As the US economy goes through a period of volatility and political uncertainty, more and more Americans are reviewing their long-term savings strategy. For many, this means re-evaluating Gold's place in their portfolio – and particularly within their Individual Retirement Account, or IRA.

What is an IRA and why is it important?

An IRA, or Individual Retirement Account, is a personal retirement account that allows Americans to build long-term tax-advantaged savings. There are several types, the most common being the traditional IRA, where contributions can be deducted from taxes (withdrawals are taxed at retirement), and the Roth IRA, where contributions are not deductible, but withdrawals are tax-free if certain conditions are met.

IRAs are popular because they enable independent retirement planning, complementing employer-sponsored 401(k)-type plans. They also offer greater freedom in the choice of assets: stocks, bonds, funds, and even... precious metals.

While Social Security provides a basic retirement income for most Americans, IRAs allow you to build additional savings and achieve greater financial independence in retirement planning.

Gold IRA: An increasingly attractive option

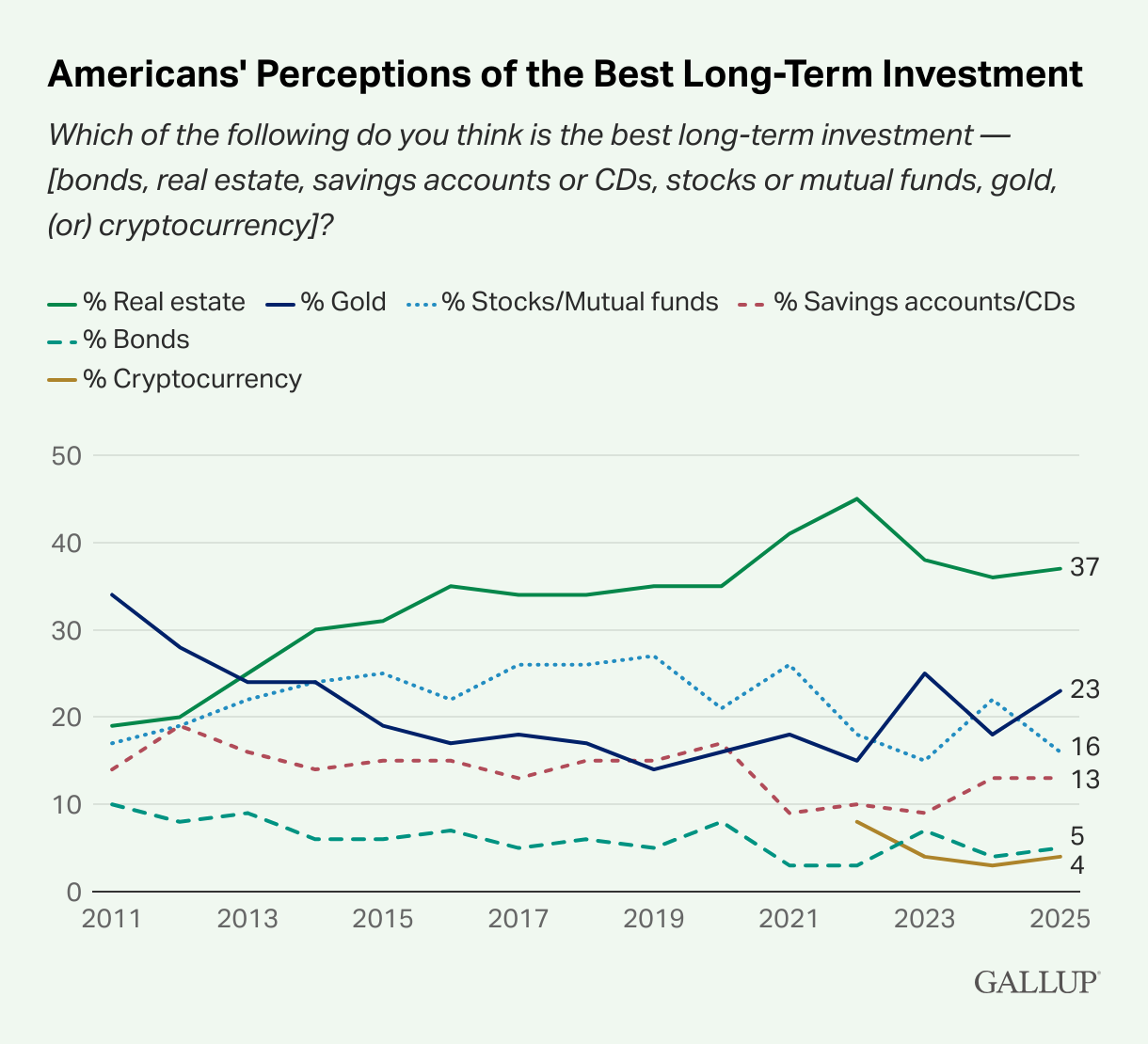

According to a recent Gallup poll conducted in April, 23% of Americans now consider Gold to be one of the best long-term investments, just behind real estate (37%), but ahead of stocks (16%). This is a significant increase from the 18% who chose Gold in 2024.

Why this renewed interest in the yellow metal? It is based on a combination of factors:

- High stock market volatility, accentuated by the Trump administration's new tariff policies.

- Persistent inflationary fears.

- Gold topped $3,500 an ounce in the first half of 2025, reaching all-time highs.

In this uncertain climate, Gold is regaining its safe-haven status. And for savers concerned about their retirement planning, it is becoming a serious option, notably via Gold IRAs.

Gold IRAs: When Gold becomes part of the retirement plan

A Gold IRA is a specific type of retirement account authorized to hold physical metals (ingots and coins of Gold, Silver, etc.), provided they meet certain purity standards set by the IRS.

These accounts must be managed by an authorized custodian, and the metals must be stored in a secure warehouse.

Why choose a Gold IRA?

- Diversification: Incorporating tangible assets reduces correlation with equity and bond markets.

- Protection against inflation: Gold has historically been a good bulwark against the loss of purchasing power.

- Perceived security: In times of economic or geopolitical turmoil, Gold is reassuring.

It is important to note, however, that Gold IRAs also carry specific fees (storage, management), and do not pay out income like dividend-paying stocks or bonds.

Gold IRAs aren't risk-free either, since if the price of Gold falls, so does the value of your savings.

A marked phenomenon across socio-economic categories

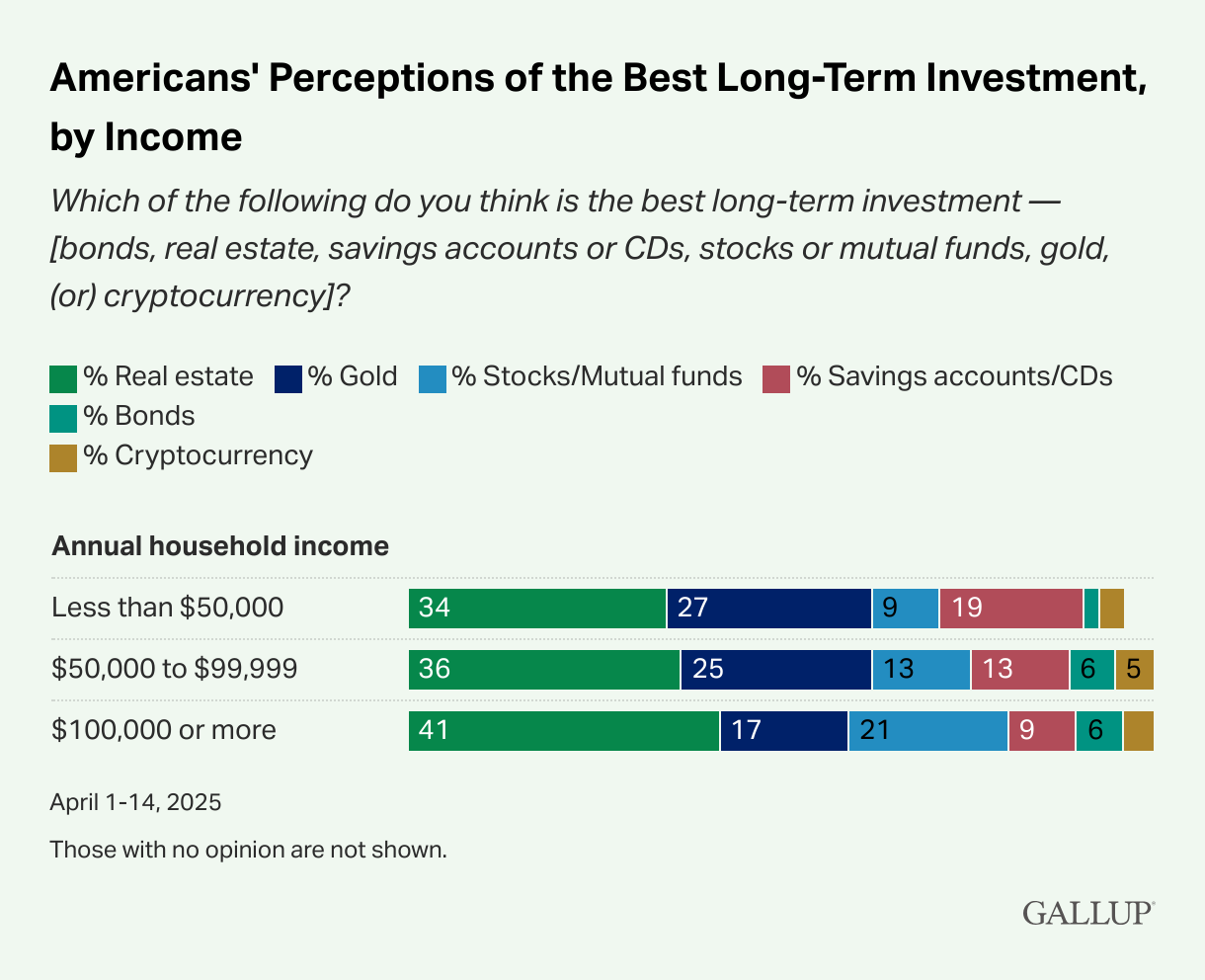

The renewed interest in Gold is particularly marked among low-income households. Among those earning less than $50,000 a year, 27% prefer Gold, compared with just 17% among those earning over $100,000.

This is partly due to increased risk aversion and less confidence in traditional financial markets.

A response to retirement worries

Despite a relatively stable IRA or 401(k) ownership rate (around 59%), the fear of not getting a good return on one's investments is very present.

More than half (53%) of Americans surveyed by Gallup say they are worried about their long-term financial performance. For those who already own stock market assets, this concern rises to 62%.

For many, Social Security alone will not be enough to maintain their standard of living after retirement. That’s why private savings, including IRAs, play such a critical role, and why assets like Gold are gaining popularity within these plans.

In this context, for some people, including Gold in their IRAs is a rational response: better a tangible, stable asset than an uncertain return on equity markets.

Will Gold continue to shine in retirement portfolios?

While Gold has yet to regain the record level of popularity it achieved in 2011 (34% of those polled), its current ascendancy testifies to a profound change in perception among American savers.

As long as stock market volatility and economic tensions persist, interest in Gold IRAs could continue to grow.

However, Gold should not be seen as a quick fix. It is part of a broader strategy of diversification and risk management. Like any asset, it has its limitations, notably the absence of a regular return and specific taxation in the event of withdrawal.

Gold IRAs for retirement planning suit the economic environment better

Gold's return to favor in American retirement planning reflects, above all, an adaptation to an uncertain economic environment.

Thanks to IRAs, and Gold IRAs in particular, investors now have a flexible tool for securing their financial future, especially as questions grow around the long-term sustainability and adequacy of Social Security benefits.

But it's important to understand the advantages, constraints and trade-offs involved in making IRAs a true long-term ally.

Gold Market Movers: Price moves away from one-week top amid modest USD strength

Gold price edges up during the European session on Wednesday, trading slightly below the one-week top at $3,358 touched on Tuesday.

Gold price chart. Source: FXStreet.

Gold’s valuation is closely related to the US interest-rate outlook. In this regard, Fed Chair Jerome Powell said on Tuesday that the US central bank would have already cut interest rates by now if not for the highly uncertain economic path created by US President Donald Trump’s tariff policies.

When asked if July would be too soon for markets to expect a rate cut, Powell answered that it’s going to depend on the data. Nevertheless, traders are pricing in over a 20% chance that the Fed will cut rates at the July meeting.

More significantly, there is a nearly 75% probability of a 25 basis point rate reduction by the Fed at the September monetary policy meeting. This caps any further USD recovery and supports the non-yielding yellow metal.

On the economic data front, the ADP report on private-sector employment showed that the US economy shed 33,000 jobs in June against expectations of a 95,000 gain. The data weighed on the US Dollar and further supported Gold prices ahead of the official Nonfarm Payrolls (NFP) report on Thursday.

On Tuesday, the Institute of Supply Management (ISM) reported that economic activity in the US manufacturing sector contracted for the fourth consecutive month, though at a slower pace in June.

Separately, the Job Openings and Labor Turnover Survey (JOLTS) revealed that the number of job openings stood at 7.769 million on the last business day of May, up from 7.395 million in April and 7.3 million anticipated.

Trump threatened to impose higher tariffs on Japanese imports over the latter's alleged unwillingness to buy American-grown rice. This comes ahead of the July 9 deadline for Trump's reciprocal tariffs and fuels uncertainty.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD: US Dollar comeback in the makes? Premium

The US Dollar (USD) stands victorious at the end of another week, with the EUR/USD pair trading near a four-week low of 1.1742, while the USD retains its strength despite some discouraging American data released at the end of the week.

Gold: Escalating geopolitical tensions help limit losses Premium

Gold (XAU/USD) struggled to make a decisive move in either direction this week as it quickly recovered above $5,000 after posting losses on Monday and Tuesday.

GBP/USD: Pound Sterling braces for more pain, as 200-day SMA tested Premium

The Pound Sterling (GBP) crashed to its lowest level in a month against the US Dollar (USD), as critical support levels were breached in a data-packed week.

Bitcoin: No recovery in sight

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.

US Dollar: Tariffed. Now What? Premium

The US Dollar (USD) reversed its previous week’s decline, managing to stage a meaningful rebound and retesting the area just above the 98.00 barrier when tracked by the US Dollar Index (DXY).

Nifty 50: The crash to 25,400s - Nature’s gift or a trap?

While the broader market panicked as Nifty tumbled from 25,800 to the 25,400 zones, disciplined Elliott Wave traders were waiting for a specific 'Alternate Scenario.'