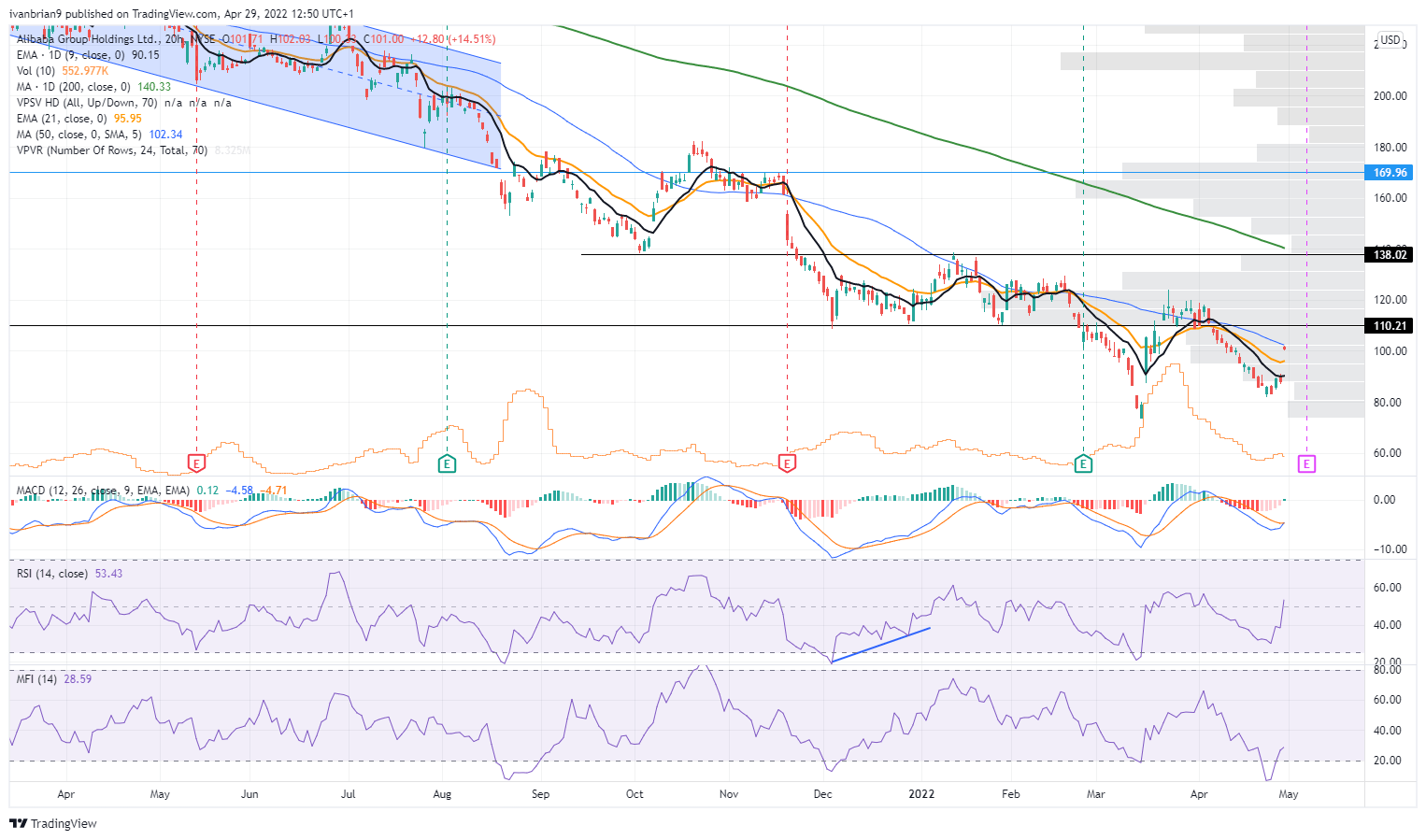

$110 is still the level BABA shares need to get above to begin to change the current bearish narrative. That will put BABA stock in a neutral set-up, only breaking $138 would put it back to a bullish trend. So quite a bit of work still to do. Both MFI and RSI gave oversold signals earlier this week when BABA dipped to $83.10 so let's see how that signal continues to play out, so far working well.

Alibaba (BABA) stock chart, daily

*The author is long BABA stock, thankfully only a small bit!

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.